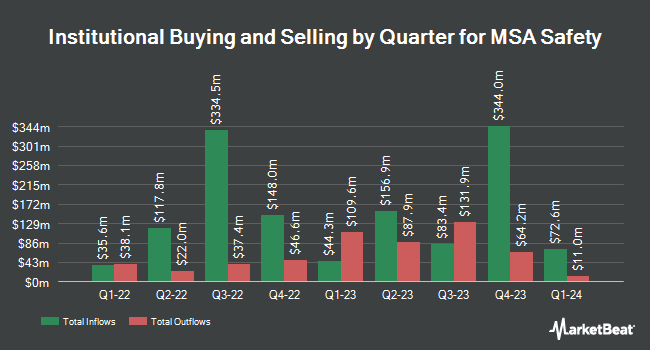

PNC Financial Services Group Inc. trimmed its position in MSA Safety Incorporated (NYSE:MSA - Free Report) by 2.8% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 88,468 shares of the industrial products company's stock after selling 2,546 shares during the quarter. PNC Financial Services Group Inc. owned about 0.23% of MSA Safety worth $14,665,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in MSA. Covestor Ltd increased its holdings in shares of MSA Safety by 985.1% in the third quarter. Covestor Ltd now owns 803 shares of the industrial products company's stock worth $143,000 after purchasing an additional 729 shares during the last quarter. Crossmark Global Holdings Inc. increased its holdings in shares of MSA Safety by 32.2% in the third quarter. Crossmark Global Holdings Inc. now owns 3,172 shares of the industrial products company's stock worth $562,000 after purchasing an additional 772 shares during the last quarter. Entropy Technologies LP purchased a new position in MSA Safety in the third quarter worth about $248,000. GSA Capital Partners LLP purchased a new position in MSA Safety in the third quarter worth about $737,000. Finally, Victory Capital Management Inc. grew its position in MSA Safety by 33.4% in the third quarter. Victory Capital Management Inc. now owns 87,454 shares of the industrial products company's stock worth $15,509,000 after acquiring an additional 21,902 shares in the last quarter. 92.51% of the stock is owned by institutional investors.

MSA Safety Trading Down 1.8 %

Shares of NYSE:MSA traded down $2.78 during trading hours on Tuesday, hitting $152.69. 135,030 shares of the company's stock traded hands, compared to its average volume of 155,282. MSA Safety Incorporated has a 1 year low of $151.03 and a 1 year high of $200.61. The business has a fifty day moving average price of $162.36 and a 200-day moving average price of $169.43. The firm has a market capitalization of $5.99 billion, a P/E ratio of 21.18 and a beta of 0.99. The company has a debt-to-equity ratio of 0.42, a current ratio of 2.79 and a quick ratio of 1.76.

MSA Safety (NYSE:MSA - Get Free Report) last announced its earnings results on Wednesday, February 12th. The industrial products company reported $2.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.23 by $0.02. MSA Safety had a return on equity of 28.64% and a net margin of 15.76%. Equities analysts expect that MSA Safety Incorporated will post 8.06 earnings per share for the current year.

MSA Safety Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Monday, March 10th. Shareholders of record on Friday, February 14th were given a dividend of $0.51 per share. The ex-dividend date was Friday, February 14th. This represents a $2.04 annualized dividend and a dividend yield of 1.34%. MSA Safety's dividend payout ratio (DPR) is presently 28.29%.

Insider Activity

In other news, CAO Jonathan D. Buck sold 717 shares of MSA Safety stock in a transaction that occurred on Monday, February 24th. The shares were sold at an average price of $159.00, for a total transaction of $114,003.00. Following the completion of the sale, the chief accounting officer now owns 3,673 shares of the company's stock, valued at approximately $584,007. The trade was a 16.33 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Insiders own 6.20% of the company's stock.

Analyst Ratings Changes

MSA has been the subject of several recent research reports. Jefferies Financial Group initiated coverage on MSA Safety in a research report on Thursday, December 12th. They issued a "hold" rating and a $200.00 price target for the company. Robert W. Baird dropped their price target on MSA Safety from $190.00 to $175.00 and set a "neutral" rating for the company in a research report on Tuesday, February 18th. Finally, DA Davidson initiated coverage on MSA Safety in a research report on Thursday, December 19th. They issued a "buy" rating and a $195.00 price target for the company. Two equities research analysts have rated the stock with a hold rating, two have given a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Buy" and an average target price of $197.00.

Get Our Latest Analysis on MSA

About MSA Safety

(

Free Report)

MSA Safety Incorporated develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures in the fire service, energy, utility, construction, and industrial manufacturing applications, as well as heating, ventilation, air conditioning, and refrigeration industries worldwide.

See Also

Before you consider MSA Safety, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSA Safety wasn't on the list.

While MSA Safety currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.