FIGS (NYSE:FIGS - Get Free Report) had its price target dropped by Morgan Stanley from $4.75 to $4.25 in a report released on Thursday,Benzinga reports. The brokerage currently has an "equal weight" rating on the stock. Morgan Stanley's target price would suggest a potential upside of 9.40% from the company's current price.

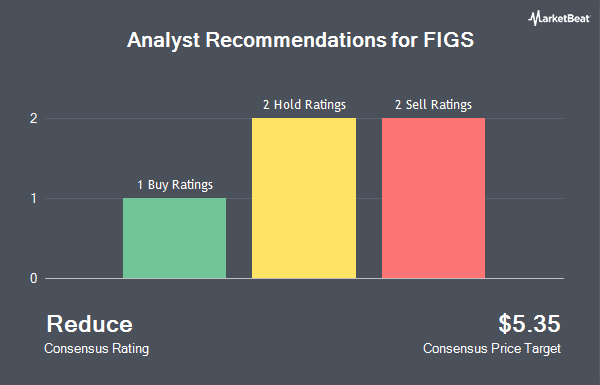

Separately, Telsey Advisory Group reissued a "market perform" rating and issued a $7.00 price target on shares of FIGS in a research report on Friday, February 28th. One analyst has rated the stock with a sell rating, three have issued a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat.com, FIGS currently has an average rating of "Hold" and a consensus target price of $5.15.

Check Out Our Latest Stock Analysis on FIGS

FIGS Price Performance

NYSE:FIGS traded up $0.08 during mid-day trading on Thursday, hitting $3.89. 1,261,722 shares of the company's stock were exchanged, compared to its average volume of 2,918,817. The company has a market cap of $631.39 million, a PE ratio of 64.75, a P/E/G ratio of 31.62 and a beta of 1.18. FIGS has a one year low of $3.57 and a one year high of $7.06. The business has a fifty day moving average price of $4.64 and a 200 day moving average price of $5.37.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in FIGS. GAMMA Investing LLC increased its position in FIGS by 585.8% in the first quarter. GAMMA Investing LLC now owns 6,536 shares of the company's stock worth $30,000 after purchasing an additional 5,583 shares during the last quarter. Sugar Maple Asset Management LLC bought a new position in shares of FIGS in the 4th quarter valued at about $43,000. Blue Trust Inc. increased its stake in FIGS by 380.0% during the fourth quarter. Blue Trust Inc. now owns 7,407 shares of the company's stock worth $51,000 after acquiring an additional 5,864 shares during the last quarter. Stifel Financial Corp purchased a new stake in FIGS during the fourth quarter valued at approximately $70,000. Finally, Cibc World Markets Corp purchased a new position in shares of FIGS in the 4th quarter worth approximately $75,000. Institutional investors own 92.21% of the company's stock.

About FIGS

(

Get Free Report)

FIGS, Inc operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally. It designs and sells healthcare apparel and scrubwear and non-scrubwear offerings, such as outerwear, underscrubs, footwear, compression socks, lab coats, loungewear, and other apparel.

Featured Stories

Before you consider FIGS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FIGS wasn't on the list.

While FIGS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.