Montrusco Bolton Investments Inc. cut its position in The Toronto-Dominion Bank (NYSE:TD - Free Report) TSE: TD by 31.5% during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 505,061 shares of the bank's stock after selling 231,984 shares during the period. Montrusco Bolton Investments Inc.'s holdings in Toronto-Dominion Bank were worth $26,875,000 as of its most recent filing with the Securities and Exchange Commission.

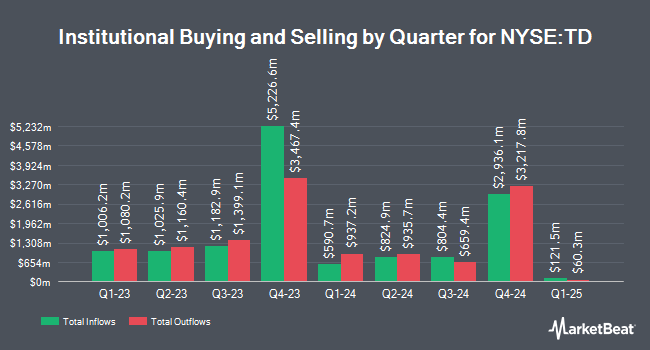

A number of other hedge funds and other institutional investors have also modified their holdings of TD. Dunhill Financial LLC boosted its stake in Toronto-Dominion Bank by 164.9% in the third quarter. Dunhill Financial LLC now owns 400 shares of the bank's stock valued at $25,000 after acquiring an additional 249 shares in the last quarter. Versant Capital Management Inc boosted its position in shares of Toronto-Dominion Bank by 40.0% in the 4th quarter. Versant Capital Management Inc now owns 700 shares of the bank's stock valued at $37,000 after purchasing an additional 200 shares during the period. Kimelman & Baird LLC acquired a new position in Toronto-Dominion Bank during the second quarter worth approximately $49,000. Union Bancaire Privee UBP SA purchased a new stake in Toronto-Dominion Bank in the fourth quarter valued at approximately $58,000. Finally, Morse Asset Management Inc acquired a new stake in shares of Toronto-Dominion Bank in the third quarter valued at approximately $63,000. 52.37% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

TD has been the subject of several research reports. StockNews.com downgraded shares of Toronto-Dominion Bank from a "hold" rating to a "sell" rating in a research report on Friday, December 27th. Barclays lowered Toronto-Dominion Bank from an "equal weight" rating to an "underweight" rating in a report on Thursday, November 21st. Scotiabank downgraded Toronto-Dominion Bank from a "sector outperform" rating to a "sector perform" rating in a research note on Friday, December 6th. BMO Capital Markets upgraded Toronto-Dominion Bank from a "market perform" rating to an "outperform" rating in a research note on Thursday, December 19th. Finally, Bank of America raised Toronto-Dominion Bank from a "neutral" rating to a "buy" rating in a report on Friday, January 17th. Two equities research analysts have rated the stock with a sell rating, five have issued a hold rating, three have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $80.50.

View Our Latest Research Report on Toronto-Dominion Bank

Toronto-Dominion Bank Price Performance

Toronto-Dominion Bank stock traded up $0.09 during midday trading on Wednesday, reaching $57.41. The company's stock had a trading volume of 1,485,671 shares, compared to its average volume of 2,911,432. The firm has a market capitalization of $100.49 billion, a PE ratio of 16.54, a P/E/G ratio of 1.82 and a beta of 0.83. The Toronto-Dominion Bank has a fifty-two week low of $51.25 and a fifty-two week high of $64.91. The stock's 50 day simple moving average is $54.62 and its 200 day simple moving average is $57.41. The company has a debt-to-equity ratio of 0.11, a quick ratio of 1.03 and a current ratio of 1.03.

Toronto-Dominion Bank Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Friday, January 10th will be issued a dividend of $0.7482 per share. The ex-dividend date is Friday, January 10th. This is a boost from Toronto-Dominion Bank's previous quarterly dividend of $0.74. This represents a $2.99 annualized dividend and a yield of 5.21%. Toronto-Dominion Bank's payout ratio is currently 84.15%.

Toronto-Dominion Bank Profile

(

Free Report)

The Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Featured Articles

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.