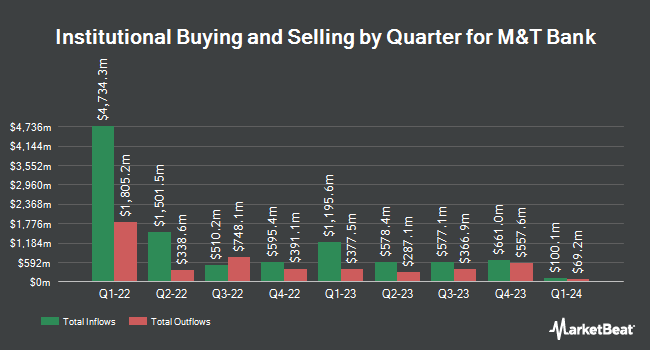

Stifel Financial Corp increased its stake in shares of M&T Bank Co. (NYSE:MTB - Free Report) by 11.2% in the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 393,624 shares of the financial services provider's stock after buying an additional 39,759 shares during the period. Stifel Financial Corp owned about 0.24% of M&T Bank worth $70,113,000 as of its most recent SEC filing.

A number of other large investors have also added to or reduced their stakes in the stock. Hedeker Wealth LLC increased its holdings in M&T Bank by 1.6% during the third quarter. Hedeker Wealth LLC now owns 3,519 shares of the financial services provider's stock worth $627,000 after buying an additional 55 shares during the last quarter. Frank Rimerman Advisors LLC increased its holdings in M&T Bank by 1.0% during the third quarter. Frank Rimerman Advisors LLC now owns 5,644 shares of the financial services provider's stock worth $1,005,000 after buying an additional 57 shares during the last quarter. Crestwood Advisors Group LLC increased its holdings in M&T Bank by 1.9% during the third quarter. Crestwood Advisors Group LLC now owns 3,103 shares of the financial services provider's stock worth $553,000 after buying an additional 57 shares during the last quarter. Hexagon Capital Partners LLC increased its holdings in M&T Bank by 54.4% during the third quarter. Hexagon Capital Partners LLC now owns 193 shares of the financial services provider's stock worth $34,000 after buying an additional 68 shares during the last quarter. Finally, Meitav Investment House Ltd. increased its holdings in M&T Bank by 3.1% during the third quarter. Meitav Investment House Ltd. now owns 2,270 shares of the financial services provider's stock worth $386,000 after buying an additional 69 shares during the last quarter. Hedge funds and other institutional investors own 84.68% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms recently issued reports on MTB. Evercore ISI raised their price objective on shares of M&T Bank from $210.00 to $232.00 and gave the stock an "outperform" rating in a report on Wednesday, October 30th. Barclays lifted their target price on shares of M&T Bank from $170.00 to $228.00 and gave the stock an "equal weight" rating in a research note on Friday, October 18th. Citigroup downgraded shares of M&T Bank from a "buy" rating to a "neutral" rating and lifted their target price for the stock from $220.00 to $230.00 in a research note on Monday, November 25th. Wedbush lifted their target price on shares of M&T Bank from $208.00 to $210.00 and gave the stock an "outperform" rating in a research note on Tuesday, September 24th. Finally, DA Davidson lifted their target price on shares of M&T Bank from $192.00 to $207.00 and gave the stock a "neutral" rating in a research note on Monday, October 21st. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating and seven have given a buy rating to the company's stock. According to data from MarketBeat.com, M&T Bank currently has an average rating of "Hold" and a consensus price target of $209.32.

View Our Latest Stock Analysis on M&T Bank

Insider Buying and Selling at M&T Bank

In other M&T Bank news, Director John P. Barnes sold 20,000 shares of M&T Bank stock in a transaction that occurred on Tuesday, October 22nd. The shares were sold at an average price of $193.97, for a total transaction of $3,879,400.00. Following the transaction, the director now directly owns 49,960 shares of the company's stock, valued at approximately $9,690,741.20. This trade represents a 28.59 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, EVP John R. Taylor sold 1,436 shares of M&T Bank stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $195.03, for a total transaction of $280,063.08. Following the transaction, the executive vice president now directly owns 5,618 shares in the company, valued at $1,095,678.54. This trade represents a 20.36 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 84,994 shares of company stock worth $17,211,278 over the last three months. 0.82% of the stock is owned by insiders.

M&T Bank Price Performance

M&T Bank stock traded down $1.16 during mid-day trading on Friday, hitting $211.26. 789,697 shares of the company traded hands, compared to its average volume of 842,760. M&T Bank Co. has a one year low of $128.31 and a one year high of $225.70. The stock has a market cap of $35.05 billion, a price-to-earnings ratio of 15.64, a price-to-earnings-growth ratio of 2.98 and a beta of 0.76. The company has a debt-to-equity ratio of 0.44, a quick ratio of 0.99 and a current ratio of 0.99. The stock has a fifty day moving average price of $200.25 and a 200-day moving average price of $174.06.

M&T Bank (NYSE:MTB - Get Free Report) last announced its earnings results on Thursday, October 17th. The financial services provider reported $4.08 earnings per share (EPS) for the quarter, beating the consensus estimate of $3.60 by $0.48. M&T Bank had a net margin of 17.82% and a return on equity of 9.52%. The business had revenue of $2.33 billion during the quarter, compared to analyst estimates of $2.30 billion. On average, equities analysts predict that M&T Bank Co. will post 14.57 earnings per share for the current fiscal year.

M&T Bank Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Monday, December 2nd will be given a dividend of $1.35 per share. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $5.40 annualized dividend and a yield of 2.56%. M&T Bank's payout ratio is presently 39.97%.

M&T Bank Company Profile

(

Free Report)

M&T Bank Corporation operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that engages in the provision of retail and commercial banking products and services in the United States. The company operates through three segments: Commercial Bank, Retail Bank, and Institutional Services and Wealth Management.

See Also

Before you consider M&T Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M&T Bank wasn't on the list.

While M&T Bank currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.