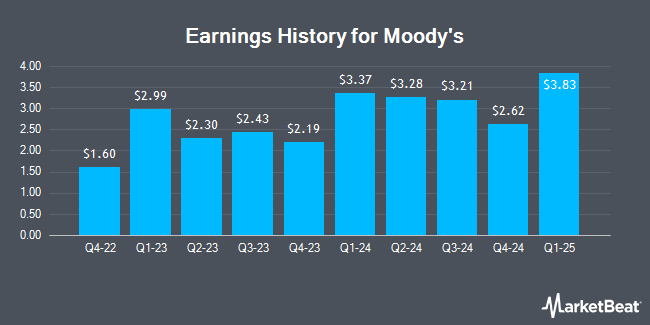

Moody's (NYSE:MCO - Get Free Report) posted its quarterly earnings data on Tuesday. The business services provider reported $3.83 EPS for the quarter, beating analysts' consensus estimates of $3.58 by $0.25, Zacks reports. Moody's had a net margin of 29.03% and a return on equity of 58.94%. Moody's updated its FY 2025 guidance to 13.250-14.000 EPS.

Moody's Trading Down 2.6 %

Moody's stock opened at $414.02 on Tuesday. The company has a 50 day moving average price of $461.94 and a 200 day moving average price of $473.94. The company has a debt-to-equity ratio of 1.81, a quick ratio of 1.67 and a current ratio of 1.47. Moody's has a 52 week low of $360.05 and a 52 week high of $531.93. The firm has a market capitalization of $74.48 billion, a price-to-earnings ratio of 36.74, a P/E/G ratio of 2.87 and a beta of 1.38.

Moody's Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 14th. Stockholders of record on Tuesday, February 25th were given a $0.94 dividend. This is an increase from Moody's's previous quarterly dividend of $0.85. This represents a $3.76 annualized dividend and a dividend yield of 0.91%. The ex-dividend date was Tuesday, February 25th. Moody's's dividend payout ratio (DPR) is 33.36%.

Wall Street Analysts Forecast Growth

MCO has been the subject of a number of research analyst reports. UBS Group upped their price objective on Moody's from $510.00 to $540.00 and gave the stock a "neutral" rating in a report on Tuesday, February 18th. JPMorgan Chase & Co. reduced their price target on Moody's from $585.00 to $495.00 and set an "overweight" rating for the company in a report on Wednesday, April 16th. Oppenheimer upped their target price on Moody's from $543.00 to $545.00 and gave the company an "outperform" rating in a research report on Friday, January 3rd. BMO Capital Markets lifted their price target on shares of Moody's from $481.00 to $531.00 and gave the stock a "market perform" rating in a research note on Tuesday, February 18th. Finally, Wells Fargo & Company decreased their price objective on shares of Moody's from $610.00 to $572.00 and set an "overweight" rating for the company in a report on Thursday, April 17th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $524.33.

View Our Latest Report on MCO

Insider Transactions at Moody's

In other Moody's news, CEO Robert Fauber sold 281 shares of Moody's stock in a transaction dated Monday, February 3rd. The stock was sold at an average price of $494.42, for a total transaction of $138,932.02. Following the transaction, the chief executive officer now owns 61,894 shares of the company's stock, valued at $30,601,631.48. The trade was a 0.45 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Insiders sold a total of 1,392 shares of company stock valued at $659,535 over the last quarter. Company insiders own 0.14% of the company's stock.

About Moody's

(

Get Free Report)

Moody's Corporation operates as an integrated risk assessment firm worldwide. It operates in two segments, Moody's Analytics and Moody's Investors Services. The Moody's Analytics segment develops a range of products and services that support the risk management activities of institutional participants in financial markets.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Moody's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moody's wasn't on the list.

While Moody's currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.