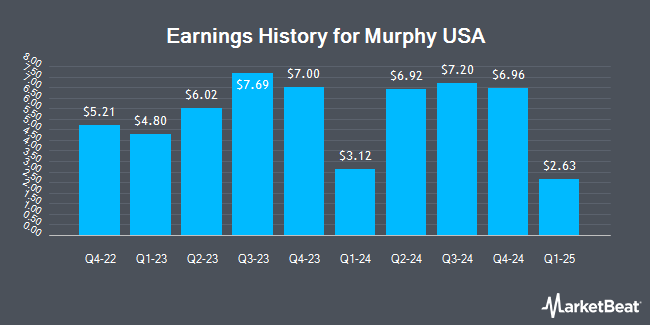

Murphy USA (NYSE:MUSA - Get Free Report) posted its quarterly earnings data on Wednesday. The specialty retailer reported $6.96 EPS for the quarter, beating the consensus estimate of $6.46 by $0.50, Zacks reports. Murphy USA had a return on equity of 61.60% and a net margin of 2.48%.

Murphy USA Price Performance

Shares of NYSE MUSA traded down $20.68 during midday trading on Friday, hitting $478.80. The company had a trading volume of 334,729 shares, compared to its average volume of 205,765. The company has a quick ratio of 0.41, a current ratio of 0.79 and a debt-to-equity ratio of 2.18. The business has a 50-day simple moving average of $508.11 and a two-hundred day simple moving average of $506.89. Murphy USA has a twelve month low of $371.30 and a twelve month high of $561.08. The firm has a market capitalization of $9.70 billion, a price-to-earnings ratio of 19.79 and a beta of 0.79.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on MUSA. Wells Fargo & Company decreased their price target on Murphy USA from $555.00 to $550.00 and set an "overweight" rating for the company in a report on Friday. StockNews.com raised shares of Murphy USA from a "hold" rating to a "buy" rating in a report on Friday. Finally, Royal Bank of Canada boosted their price target on shares of Murphy USA from $550.00 to $554.00 and gave the stock a "sector perform" rating in a research note on Thursday. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $510.80.

Check Out Our Latest Analysis on MUSA

About Murphy USA

(

Get Free Report)

Murphy USA Inc engages in marketing of retail motor fuel products and convenience merchandise. The company operates retail stores under the Murphy USA, Murphy Express, and QuickChek brands, as well as operates non-fuel convenience stores. It operates retail gasoline stores principally in the Southeast, Southwest, and Midwest United States.

Featured Articles

Before you consider Murphy USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Murphy USA wasn't on the list.

While Murphy USA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.