M&T Bank Corp trimmed its position in General Mills, Inc. (NYSE:GIS - Free Report) by 17.2% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 200,007 shares of the company's stock after selling 41,507 shares during the period. M&T Bank Corp's holdings in General Mills were worth $14,770,000 as of its most recent SEC filing.

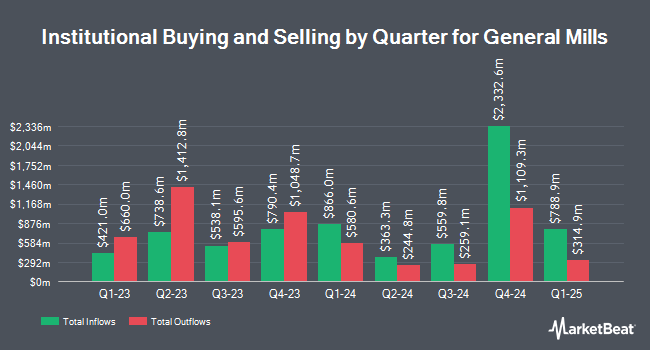

A number of other hedge funds have also recently bought and sold shares of the company. Values First Advisors Inc. acquired a new stake in General Mills during the 3rd quarter worth about $27,000. First Foundation Advisors raised its position in shares of General Mills by 400.0% in the second quarter. First Foundation Advisors now owns 500 shares of the company's stock valued at $32,000 after purchasing an additional 400 shares during the period. Planning Capital Management Corp lifted its position in shares of General Mills by 61.5% during the 3rd quarter. Planning Capital Management Corp now owns 507 shares of the company's stock worth $37,000 after purchasing an additional 193 shares during the last quarter. Fairscale Capital LLC bought a new stake in General Mills in the 2nd quarter valued at $42,000. Finally, Catalyst Capital Advisors LLC bought a new stake in shares of General Mills in the 3rd quarter worth approximately $44,000. 75.71% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research analysts recently issued reports on the stock. Deutsche Bank Aktiengesellschaft dropped their price target on shares of General Mills from $83.00 to $82.00 and set a "hold" rating for the company in a research report on Wednesday. JPMorgan Chase & Co. raised their price target on General Mills from $63.00 to $67.00 and gave the company a "neutral" rating in a report on Monday, October 14th. TD Cowen reduced their price objective on General Mills from $75.00 to $64.00 and set a "hold" rating on the stock in a research note on Thursday. Barclays lowered their target price on General Mills from $74.00 to $68.00 and set an "equal weight" rating for the company in a research note on Friday. Finally, Royal Bank of Canada reiterated a "sector perform" rating and set a $70.00 price target on shares of General Mills in a research report on Thursday. One equities research analyst has rated the stock with a sell rating, twelve have issued a hold rating and four have issued a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $71.56.

Check Out Our Latest Analysis on GIS

General Mills Stock Performance

Shares of GIS traded down $0.40 during trading hours on Friday, hitting $63.61. The company had a trading volume of 10,672,876 shares, compared to its average volume of 3,984,130. The business has a fifty day moving average of $66.47 and a 200-day moving average of $68.11. The company has a quick ratio of 0.39, a current ratio of 0.66 and a debt-to-equity ratio of 1.20. The firm has a market cap of $35.06 billion, a price-to-earnings ratio of 15.15, a PEG ratio of 3.41 and a beta of 0.10. General Mills, Inc. has a 12 month low of $61.47 and a 12 month high of $75.90.

General Mills (NYSE:GIS - Get Free Report) last released its quarterly earnings results on Wednesday, December 18th. The company reported $1.40 earnings per share for the quarter, topping the consensus estimate of $1.22 by $0.18. General Mills had a return on equity of 26.85% and a net margin of 12.14%. The business had revenue of $5.24 billion during the quarter, compared to analysts' expectations of $5.14 billion. During the same period last year, the firm posted $1.25 EPS. The firm's revenue for the quarter was up 2.7% compared to the same quarter last year. Equities analysts anticipate that General Mills, Inc. will post 4.5 EPS for the current fiscal year.

General Mills Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, February 3rd. Shareholders of record on Friday, January 10th will be issued a $0.60 dividend. This represents a $2.40 annualized dividend and a yield of 3.77%. The ex-dividend date of this dividend is Friday, January 10th. General Mills's dividend payout ratio is currently 52.17%.

Insider Activity at General Mills

In related news, CEO Jeffrey L. Harmening sold 46,500 shares of the stock in a transaction on Wednesday, October 23rd. The stock was sold at an average price of $68.61, for a total value of $3,190,365.00. Following the completion of the sale, the chief executive officer now directly owns 355,328 shares in the company, valued at $24,379,054.08. This represents a 11.57 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Maria Sastre sold 1,000 shares of General Mills stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $63.66, for a total value of $63,660.00. Following the transaction, the director now directly owns 23,013 shares in the company, valued at $1,465,007.58. The trade was a 4.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 65,230 shares of company stock valued at $4,547,822 in the last 90 days. 0.26% of the stock is owned by corporate insiders.

General Mills Company Profile

(

Free Report)

General Mills, Inc manufactures and markets branded consumer foods worldwide. The company operates through four segments: North America Retail; International; Pet; and North America Foodservice. It offers grain, ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and savory snacks, ice cream and frozen desserts, unbaked and fully baked frozen dough products, frozen hot snacks, ethnic meals, side dish mixes, frozen breakfast and entrees, nutrition bars, and frozen and shelf-stable vegetables.

Featured Stories

Before you consider General Mills, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Mills wasn't on the list.

While General Mills currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report