MRP Capital Investments LLC trimmed its stake in Amedisys, Inc. (NASDAQ:AMED - Free Report) by 97.6% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 315 shares of the health services provider's stock after selling 12,850 shares during the quarter. MRP Capital Investments LLC's holdings in Amedisys were worth $29,000 as of its most recent filing with the Securities & Exchange Commission.

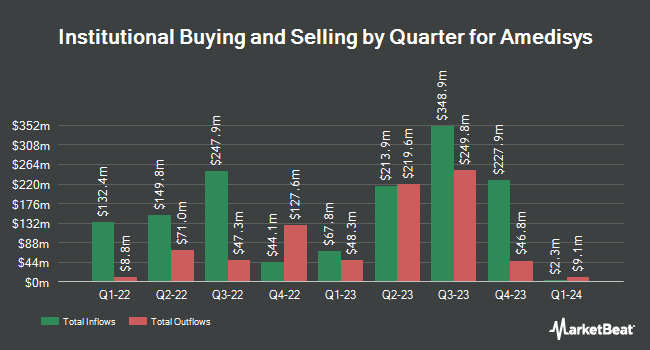

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Blue Trust Inc. increased its stake in shares of Amedisys by 55.1% in the fourth quarter. Blue Trust Inc. now owns 349 shares of the health services provider's stock worth $34,000 after purchasing an additional 124 shares in the last quarter. HBW Advisory Services LLC bought a new position in Amedisys in the 4th quarter worth approximately $38,000. Versant Capital Management Inc grew its stake in Amedisys by 68.5% in the 4th quarter. Versant Capital Management Inc now owns 450 shares of the health services provider's stock valued at $41,000 after buying an additional 183 shares in the last quarter. KBC Group NV bought a new stake in Amedisys during the 3rd quarter valued at $63,000. Finally, Vestcor Inc purchased a new stake in shares of Amedisys during the fourth quarter worth $73,000. 94.36% of the stock is owned by institutional investors.

Analyst Ratings Changes

Separately, Stephens reiterated an "equal weight" rating and issued a $101.00 price target on shares of Amedisys in a research report on Tuesday, March 4th. Five research analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average target price of $100.75.

Get Our Latest Analysis on Amedisys

Amedisys Price Performance

NASDAQ:AMED traded down $0.38 during trading hours on Tuesday, hitting $92.36. The stock had a trading volume of 298,315 shares, compared to its average volume of 380,710. The company has a 50 day simple moving average of $92.23 and a two-hundred day simple moving average of $92.50. The firm has a market capitalization of $3.03 billion, a price-to-earnings ratio of 36.65, a P/E/G ratio of 1.78 and a beta of 0.76. The company has a debt-to-equity ratio of 0.05, a current ratio of 1.19 and a quick ratio of 1.19. Amedisys, Inc. has a one year low of $82.15 and a one year high of $98.95.

Amedisys (NASDAQ:AMED - Get Free Report) last posted its earnings results on Wednesday, February 26th. The health services provider reported $0.96 EPS for the quarter, missing the consensus estimate of $1.05 by ($0.09). Amedisys had a return on equity of 12.20% and a net margin of 3.57%. The business had revenue of $598.05 million for the quarter, compared to analysts' expectations of $602.38 million. Research analysts forecast that Amedisys, Inc. will post 4.4 earnings per share for the current fiscal year.

About Amedisys

(

Free Report)

Amedisys, Inc, together with its subsidiaries, provides healthcare services in the United States. It operates through three segments: Home Health, Hospice, and High Acuity Care. The Home Health segment offers a range of services in the homes of individuals for the recovery of patients from surgery, chronic disability, or terminal illness, as well as prevents avoidable hospital readmissions through its skilled nurses; nursing services, rehabilitation therapists specialized in physical, speech, and occupational therapy; and social workers and aides for assisting its patients.

Further Reading

Before you consider Amedisys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amedisys wasn't on the list.

While Amedisys currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.