Janus Henderson Group PLC increased its stake in shares of Mueller Industries, Inc. (NYSE:MLI - Free Report) by 11.9% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 145,103 shares of the industrial products company's stock after purchasing an additional 15,413 shares during the period. Janus Henderson Group PLC owned 0.13% of Mueller Industries worth $10,753,000 as of its most recent filing with the Securities & Exchange Commission.

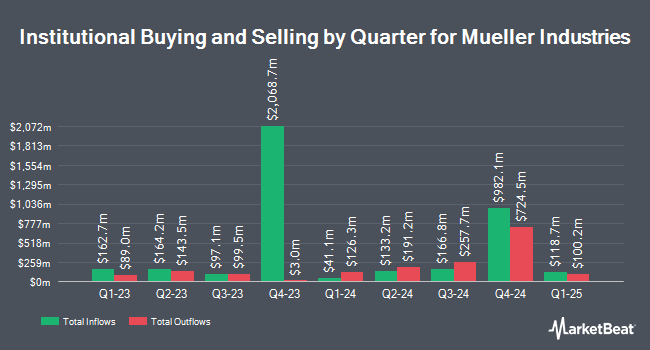

Several other hedge funds have also recently modified their holdings of the stock. GAMMA Investing LLC raised its position in shares of Mueller Industries by 36.0% during the 3rd quarter. GAMMA Investing LLC now owns 552 shares of the industrial products company's stock worth $41,000 after purchasing an additional 146 shares during the last quarter. Miller Howard Investments Inc. NY raised its holdings in Mueller Industries by 2.1% in the 2nd quarter. Miller Howard Investments Inc. NY now owns 7,188 shares of the industrial products company's stock valued at $409,000 after acquiring an additional 151 shares during the last quarter. Kapitalo Investimentos Ltda raised its holdings in Mueller Industries by 3.5% in the 3rd quarter. Kapitalo Investimentos Ltda now owns 4,582 shares of the industrial products company's stock valued at $340,000 after acquiring an additional 156 shares during the last quarter. GM Advisory Group LLC raised its holdings in Mueller Industries by 5.3% in the 3rd quarter. GM Advisory Group LLC now owns 3,792 shares of the industrial products company's stock valued at $281,000 after acquiring an additional 192 shares during the last quarter. Finally, Summit Global Investments raised its holdings in Mueller Industries by 1.6% in the 2nd quarter. Summit Global Investments now owns 12,844 shares of the industrial products company's stock valued at $731,000 after acquiring an additional 204 shares during the last quarter. Institutional investors and hedge funds own 94.50% of the company's stock.

Mueller Industries Trading Down 0.9 %

MLI stock traded down $0.69 during mid-day trading on Monday, reaching $78.03. The company's stock had a trading volume of 697,677 shares, compared to its average volume of 837,370. The stock has a market cap of $8.88 billion, a PE ratio of 15.15 and a beta of 0.99. Mueller Industries, Inc. has a fifty-two week low of $41.94 and a fifty-two week high of $96.81. The company's 50 day moving average is $81.38 and its two-hundred day moving average is $70.09.

Mueller Industries (NYSE:MLI - Get Free Report) last released its quarterly earnings data on Tuesday, October 22nd. The industrial products company reported $1.48 EPS for the quarter, beating analysts' consensus estimates of $1.32 by $0.16. The company had revenue of $997.80 million during the quarter, compared to the consensus estimate of $936.00 million. Mueller Industries had a net margin of 16.39% and a return on equity of 23.25%. The company's revenue was up 21.7% on a year-over-year basis.

Mueller Industries Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 20th. Shareholders of record on Friday, December 6th will be issued a $0.20 dividend. The ex-dividend date is Friday, December 6th. This represents a $0.80 dividend on an annualized basis and a yield of 1.03%. Mueller Industries's payout ratio is 15.53%.

Insider Transactions at Mueller Industries

In other Mueller Industries news, Director John B. Hansen sold 1,000 shares of the company's stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $83.09, for a total value of $83,090.00. Following the transaction, the director now owns 94,914 shares of the company's stock, valued at $7,886,404.26. This represents a 1.04 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Charles P. Herzog, Jr. sold 15,000 shares of Mueller Industries stock in a transaction dated Thursday, November 21st. The shares were sold at an average price of $92.04, for a total transaction of $1,380,600.00. Following the sale, the director now owns 17,733 shares of the company's stock, valued at approximately $1,632,145.32. This represents a 45.83 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 2.80% of the company's stock.

Mueller Industries Company Profile

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Further Reading

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.