Mubadala Investment Co PJSC trimmed its position in Coupang, Inc. (NYSE:CPNG - Free Report) by 30.0% during the third quarter, according to its most recent 13F filing with the SEC. The fund owned 1,000,000 shares of the company's stock after selling 428,571 shares during the period. Coupang comprises approximately 0.1% of Mubadala Investment Co PJSC's holdings, making the stock its 9th largest holding. Mubadala Investment Co PJSC owned about 0.06% of Coupang worth $24,550,000 at the end of the most recent reporting period.

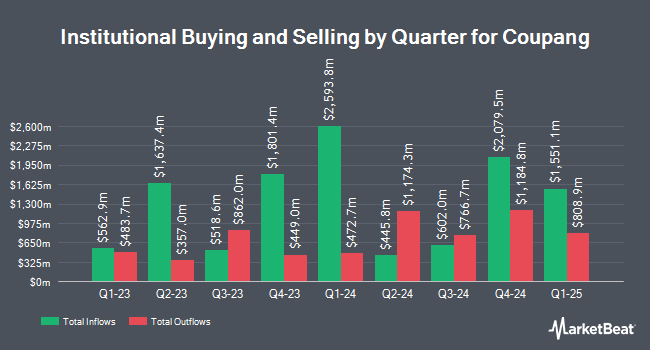

Other hedge funds and other institutional investors also recently made changes to their positions in the company. FMR LLC lifted its stake in shares of Coupang by 32.0% in the 3rd quarter. FMR LLC now owns 27,153,608 shares of the company's stock valued at $666,621,000 after purchasing an additional 6,584,910 shares during the period. Coronation Fund Managers Ltd. increased its holdings in Coupang by 139.1% in the third quarter. Coronation Fund Managers Ltd. now owns 4,817,030 shares of the company's stock valued at $118,258,000 after purchasing an additional 2,802,325 shares during the last quarter. Baillie Gifford & Co. lifted its stake in Coupang by 1.6% in the second quarter. Baillie Gifford & Co. now owns 171,350,025 shares of the company's stock valued at $3,589,783,000 after buying an additional 2,749,027 shares during the period. Envestnet Asset Management Inc. boosted its holdings in Coupang by 2,570.0% during the second quarter. Envestnet Asset Management Inc. now owns 2,049,227 shares of the company's stock worth $42,931,000 after buying an additional 1,972,476 shares during the last quarter. Finally, Assenagon Asset Management S.A. grew its position in shares of Coupang by 55.5% during the 2nd quarter. Assenagon Asset Management S.A. now owns 4,524,994 shares of the company's stock worth $94,799,000 after buying an additional 1,615,448 shares during the period. 83.72% of the stock is owned by institutional investors and hedge funds.

Coupang Stock Up 0.8 %

Shares of CPNG stock traded up $0.20 during trading hours on Tuesday, hitting $25.21. 4,689,029 shares of the company were exchanged, compared to its average volume of 9,710,621. The company has a market capitalization of $45.34 billion, a PE ratio of 43.84, a PEG ratio of 218.90 and a beta of 1.10. Coupang, Inc. has a 52 week low of $13.51 and a 52 week high of $26.91. The business has a 50 day moving average of $25.01 and a two-hundred day moving average of $22.97. The company has a current ratio of 1.13, a quick ratio of 0.86 and a debt-to-equity ratio of 0.28.

Coupang (NYSE:CPNG - Get Free Report) last released its earnings results on Tuesday, November 5th. The company reported $0.06 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.01 by $0.05. The firm had revenue of $7.87 billion during the quarter, compared to analysts' expectations of $7.76 billion. Coupang had a return on equity of 11.52% and a net margin of 3.57%. The company's revenue was up 27.2% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.05 EPS. Analysts anticipate that Coupang, Inc. will post 0.11 earnings per share for the current fiscal year.

Analysts Set New Price Targets

CPNG has been the topic of a number of analyst reports. CLSA upgraded shares of Coupang from a "hold" rating to an "outperform" rating and increased their price target for the company from $18.00 to $31.00 in a research report on Wednesday, September 4th. Sanford C. Bernstein upgraded shares of Coupang from an "underperform" rating to an "outperform" rating and set a $30.00 target price on the stock in a report on Monday, October 7th. One investment analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat, Coupang currently has an average rating of "Moderate Buy" and an average target price of $27.56.

View Our Latest Analysis on CPNG

Insider Activity at Coupang

In other news, CEO Bom Kim sold 15,000,000 shares of the stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $22.97, for a total transaction of $344,550,000.00. Following the completion of the transaction, the chief executive officer now directly owns 2,000,000 shares in the company, valued at $45,940,000. This represents a 88.24 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Greenoaks Capital Partners Llc acquired 750,000 shares of the firm's stock in a transaction dated Friday, November 8th. The stock was bought at an average price of $24.01 per share, with a total value of $18,007,500.00. Following the acquisition, the director now directly owns 52,038,723 shares in the company, valued at $1,249,449,739.23. This represents a 1.46 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 13.60% of the stock is owned by insiders.

Coupang Company Profile

(

Free Report)

Coupang, Inc, together with its subsidiaries owns and operates retail business through its mobile applications and Internet websites primarily in South Korea. The company operates through Product Commerce and Developing Offerings segments. It sells various products and services in the categories of home goods and décor products, apparel, beauty products, fresh food and groceries, sporting goods, electronics, and everyday consumables, as well as travel, and restaurant order and delivery services.

Further Reading

Before you consider Coupang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coupang wasn't on the list.

While Coupang currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report