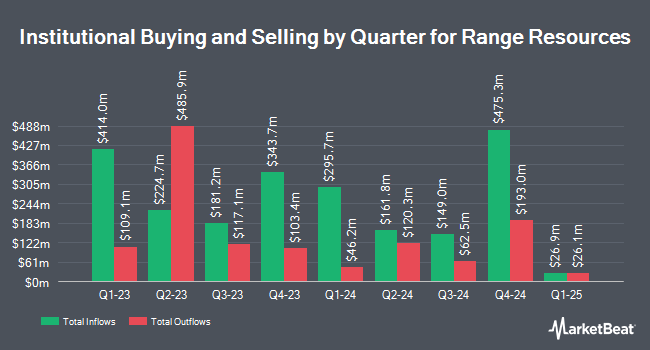

Moody Aldrich Partners LLC purchased a new position in shares of Range Resources Co. (NYSE:RRC - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor purchased 9,421 shares of the oil and gas exploration company's stock, valued at approximately $339,000.

Several other large investors also recently bought and sold shares of RRC. Envestnet Asset Management Inc. increased its holdings in shares of Range Resources by 10.2% in the second quarter. Envestnet Asset Management Inc. now owns 96,719 shares of the oil and gas exploration company's stock valued at $3,243,000 after buying an additional 8,969 shares in the last quarter. Algert Global LLC bought a new position in shares of Range Resources during the 2nd quarter worth about $818,000. Creative Planning lifted its holdings in shares of Range Resources by 5.3% during the second quarter. Creative Planning now owns 55,655 shares of the oil and gas exploration company's stock valued at $1,866,000 after acquiring an additional 2,792 shares during the period. B. Riley Wealth Advisors Inc. acquired a new position in shares of Range Resources in the 2nd quarter worth approximately $486,000. Finally, SG Americas Securities LLC increased its position in Range Resources by 853.0% in the 3rd quarter. SG Americas Securities LLC now owns 198,520 shares of the oil and gas exploration company's stock valued at $6,106,000 after acquiring an additional 177,689 shares in the last quarter. Institutional investors and hedge funds own 98.93% of the company's stock.

Analyst Ratings Changes

RRC has been the subject of several recent analyst reports. StockNews.com raised shares of Range Resources to a "sell" rating in a research note on Wednesday, November 27th. Wells Fargo & Company upped their price objective on Range Resources from $38.00 to $40.00 and gave the stock an "overweight" rating in a research note on Tuesday, December 17th. Royal Bank of Canada reaffirmed a "sector perform" rating and issued a $40.00 price objective on shares of Range Resources in a research report on Tuesday, January 14th. Mizuho upped their price target on shares of Range Resources from $40.00 to $47.00 and gave the company an "outperform" rating in a research note on Monday, December 16th. Finally, Stephens lifted their target price on Range Resources from $39.00 to $43.00 and gave the stock an "overweight" rating in a report on Wednesday. Three analysts have rated the stock with a sell rating, eleven have issued a hold rating and six have issued a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $38.00.

View Our Latest Stock Report on Range Resources

Range Resources Price Performance

Range Resources stock traded down $0.07 during trading on Thursday, reaching $37.52. The company had a trading volume of 2,236,033 shares, compared to its average volume of 2,807,581. Range Resources Co. has a 1-year low of $27.29 and a 1-year high of $41.95. The firm's 50-day simple moving average is $36.47 and its 200 day simple moving average is $32.89. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.54 and a current ratio of 0.54. The firm has a market capitalization of $9.05 billion, a PE ratio of 18.95 and a beta of 1.81.

Range Resources Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, December 27th. Stockholders of record on Friday, December 13th were given a dividend of $0.08 per share. The ex-dividend date was Friday, December 13th. This represents a $0.32 annualized dividend and a dividend yield of 0.85%. Range Resources's payout ratio is 16.16%.

Range Resources Profile

(

Free Report)

Range Resources Corporation operates as an independent natural gas, natural gas liquids (NGLs), crude oil, and condensate company in the United States. The company engages in the exploration, development, and acquisition of natural gas and crude oil properties located in the Appalachian region. It sells natural gas to utilities, marketing and midstream companies, and industrial users; NGLs to petrochemical end users, marketers/traders, and natural gas processors; and oil and condensate to crude oil processors, transporters, and refining and marketing companies.

Recommended Stories

Before you consider Range Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Range Resources wasn't on the list.

While Range Resources currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.