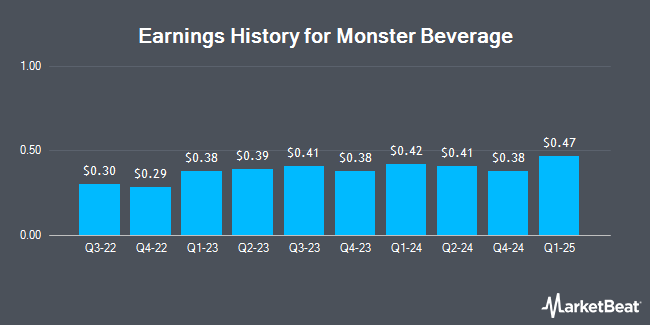

Monster Beverage (NASDAQ:MNST - Get Free Report) is projected to announce its earnings results before the market opens on Wednesday, February 26th. Analysts expect the company to announce earnings of $0.40 per share and revenue of $1.80 billion for the quarter.

Monster Beverage Stock Performance

Monster Beverage stock traded up $1.79 during trading on Friday, hitting $53.00. The stock had a trading volume of 7,700,246 shares, compared to its average volume of 6,331,421. The stock's 50 day moving average is $50.18 and its two-hundred day moving average is $50.96. Monster Beverage has a 1 year low of $43.32 and a 1 year high of $61.22. The stock has a market cap of $51.54 billion, a price-to-earnings ratio of 33.97, a price-to-earnings-growth ratio of 2.30 and a beta of 0.74. The company has a quick ratio of 2.51, a current ratio of 3.13 and a debt-to-equity ratio of 0.13.

Insider Buying and Selling

In other Monster Beverage news, CFO Thomas J. Kelly sold 10,000 shares of Monster Beverage stock in a transaction that occurred on Friday, December 13th. The shares were sold at an average price of $52.65, for a total transaction of $526,500.00. Following the completion of the sale, the chief financial officer now directly owns 74,924 shares in the company, valued at $3,944,748.60. The trade was a 11.78 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 7.80% of the stock is owned by company insiders.

Analyst Ratings Changes

MNST has been the subject of several research reports. Deutsche Bank Aktiengesellschaft cut their price target on Monster Beverage from $61.00 to $59.00 and set a "buy" rating for the company in a research note on Friday, November 8th. JPMorgan Chase & Co. cut their target price on shares of Monster Beverage from $52.00 to $51.00 and set a "neutral" rating for the company in a research report on Wednesday, February 12th. Stifel Nicolaus boosted their price target on shares of Monster Beverage from $57.00 to $59.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Needham & Company LLC began coverage on shares of Monster Beverage in a report on Friday, December 6th. They issued a "hold" rating for the company. Finally, Wells Fargo & Company lifted their price objective on shares of Monster Beverage from $57.00 to $60.00 and gave the company an "overweight" rating in a research note on Tuesday, November 5th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating and twelve have assigned a buy rating to the company. According to MarketBeat, Monster Beverage currently has a consensus rating of "Hold" and an average target price of $55.53.

Get Our Latest Stock Report on MNST

Monster Beverage Company Profile

(

Get Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

Further Reading

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.