M&T Bank Corp trimmed its stake in shares of Snap-on Incorporated (NYSE:SNA - Free Report) by 5.1% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 27,676 shares of the company's stock after selling 1,497 shares during the period. M&T Bank Corp owned about 0.05% of Snap-on worth $8,019,000 as of its most recent SEC filing.

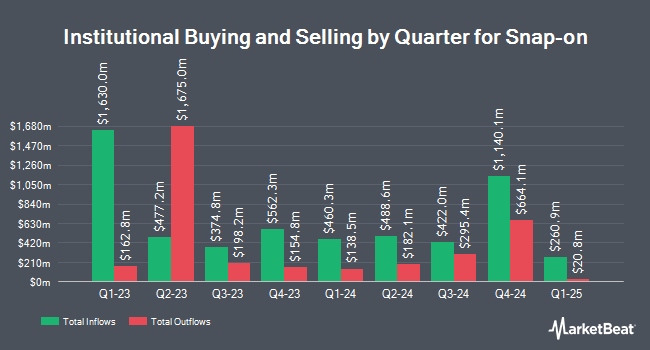

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Aurora Investment Counsel raised its stake in Snap-on by 0.9% during the 3rd quarter. Aurora Investment Counsel now owns 3,549 shares of the company's stock valued at $1,028,000 after purchasing an additional 30 shares during the period. Lake Street Advisors Group LLC lifted its stake in Snap-on by 3.1% in the 3rd quarter. Lake Street Advisors Group LLC now owns 1,074 shares of the company's stock worth $311,000 after acquiring an additional 32 shares in the last quarter. Metis Global Partners LLC increased its holdings in shares of Snap-on by 1.9% in the 3rd quarter. Metis Global Partners LLC now owns 1,691 shares of the company's stock valued at $490,000 after purchasing an additional 32 shares during the period. Tradition Wealth Management LLC increased its holdings in shares of Snap-on by 3.1% in the 3rd quarter. Tradition Wealth Management LLC now owns 1,154 shares of the company's stock valued at $334,000 after purchasing an additional 35 shares during the period. Finally, Verdence Capital Advisors LLC lifted its position in shares of Snap-on by 2.5% in the third quarter. Verdence Capital Advisors LLC now owns 1,526 shares of the company's stock worth $442,000 after purchasing an additional 37 shares in the last quarter. Institutional investors and hedge funds own 84.88% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have issued reports on the stock. Robert W. Baird lifted their target price on shares of Snap-on from $290.00 to $347.00 and gave the company a "neutral" rating in a research note on Friday, October 18th. Bank of America raised their price objective on shares of Snap-on from $255.00 to $280.00 and gave the company an "underperform" rating in a research report on Friday, October 18th. Roth Mkm upped their price target on Snap-on from $324.00 to $365.00 and gave the stock a "buy" rating in a report on Tuesday, October 22nd. Tigress Financial increased their target price on shares of Snap-on from $336.00 to $385.00 and gave the company a "buy" rating in a research note on Friday, October 25th. Finally, Barrington Research raised their target price on Snap-on from $325.00 to $350.00 and gave the stock an "outperform" rating in a research report on Thursday, October 17th. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and three have given a buy rating to the company's stock. According to MarketBeat.com, Snap-on has an average rating of "Hold" and a consensus target price of $345.40.

View Our Latest Stock Analysis on SNA

Insider Buying and Selling

In related news, VP Richard Thomas Miller sold 1,750 shares of the business's stock in a transaction that occurred on Friday, October 18th. The shares were sold at an average price of $330.00, for a total transaction of $577,500.00. Following the completion of the sale, the vice president now directly owns 3,218 shares of the company's stock, valued at $1,061,940. The trade was a 35.23 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Also, VP Iain Boyd sold 6,044 shares of the firm's stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $298.99, for a total transaction of $1,807,095.56. Following the completion of the transaction, the vice president now directly owns 10,493 shares in the company, valued at approximately $3,137,302.07. The trade was a 36.55 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 45,814 shares of company stock worth $15,627,963 in the last 90 days. Corporate insiders own 4.10% of the company's stock.

Snap-on Price Performance

Shares of Snap-on stock traded down $0.19 during mid-day trading on Thursday, reaching $355.64. 255,471 shares of the stock were exchanged, compared to its average volume of 313,558. Snap-on Incorporated has a fifty-two week low of $252.98 and a fifty-two week high of $373.89. The company has a market cap of $18.67 billion, a price-to-earnings ratio of 18.31, a price-to-earnings-growth ratio of 2.37 and a beta of 0.98. The firm has a 50-day simple moving average of $338.01 and a 200 day simple moving average of $296.02. The company has a current ratio of 4.18, a quick ratio of 3.14 and a debt-to-equity ratio of 0.22.

Snap-on (NYSE:SNA - Get Free Report) last posted its quarterly earnings data on Thursday, October 17th. The company reported $4.70 earnings per share for the quarter, topping the consensus estimate of $4.58 by $0.12. The company had revenue of $1.15 billion during the quarter, compared to analyst estimates of $1.16 billion. Snap-on had a net margin of 22.13% and a return on equity of 19.44%. On average, sell-side analysts predict that Snap-on Incorporated will post 19.05 EPS for the current fiscal year.

Snap-on Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, December 10th. Stockholders of record on Thursday, November 21st were paid a $2.14 dividend. The ex-dividend date was Thursday, November 21st. This is a positive change from Snap-on's previous quarterly dividend of $1.86. This represents a $8.56 dividend on an annualized basis and a dividend yield of 2.41%. Snap-on's dividend payout ratio (DPR) is 44.06%.

Snap-on Company Profile

(

Free Report)

Snap-on Incorporated manufactures and markets tools, equipment, diagnostics, and repair information and systems solutions for professional users worldwide. It operates through Commercial & Industrial Group, Snap-on Tools Group, Repair Systems & Information Group, and Financial Services segments.

Recommended Stories

Before you consider Snap-on, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snap-on wasn't on the list.

While Snap-on currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.