M&T Bank Corp grew its position in Newpark Resources, Inc. (NYSE:NR - Free Report) by 29.6% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 310,212 shares of the oil and gas company's stock after buying an additional 70,863 shares during the period. M&T Bank Corp owned 0.36% of Newpark Resources worth $2,150,000 at the end of the most recent quarter.

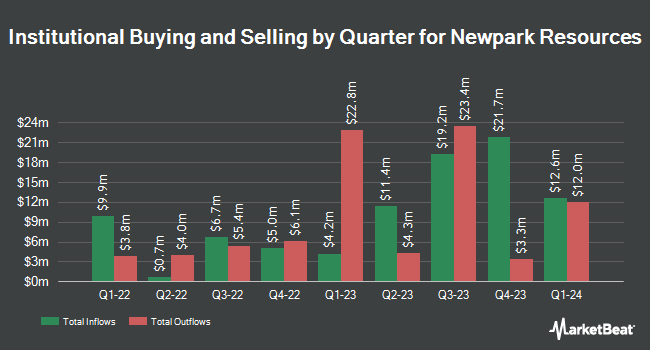

Other institutional investors and hedge funds have also recently modified their holdings of the company. State Street Corp increased its position in Newpark Resources by 3.2% during the 3rd quarter. State Street Corp now owns 2,274,460 shares of the oil and gas company's stock valued at $15,762,000 after buying an additional 69,802 shares in the last quarter. Royce & Associates LP increased its holdings in shares of Newpark Resources by 2.9% during the third quarter. Royce & Associates LP now owns 2,191,552 shares of the oil and gas company's stock valued at $15,187,000 after acquiring an additional 61,128 shares in the last quarter. American Century Companies Inc. increased its holdings in shares of Newpark Resources by 19.9% during the second quarter. American Century Companies Inc. now owns 1,891,740 shares of the oil and gas company's stock valued at $15,720,000 after acquiring an additional 313,451 shares in the last quarter. Pennant Select LLC raised its position in shares of Newpark Resources by 65.0% in the 3rd quarter. Pennant Select LLC now owns 990,000 shares of the oil and gas company's stock valued at $6,861,000 after purchasing an additional 390,000 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its stake in Newpark Resources by 125.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 764,873 shares of the oil and gas company's stock worth $5,301,000 after purchasing an additional 425,505 shares in the last quarter. Hedge funds and other institutional investors own 80.81% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts have issued reports on the stock. HC Wainwright restated a "buy" rating and set a $12.00 price target on shares of Newpark Resources in a research note on Monday, November 11th. StockNews.com downgraded Newpark Resources from a "buy" rating to a "hold" rating in a research report on Monday, September 23rd. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $11.00.

Check Out Our Latest Stock Report on Newpark Resources

Newpark Resources Stock Performance

NR traded down $0.20 during trading on Friday, reaching $7.74. 435,565 shares of the company's stock were exchanged, compared to its average volume of 669,682. The company has a debt-to-equity ratio of 0.02, a current ratio of 2.29 and a quick ratio of 2.00. Newpark Resources, Inc. has a 1 year low of $5.61 and a 1 year high of $8.65. The company's fifty day simple moving average is $7.38 and its 200-day simple moving average is $7.64. The stock has a market capitalization of $669.49 million, a P/E ratio of -4.23 and a beta of 2.92.

Newpark Resources Profile

(

Free Report)

Newpark Resources, Inc provides products, rentals, and services primarily to the oil and natural gas exploration and production (E&P) industry. It operates through two segments, Fluids Systems and Industrial Solutions. The Fluids Systems segment provides drilling, completion, and stimulation fluids products and related technical services to customers primarily in the North America, Europe, the Middle East, and Africa, as well as other countries in the Asia Pacific and Latin America.

Further Reading

Before you consider Newpark Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Newpark Resources wasn't on the list.

While Newpark Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.