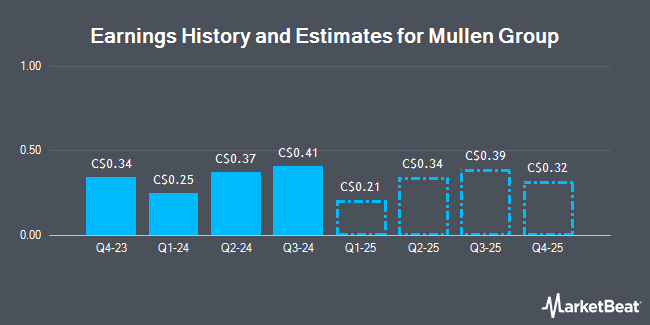

Mullen Group Ltd. (TSE:MTL - Free Report) - Equities researchers at National Bank Financial dropped their FY2025 earnings per share (EPS) estimates for shares of Mullen Group in a report released on Monday, December 9th. National Bank Financial analyst C. Doerksen now expects that the company will post earnings per share of $1.31 for the year, down from their prior forecast of $1.38. National Bank Financial also issued estimates for Mullen Group's FY2026 earnings at $1.42 EPS.

Several other brokerages have also recently issued reports on MTL. BMO Capital Markets raised their target price on shares of Mullen Group from C$17.00 to C$20.00 in a report on Friday, October 25th. Raymond James lowered their price objective on Mullen Group from C$18.75 to C$18.50 in a report on Tuesday. National Bankshares raised their target price on shares of Mullen Group from C$18.00 to C$19.00 in a research note on Monday. CIBC boosted their price target on shares of Mullen Group from C$16.50 to C$17.50 in a research report on Friday, October 25th. Finally, TD Securities reduced their target price on shares of Mullen Group from C$22.00 to C$21.00 and set a "buy" rating on the stock in a research note on Wednesday, September 11th. One research analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of C$18.97.

Check Out Our Latest Analysis on MTL

Mullen Group Stock Performance

Shares of MTL stock traded down C$0.03 during mid-day trading on Wednesday, reaching C$15.43. The stock had a trading volume of 75,755 shares, compared to its average volume of 185,838. Mullen Group has a 1-year low of C$12.47 and a 1-year high of C$16.06. The company has a current ratio of 0.75, a quick ratio of 1.06 and a debt-to-equity ratio of 93.56. The firm has a market cap of C$1.35 billion, a price-to-earnings ratio of 11.54, a PEG ratio of 1.81 and a beta of 1.82. The business's fifty day moving average is C$14.98 and its 200-day moving average is C$14.09.

Mullen Group Dividend Announcement

The firm also recently announced a monthly dividend, which was paid on Friday, November 15th. Investors of record on Thursday, October 31st were paid a dividend of $0.07 per share. This represents a $0.84 annualized dividend and a yield of 5.44%. The ex-dividend date was Thursday, October 31st. Mullen Group's payout ratio is currently 62.69%.

Mullen Group Company Profile

(

Get Free Report)

Mullen Group Ltd. provides a range of trucking and logistics services in Canada and the United States. The Less-Than-Truckload segment delivers general freight consisting of smaller shipments, packages, and parcels; and pharmaceutical and package products. The Logistics & Warehousing segment offers full truckload, specialized transportation, warehousing, and fulfillment centers that handle e-commerce transactions and transload facilities for intermodal and bulk shipments; technology solutions, including transportation, inventory, and warehouse management systems; and warehousing and distribution services.

Featured Articles

Before you consider Mullen Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mullen Group wasn't on the list.

While Mullen Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.