Landscape Capital Management L.L.C. increased its holdings in Monster Beverage Co. (NASDAQ:MNST - Free Report) by 42.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 143,099 shares of the company's stock after buying an additional 42,383 shares during the quarter. Monster Beverage comprises 0.8% of Landscape Capital Management L.L.C.'s portfolio, making the stock its 13th largest holding. Landscape Capital Management L.L.C.'s holdings in Monster Beverage were worth $7,465,000 as of its most recent SEC filing.

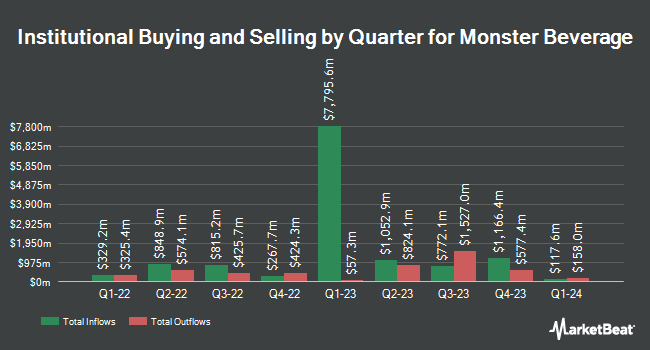

A number of other institutional investors and hedge funds have also added to or reduced their stakes in the business. Janus Henderson Group PLC increased its position in shares of Monster Beverage by 4.1% during the 1st quarter. Janus Henderson Group PLC now owns 11,209,122 shares of the company's stock valued at $664,469,000 after purchasing an additional 440,962 shares during the period. Ninety One UK Ltd grew its holdings in Monster Beverage by 93.9% during the second quarter. Ninety One UK Ltd now owns 7,477,852 shares of the company's stock worth $373,519,000 after acquiring an additional 3,620,436 shares during the period. Epoch Investment Partners Inc. raised its position in Monster Beverage by 9.5% in the second quarter. Epoch Investment Partners Inc. now owns 3,174,103 shares of the company's stock worth $158,546,000 after acquiring an additional 275,209 shares in the last quarter. Assenagon Asset Management S.A. raised its position in Monster Beverage by 1,148.0% in the third quarter. Assenagon Asset Management S.A. now owns 2,596,888 shares of the company's stock worth $135,480,000 after acquiring an additional 2,388,798 shares in the last quarter. Finally, DSM Capital Partners LLC lifted its holdings in Monster Beverage by 13.7% in the 2nd quarter. DSM Capital Partners LLC now owns 2,225,726 shares of the company's stock valued at $111,175,000 after acquiring an additional 268,198 shares during the last quarter. 72.36% of the stock is owned by institutional investors.

Analyst Ratings Changes

MNST has been the topic of a number of research reports. Stifel Nicolaus boosted their target price on shares of Monster Beverage from $57.00 to $59.00 and gave the stock a "buy" rating in a report on Friday, November 8th. Roth Mkm cut their price objective on Monster Beverage from $56.00 to $50.00 and set a "neutral" rating for the company in a research report on Monday, August 12th. Truist Financial decreased their target price on Monster Beverage from $46.00 to $40.00 and set a "sell" rating on the stock in a report on Friday, August 9th. BMO Capital Markets decreased their price target on Monster Beverage from $56.00 to $54.00 and set a "market perform" rating for the company in a research report on Thursday, August 8th. Finally, Citigroup reduced their price objective on shares of Monster Beverage from $60.00 to $54.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Two analysts have rated the stock with a sell rating, six have given a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $56.45.

View Our Latest Analysis on MNST

Monster Beverage Trading Down 0.1 %

Shares of NASDAQ MNST opened at $53.70 on Thursday. The business has a 50 day simple moving average of $52.60 and a 200 day simple moving average of $51.05. Monster Beverage Co. has a 52 week low of $43.32 and a 52 week high of $61.22. The stock has a market cap of $52.22 billion, a price-to-earnings ratio of 34.42, a PEG ratio of 2.57 and a beta of 0.74. The company has a debt-to-equity ratio of 0.13, a quick ratio of 2.51 and a current ratio of 3.13.

About Monster Beverage

(

Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

Further Reading

Want to see what other hedge funds are holding MNST? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Monster Beverage Co. (NASDAQ:MNST - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.