UBS Group started coverage on shares of Myriad Genetics (NASDAQ:MYGN - Get Free Report) in a note issued to investors on Tuesday, MarketBeat reports. The brokerage set a "neutral" rating and a $18.00 price target on the stock. UBS Group's price target suggests a potential upside of 17.34% from the company's current price.

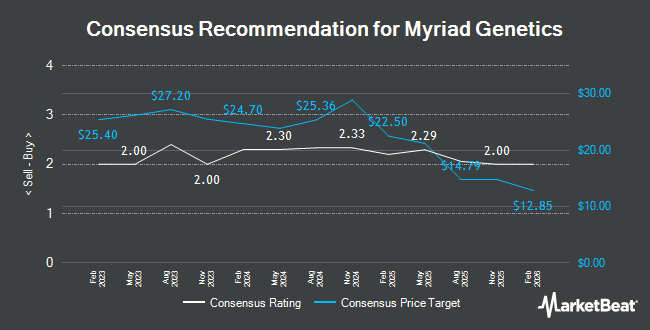

A number of other analysts have also commented on MYGN. Leerink Partners lowered Myriad Genetics from an "outperform" rating to a "market perform" rating and lowered their price objective for the stock from $30.00 to $21.00 in a research report on Monday. Scotiabank boosted their price target on shares of Myriad Genetics from $29.00 to $34.00 and gave the stock a "sector outperform" rating in a research note on Tuesday, August 13th. Morgan Stanley reduced their price objective on shares of Myriad Genetics from $32.00 to $21.00 and set an "equal weight" rating on the stock in a research note on Monday, November 18th. Piper Sandler lowered their target price on shares of Myriad Genetics from $30.00 to $24.00 and set a "neutral" rating for the company in a report on Monday, November 11th. Finally, StockNews.com downgraded Myriad Genetics from a "buy" rating to a "hold" rating in a research note on Wednesday, November 20th. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating and five have given a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $25.42.

View Our Latest Stock Analysis on MYGN

Myriad Genetics Trading Up 3.1 %

MYGN traded up $0.46 during mid-day trading on Tuesday, reaching $15.34. The stock had a trading volume of 809,951 shares, compared to its average volume of 745,752. The firm's fifty day simple moving average is $19.78 and its two-hundred day simple moving average is $23.81. The stock has a market capitalization of $1.40 billion, a P/E ratio of -11.45 and a beta of 1.88. Myriad Genetics has a 52 week low of $14.34 and a 52 week high of $29.30. The company has a debt-to-equity ratio of 0.05, a quick ratio of 1.73 and a current ratio of 1.90.

Insider Activity

In related news, CEO Paul J. Diaz sold 15,000 shares of the firm's stock in a transaction on Friday, October 11th. The shares were sold at an average price of $22.93, for a total transaction of $343,950.00. Following the sale, the chief executive officer now directly owns 962,378 shares in the company, valued at $22,067,327.54. This trade represents a 1.53 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. 2.10% of the stock is currently owned by company insiders.

Institutional Trading of Myriad Genetics

Several hedge funds and other institutional investors have recently modified their holdings of MYGN. Franklin Resources Inc. grew its stake in shares of Myriad Genetics by 8.8% during the 3rd quarter. Franklin Resources Inc. now owns 58,055 shares of the company's stock worth $1,457,000 after acquiring an additional 4,710 shares in the last quarter. Geode Capital Management LLC boosted its holdings in Myriad Genetics by 1.0% during the third quarter. Geode Capital Management LLC now owns 2,154,035 shares of the company's stock worth $59,010,000 after purchasing an additional 21,220 shares during the last quarter. Disciplined Growth Investors Inc. MN increased its stake in Myriad Genetics by 21.1% in the 3rd quarter. Disciplined Growth Investors Inc. MN now owns 2,527,435 shares of the company's stock valued at $69,226,000 after buying an additional 440,107 shares during the last quarter. Barclays PLC lifted its position in Myriad Genetics by 136.9% during the 3rd quarter. Barclays PLC now owns 190,243 shares of the company's stock worth $5,210,000 after buying an additional 109,931 shares in the last quarter. Finally, Y Intercept Hong Kong Ltd boosted its stake in shares of Myriad Genetics by 188.6% during the 3rd quarter. Y Intercept Hong Kong Ltd now owns 38,533 shares of the company's stock worth $1,055,000 after buying an additional 25,179 shares during the last quarter. Institutional investors and hedge funds own 99.02% of the company's stock.

Myriad Genetics Company Profile

(

Get Free Report)

Myriad Genetics, Inc, a genetic testing and precision medicine company, develops genetic tests in the United States and internationally. The company offers molecular diagnostic tests for use in oncology, and women's and pharmacogenomics. It also provides MyRisk Hereditary Cancer Test, a DNA sequencing test for assessing the risks for hereditary cancers; BRACAnalysis CDx Germline Companion Diagnostic Test, a DNA sequencing test to help determine the therapy for patients with metastatic breast, ovarian, metastatic pancreatic, and metastatic prostate cancer with deleterious or suspected deleterious germline BRCA variants; and MyChoice CDx Companion Diagnostic Test, a tumor test that determines homologous recombination deficiency status in patients with ovarian cancer.

Read More

Before you consider Myriad Genetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Myriad Genetics wasn't on the list.

While Myriad Genetics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.