Mplx (NYSE:MPLX - Free Report) had its price objective hoisted by Truist Financial from $48.00 to $55.00 in a research note released on Tuesday morning,Benzinga reports. Truist Financial currently has a buy rating on the pipeline company's stock.

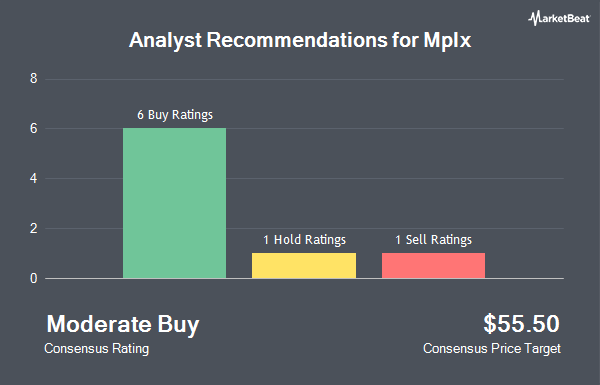

Several other equities research analysts have also commented on MPLX. UBS Group boosted their price target on Mplx from $51.00 to $55.00 and gave the stock a "buy" rating in a research note on Friday. Royal Bank of Canada boosted their target price on Mplx from $50.00 to $52.00 and gave the stock an "outperform" rating in a research report on Monday. Barclays raised their price target on Mplx from $45.00 to $49.00 and gave the company an "overweight" rating in a research report on Thursday, October 10th. StockNews.com upgraded shares of Mplx from a "buy" rating to a "strong-buy" rating in a research report on Thursday, November 14th. Finally, Wells Fargo & Company raised their target price on shares of Mplx from $50.00 to $53.00 and gave the company an "overweight" rating in a report on Thursday, November 7th. One analyst has rated the stock with a sell rating, eight have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $49.44.

View Our Latest Research Report on MPLX

Mplx Price Performance

MPLX stock traded up $0.20 on Tuesday, reaching $47.66. 1,430,456 shares of the company's stock were exchanged, compared to its average volume of 1,859,780. Mplx has a twelve month low of $35.51 and a twelve month high of $47.71. The company has a quick ratio of 0.95, a current ratio of 0.99 and a debt-to-equity ratio of 1.40. The stock has a fifty day moving average of $44.71 and a 200-day moving average of $42.82. The firm has a market cap of $48.56 billion, a PE ratio of 11.24, a P/E/G ratio of 1.28 and a beta of 1.37.

Mplx (NYSE:MPLX - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The pipeline company reported $1.01 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.05 by ($0.04). The company had revenue of $2.97 billion during the quarter, compared to analysts' expectations of $3.09 billion. Mplx had a net margin of 36.77% and a return on equity of 32.70%. The business's revenue for the quarter was up 2.1% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.89 EPS. As a group, equities analysts predict that Mplx will post 4.31 EPS for the current fiscal year.

Mplx Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, November 8th were given a $0.9565 dividend. This represents a $3.83 dividend on an annualized basis and a dividend yield of 8.03%. The ex-dividend date was Friday, November 8th. This is a positive change from Mplx's previous quarterly dividend of $0.85. Mplx's payout ratio is currently 90.33%.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the business. ING Groep NV boosted its position in shares of Mplx by 69.8% in the third quarter. ING Groep NV now owns 6,628,400 shares of the pipeline company's stock worth $294,699,000 after acquiring an additional 2,725,000 shares during the last quarter. Catalyst Capital Advisors LLC grew its stake in shares of Mplx by 7.4% during the 3rd quarter. Catalyst Capital Advisors LLC now owns 280,885 shares of the pipeline company's stock valued at $12,488,000 after buying an additional 19,320 shares during the period. Sei Investments Co. increased its holdings in shares of Mplx by 47.4% during the 1st quarter. Sei Investments Co. now owns 51,740 shares of the pipeline company's stock worth $2,150,000 after buying an additional 16,637 shares during the last quarter. Wealth Enhancement Advisory Services LLC raised its position in shares of Mplx by 22.0% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 81,884 shares of the pipeline company's stock worth $3,487,000 after buying an additional 14,782 shares during the period. Finally, Lindbrook Capital LLC boosted its holdings in Mplx by 27.2% in the third quarter. Lindbrook Capital LLC now owns 52,128 shares of the pipeline company's stock valued at $2,318,000 after acquiring an additional 11,144 shares during the last quarter. Hedge funds and other institutional investors own 24.25% of the company's stock.

About Mplx

(

Get Free Report)

MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, storage, and marketing of natural gas liquids; gathering, storage, transportation, and distribution of crude oil and refined products, as well as other hydrocarbon-based products and renewables; and sale of residue gas and condensate.

Read More

Before you consider Mplx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mplx wasn't on the list.

While Mplx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.