Mutual of America Capital Management LLC boosted its position in shares of American Financial Group, Inc. (NYSE:AFG - Free Report) by 7.9% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 85,043 shares of the insurance provider's stock after buying an additional 6,252 shares during the quarter. Mutual of America Capital Management LLC owned 0.10% of American Financial Group worth $11,447,000 as of its most recent filing with the Securities & Exchange Commission.

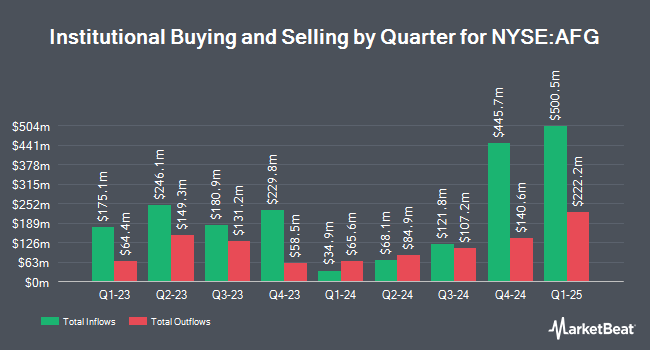

A number of other hedge funds have also bought and sold shares of the company. Innealta Capital LLC purchased a new stake in shares of American Financial Group in the second quarter worth approximately $30,000. Headlands Technologies LLC bought a new position in American Financial Group in the 2nd quarter valued at $38,000. Covestor Ltd increased its stake in American Financial Group by 402.3% in the first quarter. Covestor Ltd now owns 432 shares of the insurance provider's stock worth $59,000 after purchasing an additional 346 shares during the period. Blue Trust Inc. lifted its position in shares of American Financial Group by 44.3% during the second quarter. Blue Trust Inc. now owns 433 shares of the insurance provider's stock worth $59,000 after purchasing an additional 133 shares during the last quarter. Finally, Abich Financial Wealth Management LLC boosted its stake in shares of American Financial Group by 10,460.0% during the first quarter. Abich Financial Wealth Management LLC now owns 528 shares of the insurance provider's stock valued at $72,000 after purchasing an additional 523 shares during the period. Institutional investors own 64.37% of the company's stock.

American Financial Group Stock Up 1.3 %

NYSE:AFG traded up $1.80 during mid-day trading on Monday, reaching $139.62. The company's stock had a trading volume of 467,664 shares, compared to its average volume of 304,230. The company has a quick ratio of 0.46, a current ratio of 0.53 and a debt-to-equity ratio of 0.31. The firm has a market capitalization of $11.72 billion, a PE ratio of 12.91 and a beta of 0.79. The stock has a fifty day moving average of $134.93 and a 200-day moving average of $130.37. American Financial Group, Inc. has a 1 year low of $108.39 and a 1 year high of $144.81.

American Financial Group (NYSE:AFG - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The insurance provider reported $2.31 earnings per share for the quarter, missing the consensus estimate of $2.51 by ($0.20). The business had revenue of $2.06 billion during the quarter, compared to analysts' expectations of $1.80 billion. American Financial Group had a return on equity of 19.97% and a net margin of 10.84%. American Financial Group's revenue for the quarter was up 10.8% on a year-over-year basis. During the same period in the previous year, the company posted $2.45 EPS. Equities research analysts forecast that American Financial Group, Inc. will post 10.88 earnings per share for the current year.

American Financial Group Increases Dividend

The business also recently declared a None dividend, which will be paid on Tuesday, November 26th. Stockholders of record on Friday, November 15th will be given a $4.00 dividend. This is a positive change from American Financial Group's previous None dividend of $1.00. The ex-dividend date is Friday, November 15th. American Financial Group's payout ratio is presently 29.99%.

Wall Street Analyst Weigh In

AFG has been the subject of a number of research analyst reports. BMO Capital Markets lifted their price objective on shares of American Financial Group from $135.00 to $143.00 and gave the company a "market perform" rating in a report on Friday. Piper Sandler lifted their price target on shares of American Financial Group from $135.00 to $150.00 and gave the company a "neutral" rating in a research note on Tuesday, November 12th.

Read Our Latest Stock Analysis on American Financial Group

American Financial Group Profile

(

Free Report)

American Financial Group, Inc, an insurance holding company, provides specialty property and casualty insurance products in the United States. The company offers property and transportation insurance products, such as physical damage and liability coverage for buses and trucks, inland and ocean marine, agricultural-related products, and other commercial property and specialty transportation coverages; specialty casualty insurance, including primarily excess and surplus, executive and professional liability, general liability, umbrella and excess liability, and specialty coverage in targeted markets, as well as customized programs for small to mid-sized businesses and workers' compensation insurance; and specialty financial insurance products comprising risk management insurance programs for lending and leasing institutions, fidelity and surety products, and trade credit insurance.

See Also

Before you consider American Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Financial Group wasn't on the list.

While American Financial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.