Moran Wealth Management LLC reduced its stake in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM - Free Report) by 3.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 192,147 shares of the semiconductor company's stock after selling 6,137 shares during the period. Taiwan Semiconductor Manufacturing makes up approximately 1.0% of Moran Wealth Management LLC's investment portfolio, making the stock its 15th biggest position. Moran Wealth Management LLC's holdings in Taiwan Semiconductor Manufacturing were worth $33,370,000 as of its most recent SEC filing.

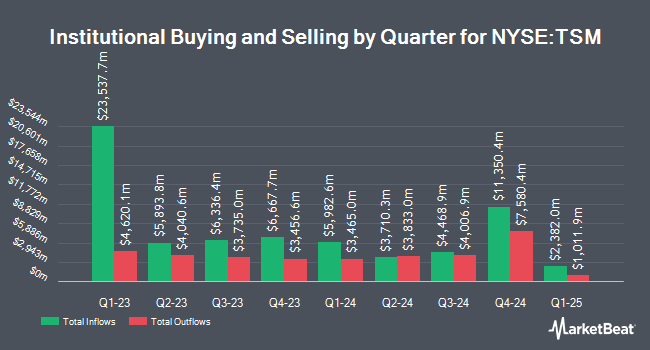

Other large investors have also added to or reduced their stakes in the company. ProShare Advisors LLC acquired a new position in shares of Taiwan Semiconductor Manufacturing in the 1st quarter valued at approximately $210,000. Crewe Advisors LLC bought a new stake in Taiwan Semiconductor Manufacturing during the first quarter worth $100,000. CreativeOne Wealth LLC boosted its holdings in shares of Taiwan Semiconductor Manufacturing by 25.8% in the 1st quarter. CreativeOne Wealth LLC now owns 4,208 shares of the semiconductor company's stock valued at $573,000 after purchasing an additional 863 shares in the last quarter. Wellington Wealth Strategies LLC. bought a new position in shares of Taiwan Semiconductor Manufacturing in the 1st quarter valued at $337,000. Finally, EP Wealth Advisors LLC raised its holdings in shares of Taiwan Semiconductor Manufacturing by 5.8% during the 1st quarter. EP Wealth Advisors LLC now owns 14,511 shares of the semiconductor company's stock worth $1,974,000 after buying an additional 794 shares in the last quarter. Institutional investors and hedge funds own 16.51% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have issued reports on TSM. StockNews.com cut Taiwan Semiconductor Manufacturing from a "buy" rating to a "hold" rating in a research report on Sunday. Barclays upped their price objective on shares of Taiwan Semiconductor Manufacturing from $215.00 to $240.00 and gave the stock an "overweight" rating in a research report on Monday. Susquehanna restated a "buy" rating on shares of Taiwan Semiconductor Manufacturing in a research report on Friday, October 18th. Finally, Needham & Company LLC reiterated a "buy" rating and issued a $210.00 price target on shares of Taiwan Semiconductor Manufacturing in a research note on Thursday, October 17th. Two research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $214.00.

Read Our Latest Stock Report on TSM

Taiwan Semiconductor Manufacturing Trading Down 0.7 %

Shares of Taiwan Semiconductor Manufacturing stock traded down $1.26 during trading on Wednesday, hitting $188.41. The company's stock had a trading volume of 10,600,908 shares, compared to its average volume of 15,361,500. The stock has a market cap of $977.17 billion, a price-to-earnings ratio of 30.19, a price-to-earnings-growth ratio of 0.87 and a beta of 1.12. The company has a debt-to-equity ratio of 0.24, a current ratio of 2.57 and a quick ratio of 2.30. Taiwan Semiconductor Manufacturing Company Limited has a 52 week low of $95.25 and a 52 week high of $212.60. The stock has a 50-day moving average price of $187.19 and a two-hundred day moving average price of $173.23.

Taiwan Semiconductor Manufacturing (NYSE:TSM - Get Free Report) last posted its quarterly earnings data on Thursday, October 17th. The semiconductor company reported $1.94 EPS for the quarter, topping analysts' consensus estimates of $1.74 by $0.20. Taiwan Semiconductor Manufacturing had a return on equity of 27.44% and a net margin of 39.10%. The company had revenue of $23.50 billion for the quarter, compared to analyst estimates of $22.72 billion. Equities research analysts anticipate that Taiwan Semiconductor Manufacturing Company Limited will post 6.84 EPS for the current fiscal year.

Taiwan Semiconductor Manufacturing Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, April 10th. Investors of record on Tuesday, March 18th will be paid a dividend of $0.5484 per share. The ex-dividend date is Tuesday, March 18th. This represents a $2.19 annualized dividend and a yield of 1.16%. This is a boost from Taiwan Semiconductor Manufacturing's previous quarterly dividend of $0.49. Taiwan Semiconductor Manufacturing's dividend payout ratio (DPR) is currently 31.57%.

Taiwan Semiconductor Manufacturing Profile

(

Free Report)

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally. It provides a range of wafer fabrication processes, including processes to manufacture complementary metal- oxide-semiconductor (CMOS) logic, mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and others.

Further Reading

Before you consider Taiwan Semiconductor Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taiwan Semiconductor Manufacturing wasn't on the list.

While Taiwan Semiconductor Manufacturing currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.