Mutual of America Capital Management LLC lessened its holdings in shares of Adient plc (NYSE:ADNT - Free Report) by 74.5% in the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 13,113 shares of the company's stock after selling 38,317 shares during the quarter. Mutual of America Capital Management LLC's holdings in Adient were worth $296,000 as of its most recent filing with the SEC.

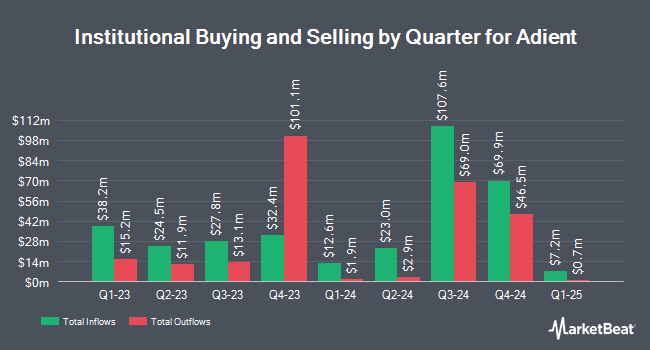

Several other hedge funds have also recently bought and sold shares of ADNT. Empowered Funds LLC purchased a new position in Adient in the third quarter valued at about $6,653,000. KBC Group NV lifted its position in Adient by 51.8% during the 3rd quarter. KBC Group NV now owns 3,328 shares of the company's stock worth $75,000 after acquiring an additional 1,136 shares in the last quarter. MQS Management LLC purchased a new position in Adient in the 3rd quarter worth approximately $278,000. Victory Capital Management Inc. boosted its holdings in Adient by 8.4% in the 3rd quarter. Victory Capital Management Inc. now owns 20,977 shares of the company's stock worth $473,000 after acquiring an additional 1,633 shares during the period. Finally, GSA Capital Partners LLP acquired a new stake in Adient in the third quarter valued at approximately $2,843,000. Hedge funds and other institutional investors own 92.44% of the company's stock.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on the stock. StockNews.com upgraded shares of Adient from a "hold" rating to a "buy" rating in a research note on Monday, November 11th. Deutsche Bank Aktiengesellschaft reiterated a "hold" rating and issued a $24.00 price target on shares of Adient in a research note on Tuesday, September 10th. Barclays lowered their price objective on Adient from $29.00 to $24.00 and set an "equal weight" rating for the company in a research note on Thursday, August 8th. JPMorgan Chase & Co. cut their target price on Adient from $31.00 to $27.00 and set a "neutral" rating on the stock in a research report on Thursday, August 8th. Finally, Bank of America downgraded shares of Adient from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $30.00 to $24.00 in a research report on Thursday, November 21st. One research analyst has rated the stock with a sell rating, seven have given a hold rating and two have given a buy rating to the company. According to data from MarketBeat.com, Adient presently has an average rating of "Hold" and an average price target of $24.38.

Get Our Latest Report on Adient

Adient Stock Performance

NYSE ADNT traded down $0.03 on Friday, hitting $19.23. The stock had a trading volume of 532,856 shares, compared to its average volume of 1,233,086. The company's 50-day moving average is $21.02 and its two-hundred day moving average is $23.29. Adient plc has a one year low of $18.53 and a one year high of $37.19. The stock has a market cap of $1.63 billion, a price-to-earnings ratio of 83.61, a P/E/G ratio of 0.32 and a beta of 2.18. The company has a quick ratio of 0.90, a current ratio of 1.11 and a debt-to-equity ratio of 0.98.

Adient (NYSE:ADNT - Get Free Report) last released its quarterly earnings results on Friday, November 8th. The company reported $0.68 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.56 by $0.12. The company had revenue of $3.56 billion during the quarter, compared to analysts' expectations of $3.47 billion. Adient had a return on equity of 6.86% and a net margin of 0.12%. The company's revenue for the quarter was down 3.7% compared to the same quarter last year. During the same quarter in the prior year, the business posted $0.51 earnings per share. On average, analysts expect that Adient plc will post 2.04 earnings per share for the current year.

About Adient

(

Free Report)

Adient plc engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks. The company's automotive seating solutions include complete seating systems, frames, mechanisms, foams, head restraints, armrests, and trim covers.

Further Reading

Before you consider Adient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adient wasn't on the list.

While Adient currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.