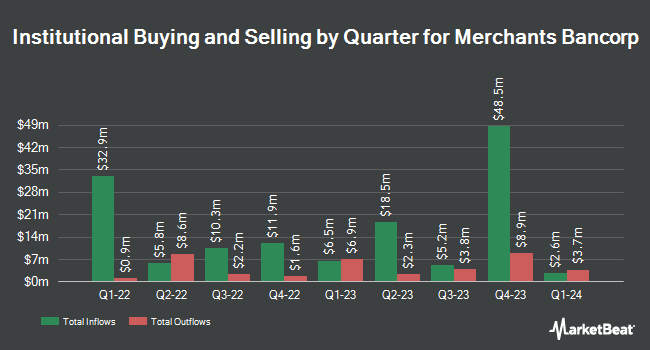

Moran Wealth Management LLC bought a new position in Merchants Bancorp (NASDAQ:MBIN - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund bought 96,640 shares of the company's stock, valued at approximately $3,524,000. Moran Wealth Management LLC owned about 0.21% of Merchants Bancorp as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently modified their holdings of the stock. Royce & Associates LP boosted its position in shares of Merchants Bancorp by 143.1% in the 3rd quarter. Royce & Associates LP now owns 490,189 shares of the company's stock valued at $22,039,000 after purchasing an additional 288,553 shares during the period. Elser Financial Planning Inc acquired a new position in shares of Merchants Bancorp in the fourth quarter worth about $994,207,000. Valeo Financial Advisors LLC increased its position in shares of Merchants Bancorp by 3.1% in the fourth quarter. Valeo Financial Advisors LLC now owns 225,419 shares of the company's stock worth $8,221,000 after acquiring an additional 6,882 shares in the last quarter. State Street Corp raised its holdings in shares of Merchants Bancorp by 4.7% during the third quarter. State Street Corp now owns 448,525 shares of the company's stock valued at $20,205,000 after acquiring an additional 20,214 shares during the period. Finally, Geode Capital Management LLC raised its holdings in shares of Merchants Bancorp by 3.0% during the third quarter. Geode Capital Management LLC now owns 566,520 shares of the company's stock valued at $25,476,000 after acquiring an additional 16,666 shares during the period. 24.57% of the stock is owned by institutional investors and hedge funds.

Merchants Bancorp Stock Up 3.5 %

Shares of MBIN stock traded up $1.27 during trading on Friday, hitting $37.90. 156,495 shares of the company were exchanged, compared to its average volume of 176,245. The business's 50-day simple moving average is $39.81 and its 200 day simple moving average is $40.91. Merchants Bancorp has a twelve month low of $34.16 and a twelve month high of $53.27. The firm has a market capitalization of $1.74 billion, a price-to-earnings ratio of 6.01 and a beta of 1.16. The company has a debt-to-equity ratio of 2.40, a quick ratio of 0.85 and a current ratio of 1.15.

Merchants Bancorp (NASDAQ:MBIN - Get Free Report) last issued its earnings results on Monday, February 3rd. The company reported $1.85 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.27 by $0.58. Merchants Bancorp had a net margin of 22.08% and a return on equity of 22.86%. As a group, analysts forecast that Merchants Bancorp will post 5.54 EPS for the current fiscal year.

Merchants Bancorp Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, April 1st. Shareholders of record on Friday, March 14th will be paid a $0.10 dividend. The ex-dividend date of this dividend is Friday, March 14th. This represents a $0.40 dividend on an annualized basis and a yield of 1.06%. This is an increase from Merchants Bancorp's previous quarterly dividend of $0.09. Merchants Bancorp's payout ratio is 6.34%.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on the stock. Raymond James reiterated an "outperform" rating and set a $53.00 price objective (up from $50.00) on shares of Merchants Bancorp in a research report on Thursday, January 30th. Morgan Stanley decreased their target price on Merchants Bancorp from $47.00 to $45.00 and set an "equal weight" rating for the company in a research report on Thursday. Finally, Piper Sandler upped their price target on Merchants Bancorp from $52.50 to $56.50 and gave the company an "overweight" rating in a research report on Thursday, January 30th.

Read Our Latest Stock Report on MBIN

Insiders Place Their Bets

In related news, insider Scott A. Evans sold 25,000 shares of the business's stock in a transaction that occurred on Wednesday, January 29th. The stock was sold at an average price of $43.10, for a total value of $1,077,500.00. Following the completion of the sale, the insider now owns 27,606 shares of the company's stock, valued at approximately $1,189,818.60. The trade was a 47.52 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Insiders own 39.70% of the company's stock.

About Merchants Bancorp

(

Free Report)

Merchants Bancorp operates as the diversified bank holding company in the United States. It operates through three segments: Multi-family Mortgage Banking, Mortgage Warehousing, and Banking. The Multi-family Mortgage Banking segment engages in the mortgage banking, which originates and services government sponsored mortgages, including bridge financing products to refinance, acquire, or reposition multi-family housing projects, and construction lending for multi-family and healthcare facilities.

Further Reading

Before you consider Merchants Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merchants Bancorp wasn't on the list.

While Merchants Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.