MQS Management LLC purchased a new position in shares of SS&C Technologies Holdings, Inc. (NASDAQ:SSNC - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 7,248 shares of the technology company's stock, valued at approximately $538,000.

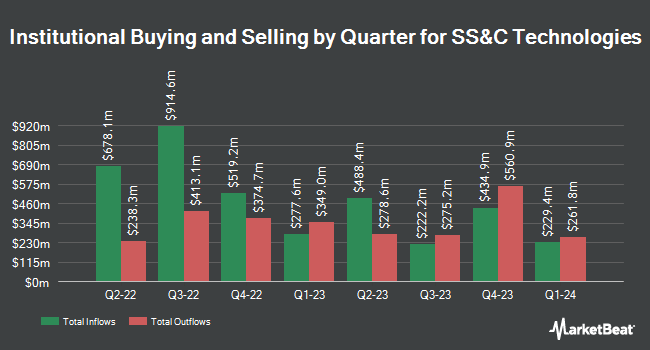

Other institutional investors also recently bought and sold shares of the company. Swedbank AB purchased a new position in shares of SS&C Technologies during the 1st quarter valued at approximately $94,939,000. Millennium Management LLC increased its holdings in shares of SS&C Technologies by 49.2% during the 2nd quarter. Millennium Management LLC now owns 3,399,874 shares of the technology company's stock valued at $213,070,000 after purchasing an additional 1,120,961 shares in the last quarter. AQR Capital Management LLC increased its holdings in shares of SS&C Technologies by 82.1% during the 2nd quarter. AQR Capital Management LLC now owns 1,267,057 shares of the technology company's stock valued at $78,900,000 after purchasing an additional 571,334 shares in the last quarter. Capital International Investors increased its holdings in shares of SS&C Technologies by 111.1% during the 1st quarter. Capital International Investors now owns 1,071,540 shares of the technology company's stock valued at $68,975,000 after purchasing an additional 564,017 shares in the last quarter. Finally, Dimensional Fund Advisors LP increased its holdings in shares of SS&C Technologies by 14.9% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,696,702 shares of the technology company's stock valued at $168,995,000 after purchasing an additional 349,911 shares in the last quarter. 96.95% of the stock is owned by hedge funds and other institutional investors.

SS&C Technologies Price Performance

SSNC traded down $0.62 on Thursday, hitting $74.23. 1,615,884 shares of the company's stock were exchanged, compared to its average volume of 1,079,148. SS&C Technologies Holdings, Inc. has a fifty-two week low of $54.40 and a fifty-two week high of $77.02. The company has a current ratio of 1.21, a quick ratio of 1.21 and a debt-to-equity ratio of 1.04. The firm has a 50-day moving average price of $74.00 and a 200-day moving average price of $68.82. The stock has a market cap of $18.39 billion, a price-to-earnings ratio of 26.61 and a beta of 1.39.

SS&C Technologies (NASDAQ:SSNC - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The technology company reported $1.29 earnings per share for the quarter, beating the consensus estimate of $1.26 by $0.03. The firm had revenue of $1.47 billion for the quarter, compared to analysts' expectations of $1.44 billion. SS&C Technologies had a net margin of 12.26% and a return on equity of 17.33%. The company's revenue was up 7.3% compared to the same quarter last year. During the same quarter in the previous year, the company posted $1.04 EPS. As a group, equities analysts anticipate that SS&C Technologies Holdings, Inc. will post 4.62 earnings per share for the current year.

SS&C Technologies Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 16th. Investors of record on Tuesday, September 3rd were issued a $0.25 dividend. This is a positive change from SS&C Technologies's previous quarterly dividend of $0.24. This represents a $1.00 annualized dividend and a yield of 1.35%. The ex-dividend date was Tuesday, September 3rd. SS&C Technologies's payout ratio is 35.84%.

SS&C Technologies announced that its board has approved a stock repurchase plan on Thursday, July 25th that allows the company to repurchase $1.00 billion in shares. This repurchase authorization allows the technology company to reacquire up to 5.4% of its stock through open market purchases. Stock repurchase plans are generally a sign that the company's board of directors believes its shares are undervalued.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on SSNC. Royal Bank of Canada lifted their target price on shares of SS&C Technologies from $75.00 to $86.00 and gave the company an "outperform" rating in a report on Thursday, September 19th. Needham & Company LLC reissued a "buy" rating and issued a $90.00 price target on shares of SS&C Technologies in a research note on Friday, October 25th. DA Davidson reissued a "buy" rating and issued a $92.00 price target on shares of SS&C Technologies in a research note on Thursday, October 10th. StockNews.com raised shares of SS&C Technologies from a "buy" rating to a "strong-buy" rating in a research note on Tuesday, November 5th. Finally, Raymond James lifted their price target on shares of SS&C Technologies from $79.00 to $85.00 and gave the company a "strong-buy" rating in a research note on Friday, October 25th. Two analysts have rated the stock with a hold rating, five have assigned a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, SS&C Technologies has an average rating of "Buy" and an average price target of $77.75.

View Our Latest Report on SS&C Technologies

Insider Activity at SS&C Technologies

In other SS&C Technologies news, Director Michael Jay Zamkow sold 19,000 shares of the stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $75.97, for a total value of $1,443,430.00. Following the transaction, the director now directly owns 22,576 shares in the company, valued at $1,715,098.72. This represents a 45.70 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, COO Rahul Kanwar sold 412,190 shares of the firm's stock in a transaction that occurred on Wednesday, August 21st. The stock was sold at an average price of $73.13, for a total transaction of $30,143,454.70. Following the transaction, the chief operating officer now owns 57,642 shares in the company, valued at approximately $4,215,359.46. This trade represents a 87.73 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 561,190 shares of company stock worth $41,386,285. Company insiders own 15.40% of the company's stock.

SS&C Technologies Profile

(

Free Report)

SS&C Technologies Holdings, Inc, together with its subsidiaries, provides software products and software-enabled services to financial services and healthcare industries. The company owns and operates technology stack across securities accounting; front-office functions, such as trading and modeling; middle-office functions comprising portfolio management and reporting; back-office functions, such as accounting, performance measurement, reconciliation, reporting, processing and clearing, and compliance and tax reporting; and healthcare solutions consisting of claims adjudication, benefit management, care management, and business intelligence solutions.

Featured Stories

Before you consider SS&C Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SS&C Technologies wasn't on the list.

While SS&C Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report