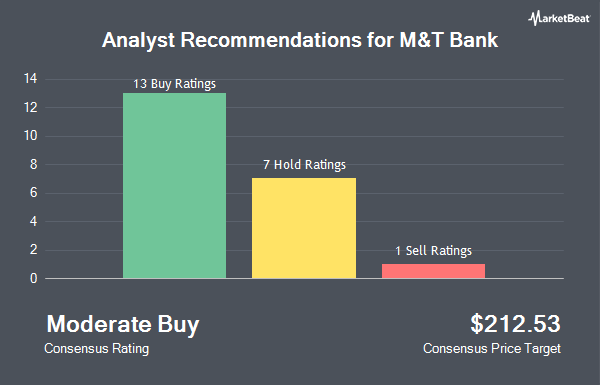

Shares of M&T Bank Co. (NYSE:MTB - Get Free Report) have been given a consensus recommendation of "Hold" by the sixteen ratings firms that are presently covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating and eight have issued a buy rating on the company. The average 12-month price objective among analysts that have issued ratings on the stock in the last year is $206.41.

Several equities research analysts have recently commented on the company. Citigroup downgraded M&T Bank from a "buy" rating to a "neutral" rating and upped their target price for the company from $220.00 to $230.00 in a report on Monday, November 25th. StockNews.com raised M&T Bank from a "sell" rating to a "hold" rating in a research report on Friday, October 18th. Barclays upped their price target on M&T Bank from $170.00 to $228.00 and gave the company an "equal weight" rating in a research report on Friday, October 18th. Wolfe Research raised M&T Bank from a "peer perform" rating to an "outperform" rating and set a $210.00 price target on the stock in a research report on Friday, October 4th. Finally, Morgan Stanley upped their price target on M&T Bank from $195.00 to $220.00 and gave the company an "overweight" rating in a research report on Monday, August 5th.

Read Our Latest Stock Analysis on M&T Bank

Insiders Place Their Bets

In other M&T Bank news, EVP John R. Taylor sold 1,436 shares of the firm's stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $195.03, for a total value of $280,063.08. Following the completion of the sale, the executive vice president now owns 5,618 shares in the company, valued at approximately $1,095,678.54. This trade represents a 20.36 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, EVP Tracy S. Woodrow sold 2,121 shares of the firm's stock in a transaction that occurred on Tuesday, November 26th. The stock was sold at an average price of $220.75, for a total value of $468,210.75. Following the completion of the sale, the executive vice president now owns 5,141 shares of the company's stock, valued at $1,134,875.75. This represents a 29.21 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 92,504 shares of company stock worth $18,394,012. 0.82% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On M&T Bank

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Franklin Resources Inc. increased its holdings in M&T Bank by 45.5% during the 3rd quarter. Franklin Resources Inc. now owns 21,481 shares of the financial services provider's stock valued at $3,986,000 after purchasing an additional 6,717 shares in the last quarter. Wilmington Savings Fund Society FSB increased its holdings in M&T Bank by 80.6% during the 3rd quarter. Wilmington Savings Fund Society FSB now owns 13,901 shares of the financial services provider's stock valued at $2,476,000 after purchasing an additional 6,205 shares in the last quarter. Sanctuary Advisors LLC increased its holdings in M&T Bank by 14.7% during the 3rd quarter. Sanctuary Advisors LLC now owns 15,767 shares of the financial services provider's stock valued at $2,808,000 after purchasing an additional 2,018 shares in the last quarter. Toronto Dominion Bank increased its holdings in M&T Bank by 71.1% during the 3rd quarter. Toronto Dominion Bank now owns 83,019 shares of the financial services provider's stock valued at $14,787,000 after purchasing an additional 34,501 shares in the last quarter. Finally, Coldstream Capital Management Inc. increased its holdings in M&T Bank by 10.1% during the 3rd quarter. Coldstream Capital Management Inc. now owns 3,690 shares of the financial services provider's stock valued at $669,000 after purchasing an additional 337 shares in the last quarter. Institutional investors own 84.68% of the company's stock.

M&T Bank Price Performance

Shares of M&T Bank stock traded down $0.81 during trading on Friday, hitting $219.99. The stock had a trading volume of 542,441 shares, compared to its average volume of 1,037,194. The company has a debt-to-equity ratio of 0.44, a current ratio of 0.99 and a quick ratio of 0.99. The firm has a market cap of $36.50 billion, a P/E ratio of 16.28, a PEG ratio of 3.11 and a beta of 0.74. The business has a fifty day moving average of $196.45 and a two-hundred day moving average of $171.86. M&T Bank has a fifty-two week low of $125.61 and a fifty-two week high of $225.70.

M&T Bank (NYSE:MTB - Get Free Report) last announced its quarterly earnings data on Thursday, October 17th. The financial services provider reported $4.08 earnings per share for the quarter, beating the consensus estimate of $3.60 by $0.48. The business had revenue of $2.33 billion during the quarter, compared to analyst estimates of $2.30 billion. M&T Bank had a return on equity of 9.52% and a net margin of 17.82%. On average, sell-side analysts expect that M&T Bank will post 14.57 earnings per share for the current fiscal year.

M&T Bank Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Monday, December 2nd will be paid a dividend of $1.35 per share. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $5.40 annualized dividend and a yield of 2.45%. M&T Bank's payout ratio is 39.97%.

M&T Bank Company Profile

(

Get Free ReportM&T Bank Corporation operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that engages in the provision of retail and commercial banking products and services in the United States. The company operates through three segments: Commercial Bank, Retail Bank, and Institutional Services and Wealth Management.

See Also

Before you consider M&T Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M&T Bank wasn't on the list.

While M&T Bank currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.