M&T Bank Corp decreased its position in The TJX Companies, Inc. (NYSE:TJX - Free Report) by 4.1% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 540,874 shares of the apparel and home fashions retailer's stock after selling 23,159 shares during the quarter. M&T Bank Corp's holdings in TJX Companies were worth $63,574,000 as of its most recent SEC filing.

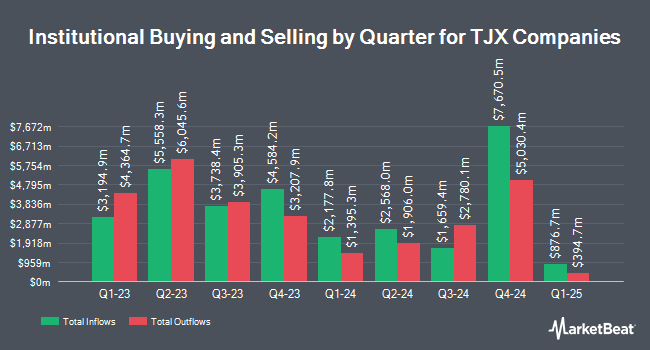

Other institutional investors and hedge funds also recently made changes to their positions in the company. Ameriprise Financial Inc. lifted its stake in TJX Companies by 33.4% during the second quarter. Ameriprise Financial Inc. now owns 12,241,176 shares of the apparel and home fashions retailer's stock worth $1,347,934,000 after purchasing an additional 3,063,318 shares during the last quarter. Capital Wealth Planning LLC bought a new stake in TJX Companies during the second quarter worth $315,698,000. Los Angeles Capital Management LLC lifted its stake in TJX Companies by 80.6% during the second quarter. Los Angeles Capital Management LLC now owns 2,943,176 shares of the apparel and home fashions retailer's stock worth $324,044,000 after purchasing an additional 1,313,517 shares during the last quarter. International Assets Investment Management LLC lifted its stake in TJX Companies by 13,309.4% during the third quarter. International Assets Investment Management LLC now owns 1,191,155 shares of the apparel and home fashions retailer's stock worth $140,008,000 after purchasing an additional 1,182,272 shares during the last quarter. Finally, Caisse DE Depot ET Placement DU Quebec lifted its stake in TJX Companies by 161.3% during the third quarter. Caisse DE Depot ET Placement DU Quebec now owns 1,786,652 shares of the apparel and home fashions retailer's stock worth $210,003,000 after purchasing an additional 1,102,912 shares during the last quarter. Institutional investors and hedge funds own 91.09% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have weighed in on TJX. Loop Capital upped their target price on TJX Companies from $125.00 to $140.00 and gave the stock a "buy" rating in a research note on Thursday, August 22nd. Evercore ISI increased their price target on TJX Companies from $138.00 to $142.00 and gave the company an "outperform" rating in a research note on Thursday, November 21st. Robert W. Baird increased their price target on TJX Companies from $133.00 to $138.00 and gave the company an "outperform" rating in a research note on Thursday, December 5th. Bank of America increased their price target on TJX Companies from $115.00 to $135.00 and gave the company a "buy" rating in a research note on Thursday, August 22nd. Finally, BMO Capital Markets increased their price target on TJX Companies from $116.00 to $133.00 and gave the company an "outperform" rating in a research note on Thursday, August 22nd. Three investment analysts have rated the stock with a hold rating and sixteen have given a buy rating to the company. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $130.89.

View Our Latest Research Report on TJX Companies

TJX Companies Stock Up 1.0 %

TJX traded up $1.30 during midday trading on Tuesday, reaching $127.20. The company's stock had a trading volume of 5,997,236 shares, compared to its average volume of 5,244,579. The firm has a market capitalization of $142.99 billion, a price-to-earnings ratio of 29.93, a PEG ratio of 3.10 and a beta of 0.90. The company has a current ratio of 1.19, a quick ratio of 0.50 and a debt-to-equity ratio of 0.35. The TJX Companies, Inc. has a 1 year low of $88.58 and a 1 year high of $128.00. The stock's 50-day moving average is $118.26 and its 200-day moving average is $114.58.

TJX Companies (NYSE:TJX - Get Free Report) last issued its quarterly earnings data on Wednesday, November 20th. The apparel and home fashions retailer reported $1.14 earnings per share for the quarter, beating analysts' consensus estimates of $1.09 by $0.05. TJX Companies had a net margin of 8.63% and a return on equity of 61.82%. The company had revenue of $14.06 billion for the quarter, compared to the consensus estimate of $13.95 billion. During the same quarter in the prior year, the firm earned $1.03 earnings per share. The firm's revenue for the quarter was up 6.0% compared to the same quarter last year. As a group, research analysts expect that The TJX Companies, Inc. will post 4.18 EPS for the current year.

TJX Companies Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Thursday, March 6th. Investors of record on Thursday, February 13th will be paid a dividend of $0.375 per share. The ex-dividend date is Thursday, February 13th. This represents a $1.50 annualized dividend and a yield of 1.18%. TJX Companies's payout ratio is 35.29%.

About TJX Companies

(

Free Report)

The TJX Companies, Inc, together with its subsidiaries, operates as an off-price apparel and home fashions retailer in the United States, Canada, Europe, and Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. The company sells family apparel, including footwear and accessories; home fashions, such as home basics, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tabletop, and cookware, as well as expanded pet, and gourmet food departments; jewelry and accessories; and other merchandise.

See Also

Before you consider TJX Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TJX Companies wasn't on the list.

While TJX Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.