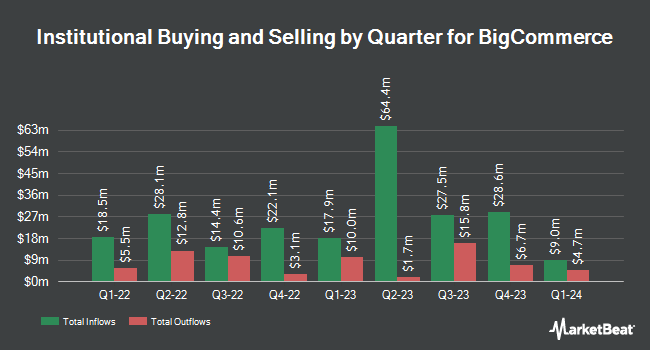

Monimus Capital Management LP bought a new position in BigCommerce Holdings, Inc. (NASDAQ:BIGC - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 316,713 shares of the company's stock, valued at approximately $1,938,000. BigCommerce accounts for 1.8% of Monimus Capital Management LP's holdings, making the stock its 21st largest holding. Monimus Capital Management LP owned approximately 0.40% of BigCommerce as of its most recent SEC filing.

Other hedge funds have also modified their holdings of the company. Franklin Resources Inc. lifted its position in shares of BigCommerce by 1.8% during the third quarter. Franklin Resources Inc. now owns 1,932,149 shares of the company's stock worth $10,859,000 after purchasing an additional 35,016 shares in the last quarter. Clearline Capital LP grew its stake in shares of BigCommerce by 69.7% during the third quarter. Clearline Capital LP now owns 1,611,619 shares of the company's stock valued at $9,428,000 after acquiring an additional 661,688 shares in the last quarter. Geode Capital Management LLC increased its position in shares of BigCommerce by 1.3% during the third quarter. Geode Capital Management LLC now owns 1,600,219 shares of the company's stock worth $9,363,000 after acquiring an additional 21,105 shares during the last quarter. State Street Corp increased its position in shares of BigCommerce by 1.1% during the third quarter. State Street Corp now owns 1,522,002 shares of the company's stock worth $8,904,000 after acquiring an additional 16,561 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its stake in BigCommerce by 3.5% during the 4th quarter. Bank of New York Mellon Corp now owns 1,263,093 shares of the company's stock valued at $7,730,000 after purchasing an additional 42,920 shares in the last quarter. 79.21% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several equities analysts have recently commented on the company. Needham & Company LLC reiterated a "buy" rating and set a $10.00 target price on shares of BigCommerce in a research note on Wednesday, March 12th. Barclays cut shares of BigCommerce from an "equal weight" rating to an "underweight" rating and reduced their price target for the stock from $8.00 to $7.00 in a research report on Friday, January 10th. Two research analysts have rated the stock with a sell rating, one has given a hold rating and two have issued a buy rating to the stock. Based on data from MarketBeat, BigCommerce presently has an average rating of "Hold" and an average price target of $7.80.

Read Our Latest Stock Analysis on BIGC

BigCommerce Stock Performance

Shares of NASDAQ BIGC traded up $0.03 during mid-day trading on Wednesday, hitting $5.89. The company had a trading volume of 492,655 shares, compared to its average volume of 841,712. The stock has a market cap of $462.95 million, a price-to-earnings ratio of -16.83 and a beta of 1.13. The firm's 50 day simple moving average is $6.43 and its two-hundred day simple moving average is $6.27. The company has a debt-to-equity ratio of 7.48, a current ratio of 2.81 and a quick ratio of 2.81. BigCommerce Holdings, Inc. has a 12 month low of $5.13 and a 12 month high of $8.60.

BigCommerce (NASDAQ:BIGC - Get Free Report) last released its quarterly earnings results on Thursday, February 20th. The company reported $0.02 EPS for the quarter, missing the consensus estimate of $0.07 by ($0.05). The firm had revenue of $87.03 million for the quarter, compared to the consensus estimate of $86.90 million. BigCommerce had a negative return on equity of 52.65% and a negative net margin of 8.12%. As a group, equities research analysts forecast that BigCommerce Holdings, Inc. will post -0.16 earnings per share for the current year.

Insider Activity at BigCommerce

In other BigCommerce news, Director Ellen F. Siminoff purchased 177,158 shares of the stock in a transaction dated Thursday, March 6th. The shares were bought at an average cost of $6.64 per share, with a total value of $1,176,329.12. Following the completion of the acquisition, the director now owns 253,333 shares of the company's stock, valued at approximately $1,682,131.12. This trade represents a 232.57 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 9.06% of the stock is owned by insiders.

About BigCommerce

(

Free Report)

BigCommerce Holdings, Inc operates a software-as-a-service platform for enterprises, small businesses, and mid-markets in the United States, North and South America, Europe, the Middle East, Africa, and the AsiaPacific. The company provides a platform for launching and scaling an ecommerce operation, including store design, catalog management, hosting, checkout, order management, reporting, and pre-integration into third-party services.

See Also

Before you consider BigCommerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BigCommerce wasn't on the list.

While BigCommerce currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.