Segall Bryant & Hamill LLC increased its position in shares of MP Materials Corp. (NYSE:MP - Free Report) by 32.7% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,245,796 shares of the company's stock after purchasing an additional 306,933 shares during the quarter. Segall Bryant & Hamill LLC owned 0.75% of MP Materials worth $21,988,000 as of its most recent SEC filing.

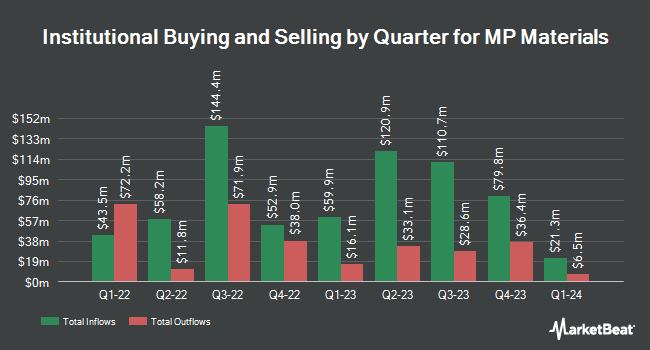

A number of other institutional investors and hedge funds have also recently modified their holdings of MP. GAMMA Investing LLC lifted its holdings in MP Materials by 136.0% in the third quarter. GAMMA Investing LLC now owns 2,230 shares of the company's stock valued at $39,000 after acquiring an additional 1,285 shares during the period. Signaturefd LLC lifted its holdings in MP Materials by 817.5% in the third quarter. Signaturefd LLC now owns 3,661 shares of the company's stock valued at $65,000 after acquiring an additional 3,262 shares during the period. Nisa Investment Advisors LLC lifted its holdings in MP Materials by 3,803.8% in the second quarter. Nisa Investment Advisors LLC now owns 4,060 shares of the company's stock valued at $52,000 after acquiring an additional 3,956 shares during the period. KBC Group NV lifted its holdings in MP Materials by 35.7% in the third quarter. KBC Group NV now owns 4,733 shares of the company's stock valued at $84,000 after acquiring an additional 1,246 shares during the period. Finally, Point72 Hong Kong Ltd acquired a new position in MP Materials in the second quarter valued at approximately $72,000. Institutional investors and hedge funds own 52.55% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on MP. JPMorgan Chase & Co. upped their target price on MP Materials from $15.00 to $18.00 and gave the stock a "neutral" rating in a research note on Monday, October 21st. Benchmark reaffirmed a "buy" rating and set a $30.00 target price on shares of MP Materials in a research note on Friday, August 2nd. DA Davidson upped their target price on MP Materials from $20.00 to $23.00 and gave the stock a "buy" rating in a research note on Tuesday, October 1st. Robert W. Baird upped their target price on MP Materials from $20.00 to $25.00 and gave the stock an "outperform" rating in a research note on Friday, September 27th. Finally, Morgan Stanley boosted their price target on MP Materials from $13.50 to $16.00 and gave the stock an "equal weight" rating in a research report on Thursday, September 19th. Four analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat, MP Materials has an average rating of "Moderate Buy" and a consensus price target of $21.40.

Read Our Latest Stock Report on MP

MP Materials Trading Up 1.2 %

Shares of MP stock traded up $0.21 during trading on Wednesday, hitting $18.23. 361,876 shares of the stock traded hands, compared to its average volume of 3,226,035. MP Materials Corp. has a 52-week low of $10.02 and a 52-week high of $20.85. The company has a debt-to-equity ratio of 0.88, a current ratio of 6.93 and a quick ratio of 6.13. The firm has a market capitalization of $2.98 billion, a P/E ratio of -33.38 and a beta of 2.23. The firm's fifty day moving average price is $17.43 and its 200-day moving average price is $15.32.

MP Materials announced that its Board of Directors has initiated a share buyback program on Tuesday, September 3rd that allows the company to buyback $300.00 million in shares. This buyback authorization allows the company to purchase up to 13.4% of its shares through open market purchases. Shares buyback programs are often a sign that the company's board of directors believes its shares are undervalued.

Insider Activity at MP Materials

In other news, CFO Ryan Corbett sold 15,195 shares of MP Materials stock in a transaction on Monday, November 18th. The stock was sold at an average price of $18.30, for a total value of $278,068.50. Following the completion of the sale, the chief financial officer now directly owns 295,021 shares of the company's stock, valued at approximately $5,398,884.30. The trade was a 4.90 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, CEO James H. Litinsky sold 300,000 shares of MP Materials stock in a transaction on Monday, November 18th. The shares were sold at an average price of $18.45, for a total value of $5,535,000.00. Following the completion of the sale, the chief executive officer now directly owns 18,221,776 shares of the company's stock, valued at $336,191,767.20. The trade was a 1.62 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 12.60% of the stock is owned by insiders.

MP Materials Company Profile

(

Free Report)

MP Materials Corp., together with its subsidiaries, produces rare earth materials. The company owns and operates the Mountain Pass Rare Earth mine and processing facility in North America. It holds the mineral rights to the Mountain Pass mine and surrounding areas, as well as intellectual property rights related to the processing and development of rare earth minerals.

Recommended Stories

Before you consider MP Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MP Materials wasn't on the list.

While MP Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.