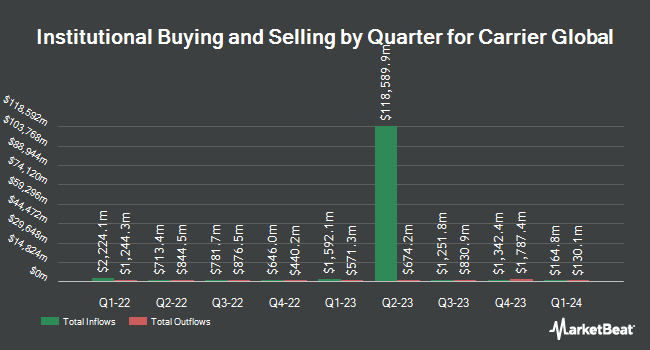

M&T Bank Corp raised its stake in Carrier Global Co. (NYSE:CARR - Free Report) by 8.9% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 311,453 shares of the company's stock after buying an additional 25,346 shares during the period. M&T Bank Corp's holdings in Carrier Global were worth $25,069,000 at the end of the most recent quarter.

A number of other hedge funds have also recently added to or reduced their stakes in CARR. State Street Corp lifted its holdings in shares of Carrier Global by 1.4% during the third quarter. State Street Corp now owns 33,665,505 shares of the company's stock worth $2,709,736,000 after purchasing an additional 469,108 shares during the period. Fisher Asset Management LLC lifted its holdings in shares of Carrier Global by 1.9% during the third quarter. Fisher Asset Management LLC now owns 14,267,109 shares of the company's stock worth $1,148,360,000 after purchasing an additional 269,538 shares during the period. FMR LLC lifted its holdings in shares of Carrier Global by 36.2% during the third quarter. FMR LLC now owns 8,729,073 shares of the company's stock worth $702,603,000 after purchasing an additional 2,320,909 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its holdings in shares of Carrier Global by 1.9% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,993,169 shares of the company's stock worth $482,390,000 after purchasing an additional 110,988 shares during the period. Finally, Charles Schwab Investment Management Inc. lifted its holdings in shares of Carrier Global by 1.0% during the third quarter. Charles Schwab Investment Management Inc. now owns 4,744,407 shares of the company's stock worth $381,877,000 after purchasing an additional 49,196 shares during the period. Institutional investors and hedge funds own 91.00% of the company's stock.

Carrier Global Stock Up 1.2 %

Shares of NYSE:CARR traded up $0.90 during midday trading on Wednesday, hitting $73.71. 3,394,815 shares of the company's stock were exchanged, compared to its average volume of 4,199,828. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.08 and a quick ratio of 0.82. The stock has a 50 day moving average price of $76.94 and a 200-day moving average price of $71.19. The company has a market cap of $66.13 billion, a PE ratio of 18.44, a price-to-earnings-growth ratio of 2.73 and a beta of 1.33. Carrier Global Co. has a 12 month low of $53.13 and a 12 month high of $83.32.

Carrier Global Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, February 7th. Stockholders of record on Friday, December 20th will be given a dividend of $0.225 per share. The ex-dividend date of this dividend is Friday, December 20th. This is an increase from Carrier Global's previous quarterly dividend of $0.19. This represents a $0.90 annualized dividend and a dividend yield of 1.22%. Carrier Global's payout ratio is presently 19.24%.

Carrier Global announced that its board has approved a stock repurchase program on Thursday, October 24th that allows the company to buyback $3.00 billion in shares. This buyback authorization allows the company to repurchase up to 4.6% of its shares through open market purchases. Shares buyback programs are typically an indication that the company's board of directors believes its stock is undervalued.

Analysts Set New Price Targets

A number of equities analysts have recently commented on the stock. Wells Fargo & Company cut their price target on shares of Carrier Global from $82.00 to $76.00 and set an "equal weight" rating on the stock in a report on Friday, October 25th. Royal Bank of Canada lowered their target price on shares of Carrier Global from $91.00 to $87.00 and set an "outperform" rating for the company in a research note on Friday, October 25th. Morgan Stanley started coverage on shares of Carrier Global in a research note on Friday, September 6th. They set an "equal weight" rating and a $75.00 target price for the company. Oppenheimer lifted their target price on shares of Carrier Global from $74.00 to $88.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 2nd. Finally, Barclays lifted their target price on shares of Carrier Global from $89.00 to $92.00 and gave the stock an "overweight" rating in a research note on Thursday, December 5th. Eight equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $82.54.

View Our Latest Research Report on CARR

About Carrier Global

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

See Also

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.