RingCentral (NYSE:RNG - Get Free Report) had its target price upped by equities research analysts at Morgan Stanley from $38.00 to $40.00 in a research report issued to clients and investors on Wednesday,Benzinga reports. The brokerage presently has an "equal weight" rating on the software maker's stock. Morgan Stanley's price target suggests a potential upside of 6.19% from the stock's current price.

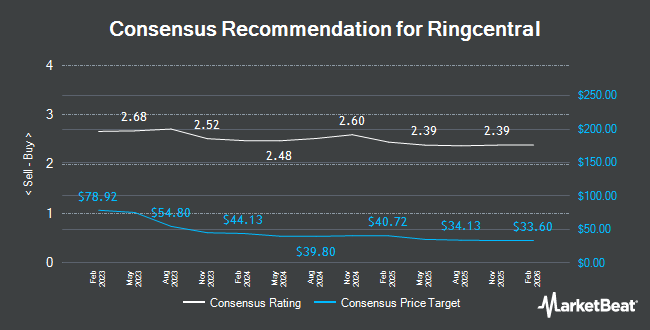

Other research analysts have also issued reports about the stock. StockNews.com raised shares of RingCentral from a "buy" rating to a "strong-buy" rating in a research report on Monday, November 11th. Raymond James decreased their price objective on shares of RingCentral from $52.00 to $50.00 and set a "strong-buy" rating for the company in a report on Friday, November 8th. Wedbush raised their price objective on shares of RingCentral from $36.00 to $41.00 and gave the stock a "neutral" rating in a report on Friday, November 8th. Piper Sandler raised their price objective on shares of RingCentral from $31.00 to $38.00 and gave the stock a "neutral" rating in a report on Friday, November 8th. Finally, Needham & Company LLC restated a "buy" rating and set a $42.00 price objective on shares of RingCentral in a report on Monday, November 11th. Eight investment analysts have rated the stock with a hold rating, five have given a buy rating and two have given a strong buy rating to the stock. According to MarketBeat, RingCentral currently has an average rating of "Moderate Buy" and a consensus price target of $42.00.

Check Out Our Latest Analysis on RNG

RingCentral Stock Performance

Shares of RingCentral stock traded down $1.57 during trading hours on Wednesday, reaching $37.67. The company's stock had a trading volume of 908,028 shares, compared to its average volume of 1,236,137. The stock's fifty day simple moving average is $36.27 and its two-hundred day simple moving average is $33.05. RingCentral has a one year low of $26.98 and a one year high of $42.19. The company has a market capitalization of $3.41 billion, a P/E ratio of -35.54, a P/E/G ratio of 2.48 and a beta of 0.99.

RingCentral (NYSE:RNG - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The software maker reported $0.24 earnings per share for the quarter, beating analysts' consensus estimates of $0.14 by $0.10. RingCentral had a negative net margin of 4.17% and a negative return on equity of 2.55%. The company had revenue of $608.77 million for the quarter, compared to analyst estimates of $601.91 million. As a group, research analysts forecast that RingCentral will post 0.84 earnings per share for the current year.

Insider Transactions at RingCentral

In related news, SVP John H. Marlow sold 8,720 shares of the company's stock in a transaction that occurred on Tuesday, December 10th. The shares were sold at an average price of $42.05, for a total transaction of $366,676.00. Following the sale, the senior vice president now owns 334,869 shares of the company's stock, valued at approximately $14,081,241.45. This represents a 2.54 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, Director Robert I. Theis sold 1,457 shares of the stock in a transaction that occurred on Wednesday, December 4th. The stock was sold at an average price of $37.79, for a total transaction of $55,060.03. Following the completion of the sale, the director now owns 28,690 shares in the company, valued at $1,084,195.10. This represents a 4.83 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 117,173 shares of company stock worth $4,175,376 over the last quarter. Corporate insiders own 6.76% of the company's stock.

Hedge Funds Weigh In On RingCentral

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Pacer Advisors Inc. increased its position in shares of RingCentral by 45.3% in the third quarter. Pacer Advisors Inc. now owns 2,639,356 shares of the software maker's stock worth $83,483,000 after purchasing an additional 822,892 shares during the last quarter. Foundry Partners LLC bought a new position in shares of RingCentral in the third quarter worth approximately $8,886,000. Cubist Systematic Strategies LLC boosted its stake in RingCentral by 130.1% in the second quarter. Cubist Systematic Strategies LLC now owns 414,347 shares of the software maker's stock worth $11,685,000 after buying an additional 234,238 shares in the last quarter. Jupiter Asset Management Ltd. boosted its stake in RingCentral by 404.2% in the second quarter. Jupiter Asset Management Ltd. now owns 219,187 shares of the software maker's stock worth $6,181,000 after buying an additional 175,715 shares in the last quarter. Finally, Susquehanna Fundamental Investments LLC purchased a new stake in RingCentral in the second quarter worth approximately $4,801,000. 98.61% of the stock is currently owned by hedge funds and other institutional investors.

RingCentral Company Profile

(

Get Free Report)

RingCentral, Inc, together with its subsidiaries, provides cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions worldwide. The company's products include RingCentral Message Video Phone that provides a unified experience for communication and collaboration across multiple modes, including HD voice, video, SMS, messaging and collaboration, conferencing, online meetings, and fax; RingCentral Contact Center, a collaborative contact center solution that delivers AI-powered omnichannel and workforce engagement solutions with integrated RingCentral MVP; and RingCX, an AI-powered contact center that a native delivers omnichannel experience.

Read More

Before you consider RingCentral, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RingCentral wasn't on the list.

While RingCentral currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.