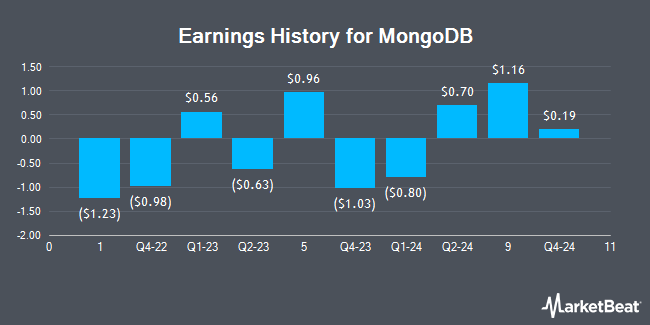

MongoDB (NASDAQ:MDB - Get Free Report) announced its quarterly earnings data on Wednesday. The company reported $0.19 EPS for the quarter, missing the consensus estimate of $0.64 by ($0.45), Zacks reports. The business had revenue of $548.40 million during the quarter, compared to the consensus estimate of $519.65 million. MongoDB had a negative net margin of 10.46% and a negative return on equity of 12.22%. During the same period last year, the company earned $0.86 EPS. MongoDB updated its Q1 2026 guidance to 0.630-0.670 EPS and its FY 2026 guidance to 2.440-2.620 EPS.

MongoDB Stock Performance

MongoDB stock traded down $5.33 during midday trading on Friday, hitting $187.65. 5,777,748 shares of the company were exchanged, compared to its average volume of 1,644,879. The firm has a market capitalization of $13.97 billion, a PE ratio of -68.49 and a beta of 1.30. MongoDB has a fifty-two week low of $181.05 and a fifty-two week high of $387.19. The business has a fifty day simple moving average of $261.68 and a two-hundred day simple moving average of $274.38.

Insider Buying and Selling

In other MongoDB news, insider Cedric Pech sold 287 shares of the stock in a transaction that occurred on Thursday, January 2nd. The stock was sold at an average price of $234.09, for a total transaction of $67,183.83. Following the transaction, the insider now owns 24,390 shares in the company, valued at approximately $5,709,455.10. This represents a 1.16 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Dwight A. Merriman sold 3,000 shares of the stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $270.63, for a total value of $811,890.00. Following the transaction, the director now owns 1,109,006 shares in the company, valued at $300,130,293.78. This represents a 0.27 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 50,314 shares of company stock valued at $13,337,753 over the last ninety days. Company insiders own 3.60% of the company's stock.

Analysts Set New Price Targets

Several brokerages have weighed in on MDB. Citigroup upped their target price on MongoDB from $400.00 to $430.00 and gave the stock a "buy" rating in a report on Monday, December 16th. The Goldman Sachs Group lowered their target price on MongoDB from $390.00 to $335.00 and set a "buy" rating for the company in a report on Thursday. Oppenheimer lowered their target price on MongoDB from $400.00 to $330.00 and set an "outperform" rating for the company in a report on Thursday. Needham & Company LLC lowered their target price on MongoDB from $415.00 to $270.00 and set a "buy" rating for the company in a report on Thursday. Finally, Mizuho upped their target price on MongoDB from $275.00 to $320.00 and gave the stock a "neutral" rating in a report on Tuesday, December 10th. One investment analyst has rated the stock with a sell rating, seven have given a hold rating and twenty-three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $319.87.

Read Our Latest Research Report on MongoDB

MongoDB Company Profile

(

Get Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Read More

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.