Bank of New York Mellon Corp boosted its position in shares of Montrose Environmental Group, Inc. (NYSE:MEG - Free Report) by 50.6% during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 482,165 shares of the company's stock after acquiring an additional 161,957 shares during the period. Bank of New York Mellon Corp owned approximately 1.41% of Montrose Environmental Group worth $8,944,000 at the end of the most recent quarter.

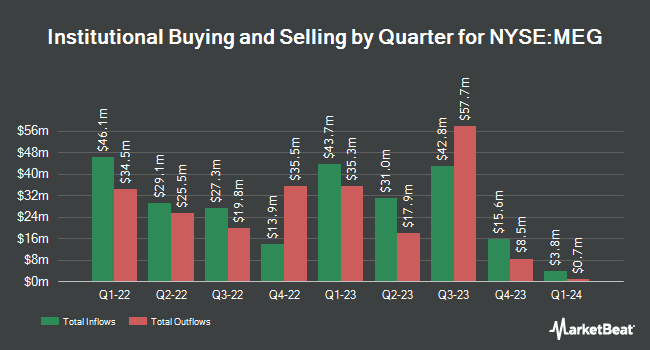

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. KBC Group NV increased its stake in Montrose Environmental Group by 126.5% during the fourth quarter. KBC Group NV now owns 2,888 shares of the company's stock valued at $54,000 after acquiring an additional 1,613 shares during the period. Avanza Fonder AB bought a new stake in shares of Montrose Environmental Group in the 4th quarter valued at approximately $105,000. Point72 DIFC Ltd bought a new stake in shares of Montrose Environmental Group in the 3rd quarter valued at approximately $111,000. Wrapmanager Inc. grew its stake in shares of Montrose Environmental Group by 12.8% in the 4th quarter. Wrapmanager Inc. now owns 10,105 shares of the company's stock valued at $187,000 after purchasing an additional 1,150 shares during the period. Finally, B. Metzler seel. Sohn & Co. Holding AG bought a new stake in shares of Montrose Environmental Group in the 3rd quarter valued at approximately $212,000. 87.87% of the stock is currently owned by institutional investors.

Montrose Environmental Group Price Performance

NYSE MEG traded up $0.03 during trading hours on Friday, reaching $16.90. 422,895 shares of the company's stock were exchanged, compared to its average volume of 499,426. The stock has a market cap of $580.24 million, a PE ratio of -11.34 and a beta of 1.72. Montrose Environmental Group, Inc. has a one year low of $15.21 and a one year high of $49.97. The firm has a fifty day moving average of $20.01 and a 200-day moving average of $21.99. The company has a current ratio of 1.93, a quick ratio of 1.93 and a debt-to-equity ratio of 0.60.

Wall Street Analysts Forecast Growth

MEG has been the topic of several analyst reports. Needham & Company LLC reiterated a "buy" rating and issued a $39.00 price objective on shares of Montrose Environmental Group in a research note on Tuesday, March 4th. Stifel Nicolaus lowered their price objective on Montrose Environmental Group from $41.00 to $38.00 and set a "buy" rating on the stock in a research note on Wednesday, December 11th. Finally, Evercore ISI lowered their price objective on Montrose Environmental Group from $40.00 to $33.00 and set an "outperform" rating on the stock in a research note on Monday, February 10th. Two research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $33.60.

View Our Latest Analysis on Montrose Environmental Group

About Montrose Environmental Group

(

Free Report)

Montrose Environmental Group, Inc operates as an environmental services company in the United States, Canada, and internationally. The company operates in three segments: Assessment, Permitting and Response; Measurement and Analysis; and Remediation and Reuse. The Assessment, Permitting and Response segment provides scientific advisory and consulting services to support environmental assessments; environmental emergency response and recovery; toxicology consulting and environmental audits and permits for current operations; facility upgrades; new projects; decommissioning projects; and development projects.

Read More

Before you consider Montrose Environmental Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Montrose Environmental Group wasn't on the list.

While Montrose Environmental Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.