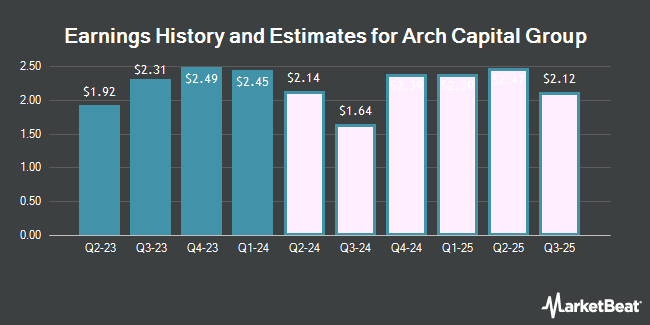

Arch Capital Group Ltd. (NASDAQ:ACGL - Free Report) - Research analysts at Roth Capital cut their Q4 2024 earnings per share estimates for Arch Capital Group in a research report issued to clients and investors on Thursday, October 31st. Roth Capital analyst H. Fong now expects that the insurance provider will earn $1.79 per share for the quarter, down from their prior forecast of $2.50. The consensus estimate for Arch Capital Group's current full-year earnings is $9.05 per share. Roth Capital also issued estimates for Arch Capital Group's Q1 2025 earnings at $2.36 EPS, Q2 2025 earnings at $2.43 EPS, FY2025 earnings at $9.25 EPS, Q1 2026 earnings at $2.71 EPS, Q3 2026 earnings at $2.08 EPS and FY2026 earnings at $10.50 EPS.

Several other brokerages also recently commented on ACGL. Bank of America increased their price objective on Arch Capital Group from $119.00 to $135.00 and gave the stock a "buy" rating in a research note on Thursday, October 10th. Keefe, Bruyette & Woods raised their price objective on Arch Capital Group from $120.00 to $121.00 and gave the company an "outperform" rating in a research note on Wednesday, August 7th. Royal Bank of Canada reduced their target price on shares of Arch Capital Group from $128.00 to $125.00 and set an "outperform" rating for the company in a research note on Friday. JMP Securities raised their price target on shares of Arch Capital Group from $115.00 to $125.00 and gave the company a "market outperform" rating in a research report on Tuesday, October 15th. Finally, Barclays began coverage on shares of Arch Capital Group in a research report on Wednesday, September 4th. They issued an "equal weight" rating and a $120.00 price objective for the company. Five equities research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $119.87.

Read Our Latest Analysis on Arch Capital Group

Arch Capital Group Stock Down 1.1 %

NASDAQ ACGL traded down $1.02 during trading hours on Monday, hitting $95.00. The company's stock had a trading volume of 2,277,683 shares, compared to its average volume of 1,652,488. The company has a market capitalization of $35.73 billion, a PE ratio of 6.38, a price-to-earnings-growth ratio of 1.83 and a beta of 0.61. The company has a current ratio of 0.58, a quick ratio of 0.60 and a debt-to-equity ratio of 0.17. Arch Capital Group has a 52 week low of $72.85 and a 52 week high of $116.47. The company's 50-day simple moving average is $110.43 and its two-hundred day simple moving average is $102.87.

Arch Capital Group (NASDAQ:ACGL - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The insurance provider reported $1.99 earnings per share for the quarter, beating analysts' consensus estimates of $1.94 by $0.05. The firm had revenue of $4.72 billion for the quarter, compared to analyst estimates of $4.05 billion. Arch Capital Group had a net margin of 33.86% and a return on equity of 18.94%. During the same period last year, the firm earned $2.31 earnings per share.

Insiders Place Their Bets

In other news, CFO Francois Morin sold 11,460 shares of the company's stock in a transaction on Friday, August 16th. The stock was sold at an average price of $102.46, for a total transaction of $1,174,191.60. Following the transaction, the chief financial officer now owns 221,779 shares of the company's stock, valued at $22,723,476.34. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 4.20% of the company's stock.

Institutional Trading of Arch Capital Group

Hedge funds and other institutional investors have recently modified their holdings of the business. Capital International Investors boosted its holdings in shares of Arch Capital Group by 61.1% in the first quarter. Capital International Investors now owns 4,112,577 shares of the insurance provider's stock worth $380,167,000 after acquiring an additional 1,560,173 shares during the period. National Pension Service purchased a new stake in Arch Capital Group during the 3rd quarter worth about $64,271,000. International Assets Investment Management LLC grew its holdings in Arch Capital Group by 18,634.1% during the 3rd quarter. International Assets Investment Management LLC now owns 551,345 shares of the insurance provider's stock valued at $616,840,000 after buying an additional 548,402 shares in the last quarter. Brandes Investment Partners LP bought a new stake in shares of Arch Capital Group during the second quarter valued at about $48,119,000. Finally, Natixis Advisors LLC increased its position in shares of Arch Capital Group by 59.1% during the second quarter. Natixis Advisors LLC now owns 1,139,480 shares of the insurance provider's stock valued at $114,962,000 after buying an additional 423,406 shares during the period. Institutional investors own 89.07% of the company's stock.

About Arch Capital Group

(

Get Free Report)

Arch Capital Group Ltd., together with its subsidiaries, provides insurance, reinsurance, and mortgage insurance products worldwide. The company's Insurance segment offers primary and excess casualty coverages; loss sensitive primary casualty insurance programs; directors' and officers' liability, errors and omissions liability, employment practices and fiduciary liability, crime, professional indemnity, and other financial related coverages; medical professional and general liability insurance coverages; and workers' compensation and umbrella liability, as well as commercial automobile and inland marine products.

Featured Articles

Before you consider Arch Capital Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arch Capital Group wasn't on the list.

While Arch Capital Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.