Victory Capital Management Inc. trimmed its position in shares of Mueller Industries, Inc. (NYSE:MLI - Free Report) by 17.9% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,055,985 shares of the industrial products company's stock after selling 230,755 shares during the period. Victory Capital Management Inc. owned approximately 0.93% of Mueller Industries worth $78,248,000 at the end of the most recent quarter.

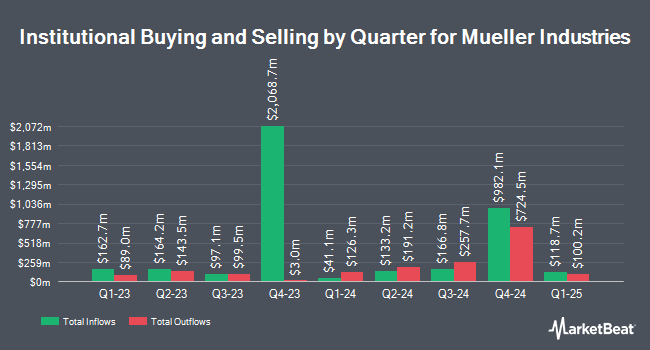

Other hedge funds have also recently bought and sold shares of the company. International Assets Investment Management LLC acquired a new stake in Mueller Industries in the second quarter valued at about $26,000. Federated Hermes Inc. bought a new stake in shares of Mueller Industries during the 2nd quarter valued at approximately $28,000. Opal Wealth Advisors LLC acquired a new position in Mueller Industries during the 2nd quarter worth approximately $30,000. GAMMA Investing LLC increased its position in Mueller Industries by 36.0% during the 3rd quarter. GAMMA Investing LLC now owns 552 shares of the industrial products company's stock worth $41,000 after purchasing an additional 146 shares in the last quarter. Finally, Larson Financial Group LLC lifted its stake in Mueller Industries by 61.7% in the 2nd quarter. Larson Financial Group LLC now owns 967 shares of the industrial products company's stock valued at $55,000 after purchasing an additional 369 shares during the last quarter. 94.50% of the stock is owned by institutional investors.

Insider Buying and Selling

In other Mueller Industries news, Director John B. Hansen sold 1,000 shares of Mueller Industries stock in a transaction dated Wednesday, October 30th. The stock was sold at an average price of $83.09, for a total transaction of $83,090.00. Following the transaction, the director now directly owns 94,914 shares of the company's stock, valued at approximately $7,886,404.26. The trade was a 1.04 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Gregory L. Christopher sold 50,000 shares of the company's stock in a transaction dated Thursday, August 22nd. The shares were sold at an average price of $69.92, for a total value of $3,496,000.00. Following the completion of the sale, the chief executive officer now owns 1,214,311 shares in the company, valued at $84,904,625.12. This trade represents a 3.95 % decrease in their position. The disclosure for this sale can be found here. 2.80% of the stock is owned by corporate insiders.

Mueller Industries Stock Down 0.8 %

Shares of NYSE MLI traded down $0.75 during midday trading on Thursday, reaching $90.25. 763,624 shares of the company were exchanged, compared to its average volume of 720,087. The stock's 50-day moving average price is $76.42 and its 200-day moving average price is $66.75. The stock has a market cap of $10.27 billion, a P/E ratio of 17.67 and a beta of 1.01. Mueller Industries, Inc. has a one year low of $40.43 and a one year high of $96.81.

Mueller Industries (NYSE:MLI - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The industrial products company reported $1.48 earnings per share for the quarter, topping analysts' consensus estimates of $1.32 by $0.16. Mueller Industries had a return on equity of 23.25% and a net margin of 16.39%. The business had revenue of $997.80 million for the quarter, compared to analyst estimates of $936.00 million. The business's quarterly revenue was up 21.7% compared to the same quarter last year.

Mueller Industries Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, December 6th will be issued a $0.20 dividend. The ex-dividend date of this dividend is Friday, December 6th. This represents a $0.80 dividend on an annualized basis and a yield of 0.89%. Mueller Industries's dividend payout ratio (DPR) is presently 15.53%.

Mueller Industries Profile

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Further Reading

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.