MoneyLion (NYSE:ML - Get Free Report)'s stock had its "buy" rating reiterated by equities researchers at Needham & Company LLC in a report issued on Tuesday,Benzinga reports. They currently have a $100.00 price objective on the stock. Needham & Company LLC's price objective would suggest a potential upside of 17.16% from the company's previous close.

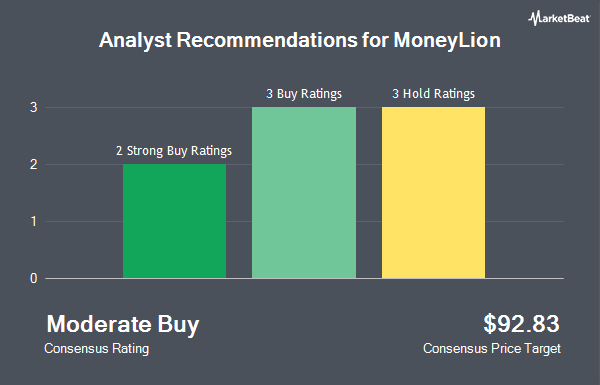

A number of other equities research analysts also recently commented on the company. Northland Securities lifted their target price on MoneyLion from $60.00 to $80.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Northland Capmk raised MoneyLion to a "strong-buy" rating in a research note on Wednesday, October 16th. Oppenheimer raised MoneyLion from a "market perform" rating to an "outperform" rating and set a $80.00 price objective for the company in a research note on Thursday, November 7th. Finally, Cantor Fitzgerald raised MoneyLion to a "strong-buy" rating in a research note on Thursday, October 3rd. Six research analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average target price of $95.00.

Read Our Latest Analysis on ML

MoneyLion Price Performance

MoneyLion stock traded down $1.30 during trading on Tuesday, reaching $85.35. 77,954 shares of the company were exchanged, compared to its average volume of 202,010. MoneyLion has a 52-week low of $36.26 and a 52-week high of $106.82. The company has a market capitalization of $947.39 million, a P/E ratio of 392.27 and a beta of 2.67. The stock's 50 day simple moving average is $53.20 and its two-hundred day simple moving average is $62.32.

Insider Buying and Selling at MoneyLion

In related news, CAO Mark Torossian sold 328 shares of the stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $80.00, for a total value of $26,240.00. Following the sale, the chief accounting officer now directly owns 20,409 shares of the company's stock, valued at approximately $1,632,720. This represents a 1.58 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Adam Vanwagner sold 2,994 shares of the company's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $79.40, for a total transaction of $237,723.60. Following the completion of the sale, the insider now directly owns 90,635 shares in the company, valued at $7,196,419. This trade represents a 3.20 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 54,680 shares of company stock valued at $4,120,514. Insiders own 11.90% of the company's stock.

Institutional Trading of MoneyLion

Several hedge funds and other institutional investors have recently bought and sold shares of the company. Vanguard Group Inc. increased its position in shares of MoneyLion by 1.4% in the 1st quarter. Vanguard Group Inc. now owns 232,591 shares of the company's stock worth $16,588,000 after purchasing an additional 3,107 shares during the last quarter. SG Americas Securities LLC grew its position in shares of MoneyLion by 500.7% during the 2nd quarter. SG Americas Securities LLC now owns 19,906 shares of the company's stock valued at $1,464,000 after buying an additional 16,592 shares during the last quarter. Bank of New York Mellon Corp bought a new stake in shares of MoneyLion during the 2nd quarter valued at about $1,776,000. Private Ocean LLC bought a new stake in shares of MoneyLion during the 2nd quarter valued at about $238,000. Finally, Commonwealth Equity Services LLC bought a new position in MoneyLion in the 2nd quarter worth about $227,000. 31.43% of the stock is owned by hedge funds and other institutional investors.

About MoneyLion

(

Get Free Report)

MoneyLion Inc, a financial technology company, provides personalized products and financial content for American consumers. The company's platform offers access to banking, borrowing, and investing solutions for customers. Its principal products include RoarMoney, an insured digital demand deposit account; Instacash, a cash advance product that gives customers early access to their recurring income deposits; Credit Builder Plus membership program; MoneyLion Investing, an online investment account that offers access to separately managed accounts invested based on model exchange-traded fund portfolios; Roundups, which provides features designed to encourage customers to establish good saving and investing habits; and MoneyLion Crypto, an online cryptocurrency account.

Featured Stories

Before you consider MoneyLion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MoneyLion wasn't on the list.

While MoneyLion currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.