Murphy Oil (NYSE:MUR - Get Free Report) had its target price lifted by research analysts at Piper Sandler from $34.00 to $35.00 in a note issued to investors on Tuesday,Benzinga reports. The firm currently has an "overweight" rating on the oil and gas producer's stock. Piper Sandler's price objective would indicate a potential upside of 60.46% from the company's current price.

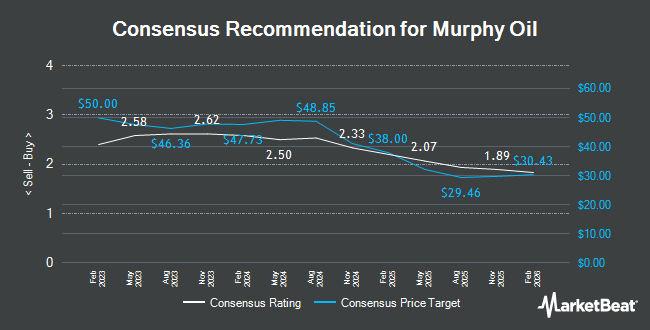

A number of other research analysts also recently commented on MUR. UBS Group lowered their target price on Murphy Oil from $28.00 to $23.00 and set a "neutral" rating for the company in a research report on Monday, April 7th. Morgan Stanley set a $27.00 target price on shares of Murphy Oil and gave the company an "underweight" rating in a research report on Tuesday, April 15th. KeyCorp reiterated a "sector weight" rating on shares of Murphy Oil in a research report on Monday. Scotiabank reduced their price objective on Murphy Oil from $36.00 to $22.00 and set a "sector perform" rating on the stock in a research note on Friday, April 11th. Finally, JPMorgan Chase & Co. lowered their price objective on Murphy Oil from $33.00 to $28.00 and set a "neutral" rating for the company in a research note on Thursday, March 13th. One research analyst has rated the stock with a sell rating, eleven have given a hold rating and two have given a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $32.85.

View Our Latest Stock Report on Murphy Oil

Murphy Oil Price Performance

Shares of MUR traded up $0.98 during trading hours on Tuesday, reaching $21.81. 987,985 shares of the stock traded hands, compared to its average volume of 2,052,384. The company's 50-day moving average price is $25.24 and its two-hundred day moving average price is $29.18. Murphy Oil has a 52-week low of $18.95 and a 52-week high of $46.91. The company has a market cap of $3.11 billion, a P/E ratio of 8.10 and a beta of 1.68. The company has a current ratio of 0.83, a quick ratio of 0.77 and a debt-to-equity ratio of 0.24.

Murphy Oil (NYSE:MUR - Get Free Report) last posted its earnings results on Thursday, January 30th. The oil and gas producer reported $0.35 earnings per share for the quarter, missing the consensus estimate of $0.62 by ($0.27). Murphy Oil had a net margin of 13.44% and a return on equity of 7.66%. During the same quarter in the previous year, the firm earned $0.90 EPS. On average, analysts anticipate that Murphy Oil will post 2.94 earnings per share for the current year.

Insider Buying and Selling

In related news, VP Meenambigai Palanivelu acquired 1,573 shares of the company's stock in a transaction dated Wednesday, February 5th. The shares were purchased at an average cost of $26.70 per share, with a total value of $41,999.10. Following the completion of the acquisition, the vice president now directly owns 37,065 shares of the company's stock, valued at $989,635.50. This represents a 4.43 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Claiborne P. Deming bought 50,000 shares of Murphy Oil stock in a transaction that occurred on Tuesday, February 4th. The stock was purchased at an average price of $26.47 per share, with a total value of $1,323,500.00. Following the purchase, the director now directly owns 931,651 shares in the company, valued at $24,660,801.97. The trade was a 5.67 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 6.52% of the stock is owned by company insiders.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of the company. Huntington National Bank increased its holdings in Murphy Oil by 342.8% in the 4th quarter. Huntington National Bank now owns 828 shares of the oil and gas producer's stock worth $25,000 after buying an additional 641 shares during the period. Riverview Trust Co purchased a new stake in shares of Murphy Oil in the 1st quarter valued at $26,000. GeoWealth Management LLC acquired a new stake in shares of Murphy Oil in the fourth quarter worth $39,000. Lindbrook Capital LLC raised its holdings in shares of Murphy Oil by 60.5% during the fourth quarter. Lindbrook Capital LLC now owns 1,441 shares of the oil and gas producer's stock worth $44,000 after purchasing an additional 543 shares during the last quarter. Finally, Byrne Asset Management LLC acquired a new position in Murphy Oil during the first quarter valued at $44,000. 78.31% of the stock is owned by institutional investors and hedge funds.

Murphy Oil Company Profile

(

Get Free Report)

Murphy Oil Corporation, together with its subsidiaries, operates as an oil and gas exploration and production company in the United States, Canada, and internationally. It explores for and produces crude oil, natural gas, and natural gas liquids. The company was formerly known as Murphy Corporation and changed its name to Murphy Oil Corporation in 1964.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Murphy Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Murphy Oil wasn't on the list.

While Murphy Oil currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.