Hennion & Walsh Asset Management Inc. cut its holdings in ACI Worldwide, Inc. (NASDAQ:ACIW - Free Report) by 76.9% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 7,527 shares of the technology company's stock after selling 25,094 shares during the period. Hennion & Walsh Asset Management Inc.'s holdings in ACI Worldwide were worth $383,000 as of its most recent filing with the SEC.

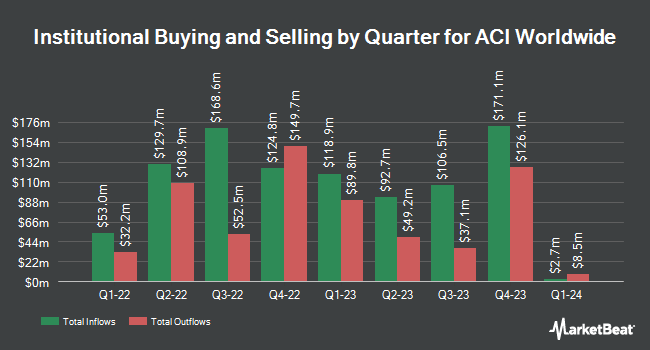

Other hedge funds have also bought and sold shares of the company. Fifth Third Bancorp lifted its position in shares of ACI Worldwide by 123.3% during the 2nd quarter. Fifth Third Bancorp now owns 1,130 shares of the technology company's stock valued at $45,000 after acquiring an additional 624 shares during the period. GAMMA Investing LLC lifted its position in ACI Worldwide by 49.3% during the second quarter. GAMMA Investing LLC now owns 1,306 shares of the technology company's stock worth $52,000 after purchasing an additional 431 shares during the period. CWM LLC grew its stake in ACI Worldwide by 638.5% during the second quarter. CWM LLC now owns 1,322 shares of the technology company's stock worth $52,000 after buying an additional 1,143 shares in the last quarter. nVerses Capital LLC bought a new position in ACI Worldwide in the 3rd quarter valued at about $112,000. Finally, USA Financial Formulas acquired a new position in shares of ACI Worldwide in the 3rd quarter valued at approximately $114,000. 94.74% of the stock is owned by institutional investors.

ACI Worldwide Price Performance

ACIW traded up $0.01 on Wednesday, reaching $49.90. The stock had a trading volume of 292,965 shares, compared to its average volume of 646,640. The company has a current ratio of 1.32, a quick ratio of 1.32 and a debt-to-equity ratio of 0.79. The company has a market capitalization of $5.26 billion, a price-to-earnings ratio of 37.24 and a beta of 1.19. ACI Worldwide, Inc. has a fifty-two week low of $19.68 and a fifty-two week high of $53.29. The firm has a 50-day moving average of $49.78 and a 200-day moving average of $42.44.

ACI Worldwide (NASDAQ:ACIW - Get Free Report) last released its quarterly earnings data on Thursday, August 1st. The technology company reported $0.39 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.15 by $0.24. ACI Worldwide had a return on equity of 19.18% and a net margin of 12.01%. The company had revenue of $373.48 million during the quarter, compared to the consensus estimate of $349.95 million. As a group, sell-side analysts anticipate that ACI Worldwide, Inc. will post 1.96 EPS for the current year.

Analysts Set New Price Targets

Several research firms recently issued reports on ACIW. Stephens lowered shares of ACI Worldwide from an "overweight" rating to an "equal weight" rating in a research report on Friday, October 18th. StockNews.com lowered ACI Worldwide from a "buy" rating to a "hold" rating in a research note on Saturday, August 3rd. Needham & Company LLC reissued a "hold" rating on shares of ACI Worldwide in a report on Friday, August 2nd. Canaccord Genuity Group raised their price objective on ACI Worldwide from $40.00 to $60.00 and gave the company a "buy" rating in a research note on Friday, August 2nd. Finally, DA Davidson boosted their target price on ACI Worldwide from $52.00 to $57.00 and gave the stock a "buy" rating in a research note on Tuesday, October 15th. Three equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $48.75.

Check Out Our Latest Report on ACI Worldwide

ACI Worldwide Company Profile

(

Free Report)

ACI Worldwide, Inc, a software company, develops, markets, installs, and supports a range of software products and solutions for facilitating digital payments in the United States and internationally. The company operates in three segments: Banks, Merchants, and Billers. The company offers ACI Acquiring, a solution to process credit, debit, and prepaid card transactions, deliver digital innovation, and fraud prevention; ACI Issuing, a digital payment issuing solution for new payment offering; and ACI Enterprise Payments Platform that provides payment processing and orchestration capabilities for digital payments.

Further Reading

Before you consider ACI Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACI Worldwide wasn't on the list.

While ACI Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.