Silicon Laboratories (NASDAQ:SLAB - Get Free Report) had its price target cut by investment analysts at Morgan Stanley from $123.00 to $97.00 in a note issued to investors on Tuesday, Benzinga reports. The firm presently has an "equal weight" rating on the semiconductor company's stock. Morgan Stanley's price objective points to a potential downside of 7.14% from the company's current price.

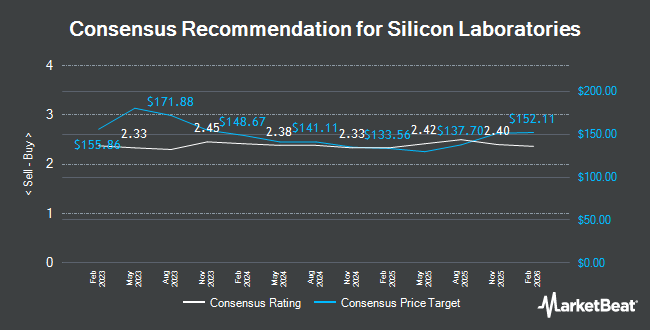

SLAB has been the subject of a number of other research reports. Stifel Nicolaus dropped their target price on Silicon Laboratories from $160.00 to $135.00 and set a "buy" rating for the company in a report on Tuesday. JPMorgan Chase & Co. cut their price objective on shares of Silicon Laboratories from $150.00 to $135.00 and set an "overweight" rating for the company in a report on Tuesday. Benchmark reaffirmed a "hold" rating on shares of Silicon Laboratories in a report on Tuesday. Barclays cut their price target on Silicon Laboratories from $120.00 to $75.00 and set an "equal weight" rating for the company in a research note on Tuesday. Finally, KeyCorp lowered their price objective on Silicon Laboratories from $150.00 to $115.00 and set an "overweight" rating on the stock in a research note on Tuesday. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, Silicon Laboratories presently has an average rating of "Hold" and a consensus target price of $121.50.

View Our Latest Analysis on SLAB

Silicon Laboratories Trading Down 0.3 %

Shares of NASDAQ:SLAB traded down $0.28 on Tuesday, hitting $104.46. The company had a trading volume of 953,558 shares, compared to its average volume of 297,919. The stock has a market cap of $3.37 billion, a price-to-earnings ratio of -17.30 and a beta of 1.20. The stock has a 50 day moving average price of $112.56 and a 200 day moving average price of $115.56. Silicon Laboratories has a 1-year low of $90.65 and a 1-year high of $154.91.

Silicon Laboratories (NASDAQ:SLAB - Get Free Report) last announced its quarterly earnings results on Monday, November 4th. The semiconductor company reported ($0.13) EPS for the quarter, beating analysts' consensus estimates of ($0.20) by $0.07. Silicon Laboratories had a negative net margin of 36.53% and a negative return on equity of 9.13%. The business had revenue of $166.00 million for the quarter, compared to analyst estimates of $165.50 million. During the same quarter in the prior year, the business earned $0.48 EPS. Silicon Laboratories's quarterly revenue was down 18.5% on a year-over-year basis. Sell-side analysts anticipate that Silicon Laboratories will post -3.41 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Silicon Laboratories news, SVP Brandon Tolany sold 845 shares of Silicon Laboratories stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $115.00, for a total value of $97,175.00. Following the transaction, the senior vice president now owns 43,615 shares in the company, valued at $5,015,725. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 1.72% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. Cullen Frost Bankers Inc. bought a new stake in Silicon Laboratories during the 2nd quarter worth $28,000. Fidelis Capital Partners LLC bought a new stake in shares of Silicon Laboratories during the first quarter worth about $55,000. GAMMA Investing LLC increased its stake in shares of Silicon Laboratories by 84.1% in the third quarter. GAMMA Investing LLC now owns 497 shares of the semiconductor company's stock valued at $57,000 after buying an additional 227 shares during the period. Daiwa Securities Group Inc. bought a new position in Silicon Laboratories in the 2nd quarter valued at approximately $60,000. Finally, Migdal Insurance & Financial Holdings Ltd. acquired a new stake in Silicon Laboratories during the 2nd quarter worth approximately $82,000.

Silicon Laboratories Company Profile

(

Get Free Report)

Silicon Laboratories Inc, a fabless semiconductor company, provides various analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally. The company's products include wireless microcontrollers and sensor products. Its products are used in various electronic products in a range of applications for the industrial Internet of Things (IoT), including industrial automation and control, smart buildings, access control, HVAC control, and industrial wearables and power tools; smart cities applications, such as smart metering, smart street lighting, renewable energy, electric vehicle supply equipment, and smart agriculture; commercial IoT applications, including smart lighting, asset tracking, electronic shelf labels, theft protection, and enterprise access points; smart home applications, comprising home automation/security systems, smart speakers, smart lighting, HVAC control, smart cameras, smart appliances, smart home sensing, smart locks, and window/blind controls; and connected health applications, including diabetes management, consumer health and fitness, elderly care, patient monitoring, and activity tracking; as well as in commercial building automation, consumer electronics, and medical instrumentation.

Featured Articles

Before you consider Silicon Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silicon Laboratories wasn't on the list.

While Silicon Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.