Barrington Research reissued their outperform rating on shares of ACV Auctions (NASDAQ:ACVA - Free Report) in a research note released on Monday, Benzinga reports. They currently have a $23.00 target price on the stock.

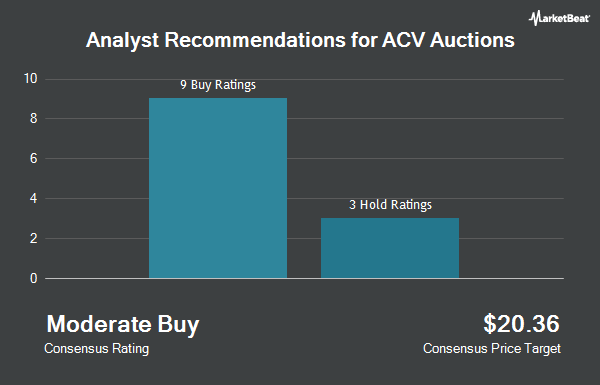

ACVA has been the topic of several other research reports. Jefferies Financial Group boosted their price target on ACV Auctions from $22.00 to $25.00 and gave the stock a "buy" rating in a research note on Tuesday, October 22nd. JMP Securities boosted their price target on ACV Auctions from $21.00 to $24.00 and gave the stock a "market outperform" rating in a research note on Tuesday, September 17th. Finally, Raymond James started coverage on ACV Auctions in a research note on Friday, September 27th. They set a "market perform" rating and a $22.00 price target on the stock. Two analysts have rated the stock with a hold rating and six have issued a buy rating to the company. According to data from MarketBeat, ACV Auctions currently has a consensus rating of "Moderate Buy" and an average target price of $22.00.

Get Our Latest Stock Report on ACVA

ACV Auctions Stock Performance

ACVA stock traded up $0.21 during trading on Monday, hitting $17.25. The company had a trading volume of 971,496 shares, compared to its average volume of 1,191,140. The firm has a market cap of $2.87 billion, a PE ratio of -35.94 and a beta of 1.59. ACV Auctions has a 1-year low of $12.84 and a 1-year high of $21.10. The firm has a 50-day moving average price of $19.01 and a 200-day moving average price of $18.28. The company has a quick ratio of 1.49, a current ratio of 1.49 and a debt-to-equity ratio of 0.24.

ACV Auctions (NASDAQ:ACVA - Get Free Report) last announced its quarterly earnings data on Wednesday, August 7th. The company reported ($0.07) earnings per share for the quarter, beating analysts' consensus estimates of ($0.09) by $0.02. ACV Auctions had a negative return on equity of 13.20% and a negative net margin of 14.53%. The company had revenue of $160.62 million for the quarter, compared to analyst estimates of $156.33 million. On average, analysts expect that ACV Auctions will post -0.35 earnings per share for the current year.

Insider Buying and Selling

In related news, CEO George Chamoun sold 111,363 shares of ACV Auctions stock in a transaction that occurred on Tuesday, September 17th. The stock was sold at an average price of $20.27, for a total transaction of $2,257,328.01. Following the completion of the transaction, the chief executive officer now directly owns 928,166 shares in the company, valued at $18,813,924.82. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In other ACV Auctions news, CEO George Chamoun sold 111,363 shares of the business's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $20.27, for a total value of $2,257,328.01. Following the completion of the transaction, the chief executive officer now directly owns 928,166 shares in the company, valued at approximately $18,813,924.82. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, VP Andrew Peer sold 1,795 shares of the business's stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $21.00, for a total value of $37,695.00. Following the completion of the transaction, the vice president now owns 62,956 shares of the company's stock, valued at $1,322,076. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 741,926 shares of company stock worth $14,285,765 in the last ninety days. Insiders own 8.50% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the business. Quantbot Technologies LP acquired a new stake in shares of ACV Auctions during the 1st quarter worth $519,000. Oppenheimer Asset Management Inc. increased its holdings in shares of ACV Auctions by 6.0% during the 1st quarter. Oppenheimer Asset Management Inc. now owns 111,890 shares of the company's stock worth $2,100,000 after buying an additional 6,325 shares during the last quarter. TimesSquare Capital Management LLC increased its holdings in shares of ACV Auctions by 45.6% during the 1st quarter. TimesSquare Capital Management LLC now owns 1,765,822 shares of the company's stock worth $33,144,000 after buying an additional 552,719 shares during the last quarter. ProShare Advisors LLC increased its holdings in shares of ACV Auctions by 8.5% during the 1st quarter. ProShare Advisors LLC now owns 22,843 shares of the company's stock worth $429,000 after buying an additional 1,798 shares during the last quarter. Finally, Blair William & Co. IL increased its holdings in shares of ACV Auctions by 14.7% during the 1st quarter. Blair William & Co. IL now owns 12,691 shares of the company's stock worth $238,000 after buying an additional 1,626 shares during the last quarter. 88.55% of the stock is currently owned by institutional investors and hedge funds.

ACV Auctions Company Profile

(

Get Free Report)

ACV Auctions Inc operates a digital marketplace that connects buyers and sellers for the online auction of wholesale vehicles. The company's marketplace platform includes digital marketplace, which connects buyers and sellers by providing online auction, which facilitates real-time transactions of wholesale vehicles; Run List for pre-filtering and pre-screening of vehicles up to 24 hours prior to an auction taking place; ACV transportation service to enable the buyers to see real-time transportation quotes and status reports of the vehicle; ACV capital, a short-term inventory financing services for buyers to purchase vehicles; and Go Green's seller assurance service for against claims related to defects in the vehicle.

See Also

Before you consider ACV Auctions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACV Auctions wasn't on the list.

While ACV Auctions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.