Maxwell Wealth Strategies Inc. grew its holdings in Motorola Solutions, Inc. (NYSE:MSI - Free Report) by 18.6% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 10,285 shares of the communications equipment provider's stock after acquiring an additional 1,614 shares during the period. Motorola Solutions comprises approximately 2.0% of Maxwell Wealth Strategies Inc.'s portfolio, making the stock its 12th largest position. Maxwell Wealth Strategies Inc.'s holdings in Motorola Solutions were worth $4,753,000 as of its most recent SEC filing.

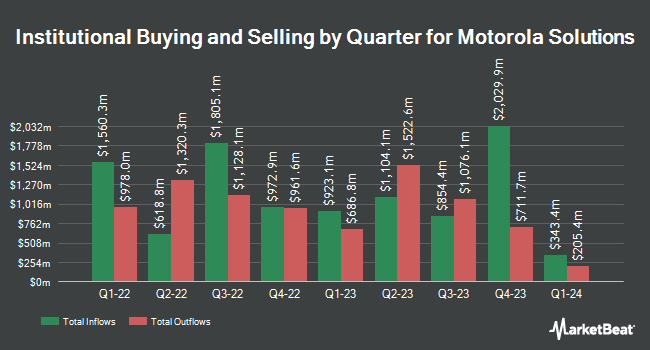

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Versor Investments LP purchased a new stake in shares of Motorola Solutions during the 3rd quarter worth approximately $449,000. Skandinaviska Enskilda Banken AB publ grew its position in Motorola Solutions by 32.9% in the 2nd quarter. Skandinaviska Enskilda Banken AB publ now owns 358,011 shares of the communications equipment provider's stock valued at $138,210,000 after buying an additional 88,603 shares during the last quarter. Magnolia Capital Advisors LLC acquired a new position in shares of Motorola Solutions during the second quarter worth about $19,694,000. Los Angeles Capital Management LLC increased its position in Motorola Solutions by 8.5% during the 3rd quarter. Los Angeles Capital Management LLC now owns 409,421 shares of the communications equipment provider's stock worth $184,088,000 after purchasing an additional 32,157 shares during the period. Finally, First Foundation Advisors grew its holdings in Motorola Solutions by 37.7% during the first quarter. First Foundation Advisors now owns 354 shares of the communications equipment provider's stock worth $126,000 after acquiring an additional 97 shares during the period. 84.17% of the stock is owned by institutional investors and hedge funds.

Motorola Solutions Stock Down 1.0 %

Shares of MSI traded down $4.70 during midday trading on Friday, hitting $489.00. The company had a trading volume of 726,244 shares, compared to its average volume of 669,014. The company's 50 day moving average price is $460.37 and its 200 day moving average price is $414.21. Motorola Solutions, Inc. has a 52 week low of $307.09 and a 52 week high of $507.82. The stock has a market cap of $81.72 billion, a price-to-earnings ratio of 53.56, a PEG ratio of 4.15 and a beta of 0.97. The company has a quick ratio of 1.07, a current ratio of 1.25 and a debt-to-equity ratio of 4.23.

Motorola Solutions (NYSE:MSI - Get Free Report) last issued its earnings results on Thursday, November 7th. The communications equipment provider reported $3.46 earnings per share for the quarter, topping analysts' consensus estimates of $3.10 by $0.36. Motorola Solutions had a net margin of 14.65% and a return on equity of 251.96%. The company had revenue of $2.79 billion for the quarter, compared to analysts' expectations of $2.76 billion. On average, equities research analysts predict that Motorola Solutions, Inc. will post 12.26 EPS for the current year.

Motorola Solutions Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Friday, December 13th will be given a $1.09 dividend. The ex-dividend date of this dividend is Friday, December 13th. This is a positive change from Motorola Solutions's previous quarterly dividend of $0.98. This represents a $4.36 annualized dividend and a yield of 0.89%. Motorola Solutions's dividend payout ratio (DPR) is currently 47.75%.

Analyst Ratings Changes

MSI has been the subject of several research reports. Deutsche Bank Aktiengesellschaft lifted their price objective on Motorola Solutions from $385.00 to $440.00 and gave the stock a "buy" rating in a report on Tuesday, August 6th. Evercore ISI raised their target price on shares of Motorola Solutions from $450.00 to $500.00 and gave the stock an "outperform" rating in a research report on Friday, August 30th. Barclays upped their price objective on shares of Motorola Solutions from $467.00 to $529.00 and gave the company an "overweight" rating in a research note on Friday, November 8th. Bank of America increased their target price on Motorola Solutions from $440.00 to $520.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Finally, Raymond James lifted their price target on shares of Motorola Solutions from $425.00 to $515.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Nine analysts have rated the stock with a buy rating, According to data from MarketBeat, the company presently has an average rating of "Buy" and an average target price of $493.43.

View Our Latest Research Report on MSI

Motorola Solutions Profile

(

Free Report)

Motorola Solutions, Inc provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally. The company operates in two segments, Products and Systems Integration, and Software and Services. The Products and Systems Integration segment offers a portfolio of infrastructure, devices, accessories, and video security devices and infrastructure, as well as the implementation and integration of systems, devices, software, and applications for government, public safety, and commercial customers who operate private communications networks and video security solutions, as well as manage a mobile workforce.

Recommended Stories

Before you consider Motorola Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Motorola Solutions wasn't on the list.

While Motorola Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.