New York State Common Retirement Fund trimmed its stake in ACI Worldwide, Inc. (NASDAQ:ACIW - Free Report) by 6.0% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 574,327 shares of the technology company's stock after selling 36,382 shares during the period. New York State Common Retirement Fund owned approximately 0.54% of ACI Worldwide worth $29,233,000 at the end of the most recent reporting period.

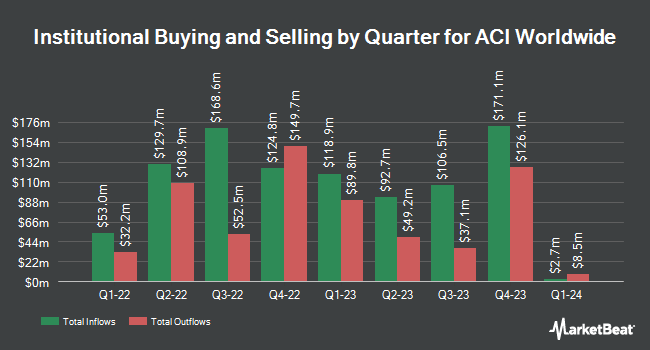

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. First Trust Direct Indexing L.P. bought a new stake in shares of ACI Worldwide in the 3rd quarter worth about $214,000. Semanteon Capital Management LP purchased a new position in ACI Worldwide in the 3rd quarter worth about $1,237,000. Mount Yale Investment Advisors LLC purchased a new position in ACI Worldwide in the 3rd quarter worth about $208,000. Assenagon Asset Management S.A. increased its stake in ACI Worldwide by 144.1% in the 3rd quarter. Assenagon Asset Management S.A. now owns 482,740 shares of the technology company's stock worth $24,571,000 after buying an additional 285,001 shares during the period. Finally, Cetera Trust Company N.A increased its stake in ACI Worldwide by 7.9% in the 3rd quarter. Cetera Trust Company N.A now owns 4,780 shares of the technology company's stock worth $243,000 after buying an additional 350 shares during the period. Hedge funds and other institutional investors own 94.74% of the company's stock.

ACI Worldwide Stock Performance

Shares of NASDAQ:ACIW traded up $0.66 during trading on Monday, hitting $50.15. The stock had a trading volume of 460,126 shares, compared to its average volume of 644,037. The company has a quick ratio of 1.32, a current ratio of 1.32 and a debt-to-equity ratio of 0.79. ACI Worldwide, Inc. has a 12-month low of $23.90 and a 12-month high of $53.29. The stock has a market capitalization of $5.25 billion, a price-to-earnings ratio of 29.41 and a beta of 1.19. The stock has a 50-day simple moving average of $49.80 and a two-hundred day simple moving average of $42.77.

ACI Worldwide (NASDAQ:ACIW - Get Free Report) last posted its quarterly earnings results on Thursday, August 1st. The technology company reported $0.39 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.15 by $0.24. The company had revenue of $373.48 million during the quarter, compared to analyst estimates of $349.95 million. ACI Worldwide had a net margin of 12.01% and a return on equity of 19.18%. On average, equities research analysts expect that ACI Worldwide, Inc. will post 1.96 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

ACIW has been the topic of a number of research reports. Needham & Company LLC reissued a "hold" rating on shares of ACI Worldwide in a research report on Friday, August 2nd. Canaccord Genuity Group lifted their price target on shares of ACI Worldwide from $40.00 to $60.00 and gave the stock a "buy" rating in a report on Friday, August 2nd. Stephens lowered ACI Worldwide from an "overweight" rating to an "equal weight" rating in a report on Friday, October 18th. DA Davidson boosted their target price on ACI Worldwide from $52.00 to $57.00 and gave the stock a "buy" rating in a research note on Tuesday, October 15th. Finally, StockNews.com cut ACI Worldwide from a "buy" rating to a "hold" rating in a research note on Saturday, August 3rd. Three equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat, ACI Worldwide has a consensus rating of "Moderate Buy" and an average target price of $48.75.

Get Our Latest Stock Report on ACIW

ACI Worldwide Profile

(

Free Report)

ACI Worldwide, Inc, a software company, develops, markets, installs, and supports a range of software products and solutions for facilitating digital payments in the United States and internationally. The company operates in three segments: Banks, Merchants, and Billers. The company offers ACI Acquiring, a solution to process credit, debit, and prepaid card transactions, deliver digital innovation, and fraud prevention; ACI Issuing, a digital payment issuing solution for new payment offering; and ACI Enterprise Payments Platform that provides payment processing and orchestration capabilities for digital payments.

Featured Articles

Before you consider ACI Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACI Worldwide wasn't on the list.

While ACI Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.