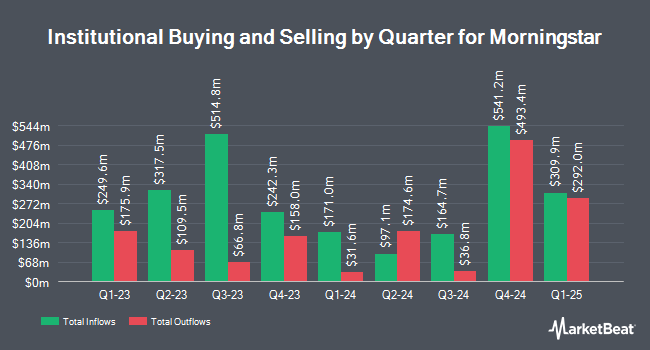

Principal Financial Group Inc. cut its holdings in Morningstar, Inc. (NASDAQ:MORN - Free Report) by 22.8% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 84,845 shares of the business services provider's stock after selling 25,095 shares during the quarter. Principal Financial Group Inc. owned about 0.20% of Morningstar worth $27,076,000 as of its most recent SEC filing.

Other large investors have also bought and sold shares of the company. Scout Investments Inc. raised its stake in shares of Morningstar by 75.8% in the 1st quarter. Scout Investments Inc. now owns 42,549 shares of the business services provider's stock valued at $13,034,000 after purchasing an additional 18,345 shares during the period. M&G Plc lifted its position in Morningstar by 2.0% during the 2nd quarter. M&G Plc now owns 173,105 shares of the business services provider's stock worth $51,239,000 after buying an additional 3,322 shares in the last quarter. Tidal Investments LLC bought a new position in shares of Morningstar in the 1st quarter valued at about $1,207,000. BNP Paribas Financial Markets grew its holdings in shares of Morningstar by 104.2% in the 1st quarter. BNP Paribas Financial Markets now owns 6,114 shares of the business services provider's stock valued at $1,885,000 after acquiring an additional 3,120 shares in the last quarter. Finally, Harbor Capital Advisors Inc. raised its holdings in Morningstar by 295.4% during the second quarter. Harbor Capital Advisors Inc. now owns 2,637 shares of the business services provider's stock worth $780,000 after acquiring an additional 1,970 shares in the last quarter. 57.02% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently issued reports on the company. BMO Capital Markets reiterated an "outperform" rating and set a $352.00 price objective on shares of Morningstar in a research note on Wednesday, August 28th. StockNews.com cut Morningstar from a "buy" rating to a "hold" rating in a research report on Thursday, November 7th. Redburn Atlantic cut shares of Morningstar from a "buy" rating to a "neutral" rating and set a $340.00 price objective for the company. in a research report on Wednesday, October 9th. Finally, UBS Group initiated coverage on shares of Morningstar in a report on Tuesday, October 8th. They set a "buy" rating and a $390.00 target price on the stock. Two research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to data from MarketBeat, Morningstar has a consensus rating of "Moderate Buy" and a consensus price target of $360.67.

Get Our Latest Stock Analysis on Morningstar

Insider Buying and Selling

In other news, Chairman Joseph D. Mansueto sold 7,222 shares of the company's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $349.67, for a total transaction of $2,525,316.74. Following the sale, the chairman now directly owns 10,801,361 shares of the company's stock, valued at $3,776,911,900.87. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, Chairman Joseph D. Mansueto sold 7,222 shares of Morningstar stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $349.67, for a total value of $2,525,316.74. Following the transaction, the chairman now owns 10,801,361 shares of the company's stock, valued at $3,776,911,900.87. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, Chairman Joseph D. Mansueto sold 9,062 shares of Morningstar stock in a transaction that occurred on Friday, November 8th. The shares were sold at an average price of $348.45, for a total transaction of $3,157,653.90. Following the sale, the chairman now owns 10,808,583 shares of the company's stock, valued at approximately $3,766,250,746.35. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 67,370 shares of company stock worth $21,909,493. Corporate insiders own 39.90% of the company's stock.

Morningstar Price Performance

Morningstar stock traded down $1.27 during mid-day trading on Wednesday, hitting $349.28. The stock had a trading volume of 39,796 shares, compared to its average volume of 114,895. The company has a current ratio of 1.14, a quick ratio of 1.14 and a debt-to-equity ratio of 0.55. The firm's 50 day moving average is $327.49 and its 200 day moving average is $310.48. The firm has a market capitalization of $14.98 billion, a P/E ratio of 46.36 and a beta of 1.18. Morningstar, Inc. has a one year low of $264.79 and a one year high of $352.55.

Morningstar (NASDAQ:MORN - Get Free Report) last posted its quarterly earnings results on Wednesday, October 23rd. The business services provider reported $2.00 EPS for the quarter, missing analysts' consensus estimates of $2.01 by ($0.01). The business had revenue of $569.40 million during the quarter. Morningstar had a return on equity of 23.28% and a net margin of 14.69%.

Morningstar Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Shareholders of record on Friday, October 4th were paid a $0.405 dividend. This represents a $1.62 annualized dividend and a yield of 0.46%. The ex-dividend date was Friday, October 4th. Morningstar's payout ratio is currently 21.40%.

About Morningstar

(

Free Report)

Morningstar, Inc provides independent investment insights in the United States, Asia. Australia, Continental Europe, the United Kingdom, and internationally. The company operates in five segments: Morningstar Data and Analytics; PitchBook; Morningstar Wealth; Morningstar Credit; and Morningstar Retirement.

Further Reading

Before you consider Morningstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morningstar wasn't on the list.

While Morningstar currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report