M&T Bank Corp lowered its position in shares of Mitsubishi UFJ Financial Group, Inc. (NYSE:MUFG - Free Report) by 4.5% in the fourth quarter, according to its most recent 13F filing with the SEC. The firm owned 530,503 shares of the company's stock after selling 25,172 shares during the quarter. M&T Bank Corp's holdings in Mitsubishi UFJ Financial Group were worth $6,217,000 as of its most recent filing with the SEC.

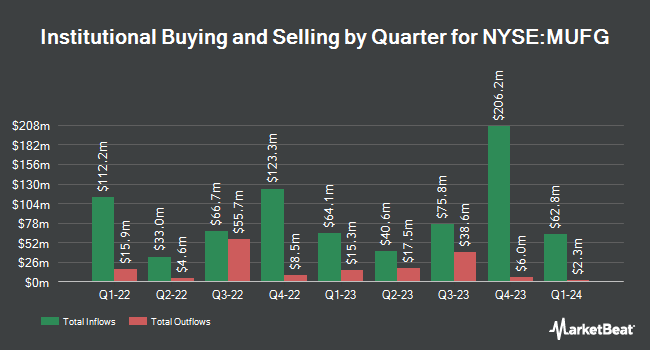

A number of other institutional investors have also modified their holdings of the company. Eagle Bay Advisors LLC boosted its stake in shares of Mitsubishi UFJ Financial Group by 9.3% during the 4th quarter. Eagle Bay Advisors LLC now owns 10,094 shares of the company's stock valued at $118,000 after buying an additional 858 shares during the last quarter. Franklin Resources Inc. raised its position in shares of Mitsubishi UFJ Financial Group by 1.9% during the 3rd quarter. Franklin Resources Inc. now owns 49,208 shares of the company's stock valued at $526,000 after acquiring an additional 938 shares in the last quarter. Abel Hall LLC raised its position in shares of Mitsubishi UFJ Financial Group by 4.9% during the 3rd quarter. Abel Hall LLC now owns 20,388 shares of the company's stock valued at $208,000 after acquiring an additional 949 shares in the last quarter. OLD National Bancorp IN raised its position in shares of Mitsubishi UFJ Financial Group by 5.1% during the 4th quarter. OLD National Bancorp IN now owns 19,841 shares of the company's stock valued at $233,000 after acquiring an additional 955 shares in the last quarter. Finally, Private Advisor Group LLC raised its position in shares of Mitsubishi UFJ Financial Group by 1.6% during the 4th quarter. Private Advisor Group LLC now owns 66,349 shares of the company's stock valued at $778,000 after acquiring an additional 1,040 shares in the last quarter. Hedge funds and other institutional investors own 13.59% of the company's stock.

Analysts Set New Price Targets

Separately, StockNews.com raised Mitsubishi UFJ Financial Group from a "sell" rating to a "hold" rating in a research report on Wednesday.

View Our Latest Analysis on Mitsubishi UFJ Financial Group

Mitsubishi UFJ Financial Group Stock Performance

NYSE MUFG traded up $0.05 during trading hours on Friday, hitting $13.02. The company had a trading volume of 3,881,008 shares, compared to its average volume of 2,383,148. Mitsubishi UFJ Financial Group, Inc. has a fifty-two week low of $8.75 and a fifty-two week high of $13.34. The company has a quick ratio of 0.92, a current ratio of 0.90 and a debt-to-equity ratio of 2.06. The business has a fifty day simple moving average of $12.44 and a 200-day simple moving average of $11.48. The firm has a market cap of $157.07 billion, a P/E ratio of 11.94, a price-to-earnings-growth ratio of 1.16 and a beta of 0.60.

Mitsubishi UFJ Financial Group (NYSE:MUFG - Get Free Report) last issued its earnings results on Tuesday, February 4th. The company reported $0.28 earnings per share for the quarter, topping the consensus estimate of $0.19 by $0.09. Mitsubishi UFJ Financial Group had a return on equity of 9.27% and a net margin of 14.19%. Equities analysts predict that Mitsubishi UFJ Financial Group, Inc. will post 0.99 EPS for the current year.

Mitsubishi UFJ Financial Group Profile

(

Free Report)

Mitsubishi UFJ Financial Group, Inc operates as the bank holding company, that engages in a range of financial businesses in Japan, the United States, Europe, Asia/Oceania, and internationally. It operates through seven segments: Digital Service, Retail & Commercial Banking, Japanese Corporate & Investment Banking, Global Commercial Banking, Asset Management & Investor Services, Global Corporate & Investment Banking, and Global Markets.

Recommended Stories

Before you consider Mitsubishi UFJ Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mitsubishi UFJ Financial Group wasn't on the list.

While Mitsubishi UFJ Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.