Allspring Global Investments Holdings LLC decreased its holdings in Mueller Industries, Inc. (NYSE:MLI - Free Report) by 13.9% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 2,613,407 shares of the industrial products company's stock after selling 420,594 shares during the quarter. Allspring Global Investments Holdings LLC owned approximately 2.30% of Mueller Industries worth $208,367,000 at the end of the most recent reporting period.

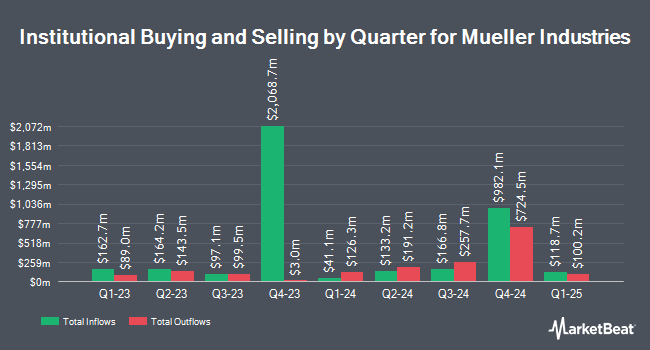

Several other institutional investors also recently modified their holdings of MLI. Four Tree Island Advisory LLC bought a new stake in Mueller Industries during the fourth quarter valued at $19,376,000. Legacy Financial Strategies LLC acquired a new position in shares of Mueller Industries during the fourth quarter valued at about $272,000. Entropy Technologies LP acquired a new position in shares of Mueller Industries during the fourth quarter valued at about $532,000. Kingsview Wealth Management LLC acquired a new position in shares of Mueller Industries during the fourth quarter valued at about $2,254,000. Finally, Vest Financial LLC raised its holdings in shares of Mueller Industries by 12.0% during the fourth quarter. Vest Financial LLC now owns 431,226 shares of the industrial products company's stock valued at $34,222,000 after purchasing an additional 46,103 shares during the period. Institutional investors own 94.50% of the company's stock.

Mueller Industries Stock Performance

Shares of NYSE MLI traded up $0.61 during trading on Friday, hitting $81.23. 880,993 shares of the company traded hands, compared to its average volume of 729,991. The business's fifty day moving average is $80.38 and its 200 day moving average is $77.32. Mueller Industries, Inc. has a fifty-two week low of $47.46 and a fifty-two week high of $96.81. The firm has a market capitalization of $9.24 billion, a price-to-earnings ratio of 15.30 and a beta of 0.98.

Mueller Industries (NYSE:MLI - Get Free Report) last posted its earnings results on Tuesday, February 4th. The industrial products company reported $1.21 earnings per share for the quarter, topping analysts' consensus estimates of $1.12 by $0.09. Mueller Industries had a net margin of 16.05% and a return on equity of 22.97%.

Wall Street Analyst Weigh In

Separately, Northcoast Research upgraded shares of Mueller Industries from a "neutral" rating to a "buy" rating and set a $105.00 price objective on the stock in a report on Wednesday, December 11th.

Check Out Our Latest Stock Report on MLI

Insider Buying and Selling

In related news, Director Scott Jay Goldman sold 10,000 shares of the company's stock in a transaction dated Thursday, February 13th. The shares were sold at an average price of $79.81, for a total value of $798,100.00. Following the sale, the director now owns 56,098 shares in the company, valued at $4,477,181.38. This represents a 15.13 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Charles P. Herzog, Jr. sold 15,000 shares of the company's stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $92.04, for a total transaction of $1,380,600.00. Following the completion of the sale, the director now owns 17,733 shares in the company, valued at $1,632,145.32. This represents a 45.83 % decrease in their position. The disclosure for this sale can be found here. 2.80% of the stock is currently owned by company insiders.

Mueller Industries Profile

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Featured Articles

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.