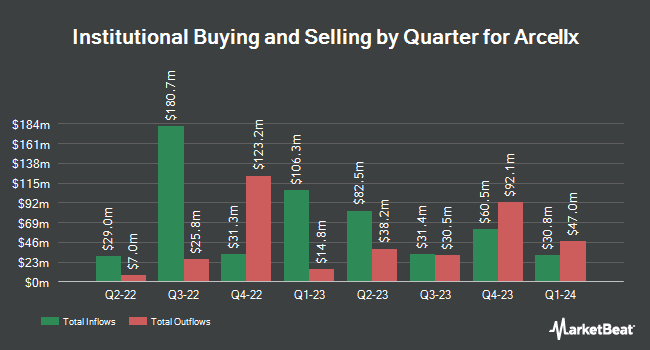

abrdn plc purchased a new position in Arcellx, Inc. (NASDAQ:ACLX - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 50,796 shares of the company's stock, valued at approximately $4,242,000. abrdn plc owned about 0.09% of Arcellx as of its most recent SEC filing.

Other institutional investors and hedge funds have also made changes to their positions in the company. Vanguard Group Inc. raised its stake in Arcellx by 1.1% in the 4th quarter. Vanguard Group Inc. now owns 2,061,819 shares of the company's stock valued at $114,431,000 after purchasing an additional 23,262 shares during the last quarter. Allspring Global Investments Holdings LLC acquired a new position in shares of Arcellx in the first quarter valued at approximately $804,000. Advisory Alpha LLC purchased a new position in shares of Arcellx during the first quarter valued at approximately $209,000. Sei Investments Co. boosted its position in Arcellx by 36.3% during the first quarter. Sei Investments Co. now owns 14,836 shares of the company's stock worth $1,032,000 after acquiring an additional 3,951 shares during the last quarter. Finally, Russell Investments Group Ltd. boosted its position in Arcellx by 3.1% during the first quarter. Russell Investments Group Ltd. now owns 195,437 shares of the company's stock worth $13,593,000 after acquiring an additional 5,895 shares during the last quarter. 96.03% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on the company. Needham & Company LLC reissued a "buy" rating and set a $96.00 price target on shares of Arcellx in a research note on Thursday. Stifel Nicolaus increased their target price on Arcellx from $83.00 to $122.00 and gave the stock a "buy" rating in a research report on Friday, October 18th. Canaccord Genuity Group lifted their price target on Arcellx from $85.00 to $115.00 and gave the company a "buy" rating in a report on Thursday, October 17th. Redburn Atlantic started coverage on shares of Arcellx in a report on Tuesday, October 8th. They set a "buy" rating and a $109.00 price objective on the stock. Finally, Cantor Fitzgerald restated an "overweight" rating on shares of Arcellx in a report on Monday, September 9th. Twelve analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Buy" and a consensus target price of $89.75.

Check Out Our Latest Stock Analysis on ACLX

Arcellx Stock Up 0.3 %

Shares of ACLX stock traded up $0.27 during mid-day trading on Monday, reaching $86.44. The company's stock had a trading volume of 784,409 shares, compared to its average volume of 464,288. The firm has a market capitalization of $4.65 billion, a PE ratio of -85.04 and a beta of 0.27. The company's 50 day simple moving average is $80.61 and its 200-day simple moving average is $64.68. Arcellx, Inc. has a 12-month low of $43.50 and a 12-month high of $97.54.

Arcellx (NASDAQ:ACLX - Get Free Report) last issued its quarterly earnings data on Thursday, August 8th. The company reported ($0.51) EPS for the quarter, topping analysts' consensus estimates of ($0.52) by $0.01. Arcellx had a negative return on equity of 12.42% and a negative net margin of 37.23%. The company had revenue of $27.38 million for the quarter, compared to analysts' expectations of $22.04 million. The company's quarterly revenue was up 91.5% on a year-over-year basis. As a group, research analysts anticipate that Arcellx, Inc. will post -1.65 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, Director Kavita Patel sold 1,500 shares of Arcellx stock in a transaction that occurred on Tuesday, October 22nd. The shares were sold at an average price of $89.69, for a total transaction of $134,535.00. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. In other news, Director Kavita Patel sold 1,500 shares of the firm's stock in a transaction dated Tuesday, October 22nd. The stock was sold at an average price of $89.69, for a total transaction of $134,535.00. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Christopher Heery sold 27,451 shares of Arcellx stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $67.03, for a total value of $1,840,040.53. Following the sale, the insider now directly owns 9,278 shares in the company, valued at approximately $621,904.34. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 70,556 shares of company stock worth $5,033,845 in the last 90 days. 6.24% of the stock is owned by company insiders.

Arcellx Profile

(

Free Report)

Arcellx, Inc, together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States. The company's lead ddCAR product candidate is anitocabtagene autoleucel, which is in phase 2 clinical trial for the treatment of patients with relapsed or refractory multiple myeloma (rrMM).

Featured Articles

Before you consider Arcellx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcellx wasn't on the list.

While Arcellx currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.