monday.com (NASDAQ:MNDY - Get Free Report) had its price objective lowered by stock analysts at Wells Fargo & Company from $380.00 to $310.00 in a note issued to investors on Tuesday,Benzinga reports. The firm currently has an "overweight" rating on the stock. Wells Fargo & Company's price target suggests a potential upside of 35.35% from the company's previous close.

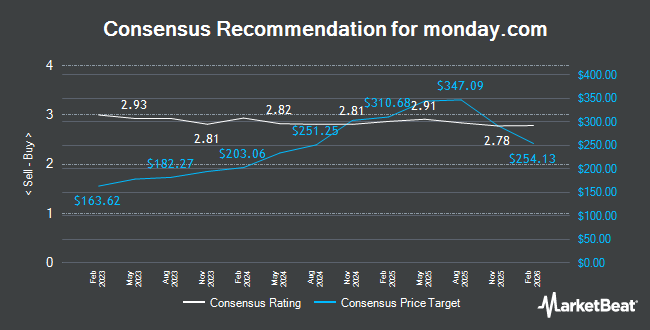

A number of other equities research analysts have also recently commented on MNDY. DA Davidson lowered their price target on shares of monday.com from $350.00 to $290.00 and set a "buy" rating on the stock in a report on Monday, April 14th. Robert W. Baird boosted their price objective on monday.com from $275.00 to $335.00 and gave the company a "neutral" rating in a research note on Tuesday, February 11th. Canaccord Genuity Group increased their target price on shares of monday.com from $310.00 to $375.00 and gave the stock a "buy" rating in a research report on Tuesday, February 11th. Jefferies Financial Group lowered their price target on shares of monday.com from $400.00 to $360.00 and set a "buy" rating on the stock in a research report on Monday, March 31st. Finally, KeyCorp raised shares of monday.com from a "sector weight" rating to an "overweight" rating and set a $420.00 price objective for the company in a report on Tuesday, February 11th. Three research analysts have rated the stock with a hold rating and twenty-one have issued a buy rating to the stock. According to MarketBeat.com, monday.com has a consensus rating of "Moderate Buy" and an average target price of $346.73.

View Our Latest Report on MNDY

monday.com Trading Down 7.0 %

Shares of MNDY opened at $229.03 on Tuesday. The stock has a 50 day moving average of $264.63 and a 200 day moving average of $266.65. The company has a market capitalization of $11.63 billion, a price-to-earnings ratio of 381.72, a PEG ratio of 16.53 and a beta of 1.34. monday.com has a 12 month low of $174.75 and a 12 month high of $342.64.

monday.com (NASDAQ:MNDY - Get Free Report) last issued its quarterly earnings results on Monday, February 10th. The company reported $0.50 earnings per share for the quarter, missing analysts' consensus estimates of $0.78 by ($0.28). monday.com had a return on equity of 6.22% and a net margin of 3.33%. As a group, equities research analysts predict that monday.com will post 0.46 earnings per share for the current year.

Institutional Investors Weigh In On monday.com

Hedge funds have recently added to or reduced their stakes in the business. Shelton Wealth Management LLC acquired a new stake in monday.com in the first quarter valued at approximately $889,000. Retirement Systems of Alabama purchased a new stake in shares of monday.com during the 1st quarter valued at approximately $3,059,000. Blue Trust Inc. lifted its stake in shares of monday.com by 21.1% in the 1st quarter. Blue Trust Inc. now owns 1,588 shares of the company's stock valued at $386,000 after purchasing an additional 277 shares during the last quarter. Grove Bank & Trust purchased a new position in monday.com during the first quarter worth about $30,000. Finally, Opal Wealth Advisors LLC purchased a new position in shares of monday.com during the 1st quarter worth approximately $64,000. 73.70% of the stock is owned by hedge funds and other institutional investors.

About monday.com

(

Get Free Report)

monday.com Ltd., together with its subsidiaries, develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally. The company provides Work OS, a cloud-based visual work operating system that consists of modular building blocks used and assembled to create software applications and work management tools.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider monday.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and monday.com wasn't on the list.

While monday.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.