M&T Bank Corp lessened its stake in Old Republic International Co. (NYSE:ORI - Free Report) by 4.4% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,052,698 shares of the insurance provider's stock after selling 48,049 shares during the quarter. M&T Bank Corp owned 0.42% of Old Republic International worth $37,287,000 at the end of the most recent quarter.

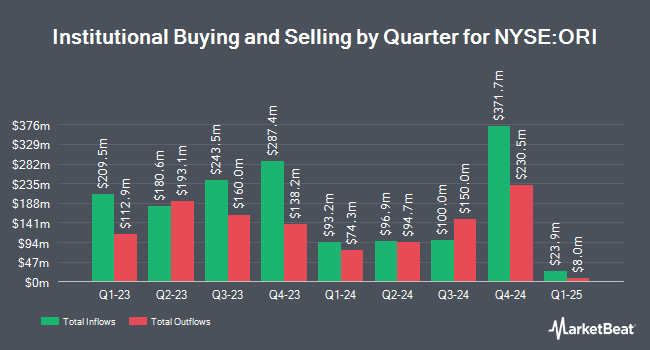

A number of other large investors have also made changes to their positions in the stock. Allworth Financial LP grew its stake in Old Republic International by 161.9% in the 3rd quarter. Allworth Financial LP now owns 728 shares of the insurance provider's stock valued at $26,000 after acquiring an additional 450 shares during the last quarter. V Square Quantitative Management LLC acquired a new stake in Old Republic International in the 3rd quarter valued at about $31,000. Innealta Capital LLC acquired a new stake in Old Republic International in the 2nd quarter valued at about $30,000. FSA Wealth Management LLC acquired a new stake in Old Republic International in the 3rd quarter valued at about $41,000. Finally, Huntington National Bank grew its stake in Old Republic International by 381.0% in the 3rd quarter. Huntington National Bank now owns 1,289 shares of the insurance provider's stock valued at $46,000 after acquiring an additional 1,021 shares during the last quarter. Hedge funds and other institutional investors own 70.92% of the company's stock.

Wall Street Analyst Weigh In

Separately, Piper Sandler raised their price target on shares of Old Republic International from $36.00 to $37.00 and gave the stock an "overweight" rating in a research note on Monday, October 21st.

Read Our Latest Stock Analysis on ORI

Old Republic International Stock Down 3.1 %

Shares of ORI traded down $1.15 during mid-day trading on Tuesday, reaching $35.98. 1,158,504 shares of the stock traded hands, compared to its average volume of 1,394,254. The firm has a market cap of $9.12 billion, a price-to-earnings ratio of 12.41 and a beta of 0.86. The stock has a fifty day simple moving average of $36.59 and a 200 day simple moving average of $34.26. Old Republic International Co. has a 12-month low of $27.19 and a 12-month high of $39.27. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.31.

Old Republic International Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, December 6th will be given a dividend of $0.265 per share. This represents a $1.06 dividend on an annualized basis and a dividend yield of 2.95%. The ex-dividend date is Friday, December 6th. Old Republic International's payout ratio is currently 36.55%.

Old Republic International Company Profile

(

Free Report)

Old Republic International Corporation, through its subsidiaries, engages in the insurance underwriting and related services business primarily in the United States and Canada. It operates through three segments: General Insurance, Title Insurance, and Republic Financial Indemnity Group Run-off Business.

Read More

Before you consider Old Republic International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Republic International wasn't on the list.

While Old Republic International currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.