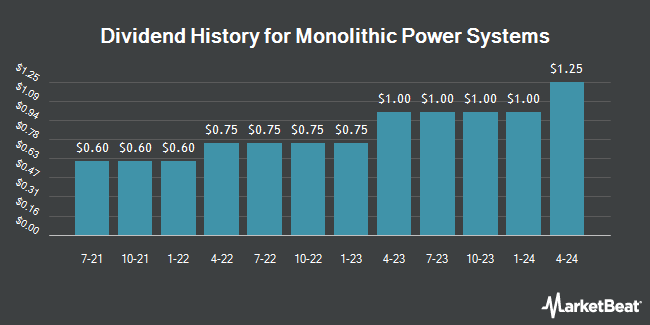

Monolithic Power Systems, Inc. (NASDAQ:MPWR - Get Free Report) declared a quarterly dividend on Friday, December 13th,RTT News reports. Stockholders of record on Tuesday, December 31st will be paid a dividend of 1.25 per share by the semiconductor company on Wednesday, January 15th. This represents a $5.00 annualized dividend and a dividend yield of 0.82%.

Monolithic Power Systems has raised its dividend by an average of 26.0% per year over the last three years. Monolithic Power Systems has a dividend payout ratio of 30.1% indicating that its dividend is sufficiently covered by earnings. Analysts expect Monolithic Power Systems to earn $13.34 per share next year, which means the company should continue to be able to cover its $5.00 annual dividend with an expected future payout ratio of 37.5%.

Monolithic Power Systems Trading Up 0.5 %

NASDAQ:MPWR traded up $2.99 during trading hours on Friday, reaching $608.44. 816,173 shares of the company were exchanged, compared to its average volume of 621,879. The stock's 50-day moving average is $737.10 and its 200-day moving average is $807.89. Monolithic Power Systems has a twelve month low of $546.71 and a twelve month high of $959.64. The firm has a market cap of $29.68 billion, a PE ratio of 68.26, a price-to-earnings-growth ratio of 2.97 and a beta of 1.05.

Monolithic Power Systems (NASDAQ:MPWR - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The semiconductor company reported $2.99 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.04 by ($0.05). Monolithic Power Systems had a return on equity of 20.44% and a net margin of 21.29%. The firm had revenue of $620.12 million during the quarter, compared to analyst estimates of $600.10 million. As a group, research analysts anticipate that Monolithic Power Systems will post 10.46 EPS for the current year.

Wall Street Analyst Weigh In

MPWR has been the subject of several recent research reports. Citigroup initiated coverage on Monolithic Power Systems in a research note on Wednesday. They issued a "buy" rating and a $700.00 price objective for the company. KeyCorp decreased their price target on shares of Monolithic Power Systems from $1,075.00 to $700.00 and set an "overweight" rating on the stock in a research note on Monday, November 18th. Needham & Company LLC dropped their price objective on shares of Monolithic Power Systems from $950.00 to $600.00 and set a "buy" rating for the company in a research note on Friday, November 22nd. Wells Fargo & Company initiated coverage on shares of Monolithic Power Systems in a report on Friday, November 22nd. They issued an "equal weight" rating and a $610.00 price objective for the company. Finally, Loop Capital upgraded Monolithic Power Systems from a "hold" rating to a "buy" rating and set a $660.00 target price on the stock in a report on Monday, November 18th. Two analysts have rated the stock with a hold rating and ten have issued a buy rating to the company. According to MarketBeat.com, Monolithic Power Systems presently has an average rating of "Moderate Buy" and a consensus price target of $828.67.

View Our Latest Research Report on Monolithic Power Systems

Insiders Place Their Bets

In related news, CFO Theodore Blegen sold 2,500 shares of the stock in a transaction that occurred on Monday, December 9th. The shares were sold at an average price of $600.00, for a total transaction of $1,500,000.00. Following the completion of the transaction, the chief financial officer now owns 53,444 shares of the company's stock, valued at approximately $32,066,400. This trade represents a 4.47 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Maurice Sciammas sold 11,000 shares of the business's stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $929.59, for a total value of $10,225,490.00. Following the completion of the sale, the executive vice president now directly owns 103,829 shares in the company, valued at approximately $96,518,400.11. The trade was a 9.58 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 20,100 shares of company stock valued at $17,153,021 over the last quarter. 3.70% of the stock is owned by insiders.

About Monolithic Power Systems

(

Get Free Report)

Monolithic Power Systems, Inc engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as cloud-based CPU servers, server artificial intelligence applications, storage applications, commercial notebooks, digital cockpit, power sources, home appliances, 4G and 5G infrastructure, and satellite communications applications.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Monolithic Power Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monolithic Power Systems wasn't on the list.

While Monolithic Power Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.