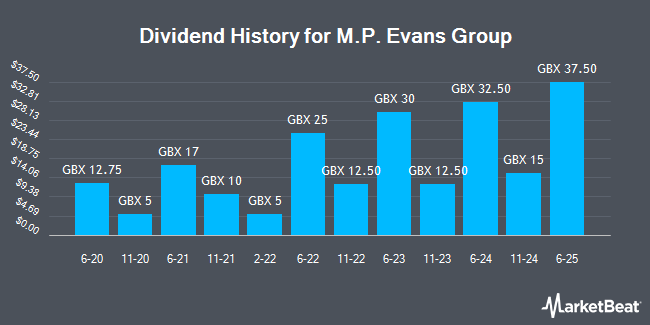

M.P. Evans Group PLC (LON:MPE - Get Free Report) announced a dividend on Tuesday, March 25th, DividendData.Co.Uk reports. Shareholders of record on Thursday, April 24th will be given a dividend of GBX 37.50 ($0.49) per share on Thursday, June 19th. This represents a dividend yield of 3.64%. The ex-dividend date of this dividend is Thursday, April 24th. This is a 150.0% increase from M.P. Evans Group's previous dividend of $15.00. The official announcement can be viewed at this link.

M.P. Evans Group Price Performance

Shares of LON:MPE remained flat at GBX 1,000 ($12.94) during midday trading on Friday. The company had a trading volume of 32,095 shares, compared to its average volume of 52,419. The business's 50 day moving average price is GBX 1,029.06 and its two-hundred day moving average price is GBX 973.65. The company has a market capitalization of £649.12 million, a price-to-earnings ratio of 10.07 and a beta of 0.69. The company has a quick ratio of 1.91, a current ratio of 1.70 and a debt-to-equity ratio of 8.89. M.P. Evans Group has a 12 month low of GBX 792 ($10.25) and a 12 month high of GBX 1,130 ($14.63).

Analyst Ratings Changes

Separately, Canaccord Genuity Group increased their target price on shares of M.P. Evans Group from GBX 1,400 ($18.12) to GBX 1,500 ($19.41) and gave the stock a "buy" rating in a research note on Friday.

Read Our Latest Report on MPE

About M.P. Evans Group

(

Get Free Report)

M.P. Evans Group PLC is a responsible producer of certified sustainable crude palm oil (“CPO”), with plantations in five Indonesian provinces: Aceh, Bangka Belitung, East Kalimantan, North Sumatra and South Sumatra.

Headquartered in the UK, the Group's shares are traded on the London Stock Exchange's Alternative Investment Market (“AIM”).

Recommended Stories

Before you consider M.P. Evans Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M.P. Evans Group wasn't on the list.

While M.P. Evans Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.