Kennametal (NYSE:KMT - Free Report) had its price objective increased by Morgan Stanley from $24.50 to $28.00 in a research report report published on Tuesday morning,Benzinga reports. The brokerage currently has an equal weight rating on the industrial products company's stock.

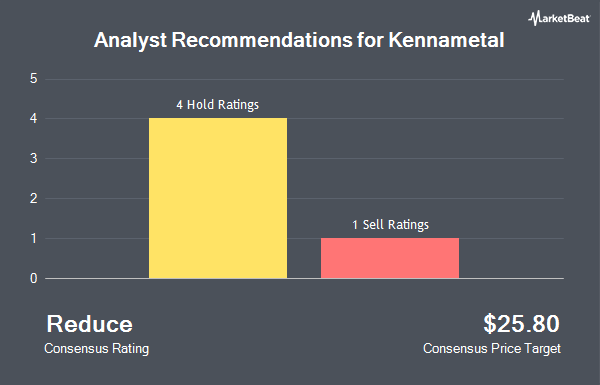

Several other brokerages have also recently issued reports on KMT. Bank of America cut shares of Kennametal from a "neutral" rating to an "underperform" rating and set a $26.00 target price on the stock. in a report on Friday, October 18th. Jefferies Financial Group cut shares of Kennametal from a "buy" rating to a "hold" rating and lowered their price target for the company from $40.00 to $32.00 in a report on Friday, December 6th. StockNews.com cut shares of Kennametal from a "buy" rating to a "hold" rating in a report on Thursday, November 7th. Finally, Loop Capital raised their price target on shares of Kennametal from $24.00 to $26.00 and gave the company a "hold" rating in a report on Tuesday, November 19th. Two research analysts have rated the stock with a sell rating and five have assigned a hold rating to the stock. According to data from MarketBeat.com, Kennametal has an average rating of "Hold" and an average target price of $26.83.

Check Out Our Latest Stock Report on Kennametal

Kennametal Trading Down 0.2 %

Shares of KMT traded down $0.04 during midday trading on Tuesday, hitting $26.49. The stock had a trading volume of 730,353 shares, compared to its average volume of 714,987. The firm has a market cap of $2.06 billion, a PE ratio of 20.70, a price-to-earnings-growth ratio of 2.29 and a beta of 1.65. Kennametal has a 1 year low of $22.50 and a 1 year high of $32.18. The stock's 50 day moving average is $27.19 and its 200 day moving average is $25.60. The company has a debt-to-equity ratio of 0.45, a current ratio of 2.52 and a quick ratio of 1.16.

Kennametal (NYSE:KMT - Get Free Report) last issued its earnings results on Wednesday, November 6th. The industrial products company reported $0.29 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.26 by $0.03. Kennametal had a net margin of 4.98% and a return on equity of 8.35%. The company had revenue of $481.90 million for the quarter, compared to analysts' expectations of $485.26 million. During the same period in the prior year, the business earned $0.41 EPS. The firm's quarterly revenue was down 2.2% on a year-over-year basis. As a group, analysts forecast that Kennametal will post 1.44 EPS for the current fiscal year.

Kennametal Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, November 26th. Shareholders of record on Tuesday, November 12th were given a dividend of $0.20 per share. This represents a $0.80 dividend on an annualized basis and a yield of 3.02%. The ex-dividend date of this dividend was Tuesday, November 12th. Kennametal's dividend payout ratio is presently 62.50%.

Insider Activity

In other Kennametal news, VP John Wayne Witt sold 1,765 shares of Kennametal stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $29.35, for a total transaction of $51,802.75. Following the sale, the vice president now owns 1,642 shares of the company's stock, valued at $48,192.70. The trade was a 51.81 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, VP Franklin Cardenas sold 20,470 shares of the business's stock in a transaction dated Wednesday, December 4th. The shares were sold at an average price of $28.24, for a total transaction of $578,072.80. Following the transaction, the vice president now directly owns 39,581 shares in the company, valued at approximately $1,117,767.44. The trade was a 34.09 % decrease in their position. The disclosure for this sale can be found here. Insiders own 1.41% of the company's stock.

Institutional Trading of Kennametal

Large investors have recently made changes to their positions in the company. Dynamic Technology Lab Private Ltd acquired a new stake in shares of Kennametal in the third quarter valued at approximately $804,000. Azarias Capital Management L.P. boosted its stake in shares of Kennametal by 34.9% during the second quarter. Azarias Capital Management L.P. now owns 259,399 shares of the industrial products company's stock valued at $6,106,000 after acquiring an additional 67,139 shares during the last quarter. Barrow Hanley Mewhinney & Strauss LLC boosted its stake in shares of Kennametal by 1.0% during the second quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 2,051,503 shares of the industrial products company's stock valued at $48,292,000 after acquiring an additional 20,634 shares during the last quarter. Jane Street Group LLC boosted its stake in shares of Kennametal by 113.7% during the third quarter. Jane Street Group LLC now owns 191,151 shares of the industrial products company's stock valued at $4,957,000 after acquiring an additional 101,711 shares during the last quarter. Finally, Brandes Investment Partners LP boosted its stake in Kennametal by 35.1% in the 2nd quarter. Brandes Investment Partners LP now owns 2,332,993 shares of the industrial products company's stock worth $54,798,000 after buying an additional 606,477 shares during the last quarter.

Kennametal Company Profile

(

Get Free Report)

Kennametal Inc engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide. The company operates through two segments, Metal Cutting and Infrastructure.

Further Reading

Before you consider Kennametal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kennametal wasn't on the list.

While Kennametal currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.