Adeia (NASDAQ:ADEA - Get Free Report) is set to release its earnings data after the market closes on Thursday, November 7th. Analysts expect Adeia to post earnings of $0.31 per share for the quarter. Adeia has set its FY 2024 guidance at EPS.Persons that are interested in participating in the company's earnings conference call can do so using this link.

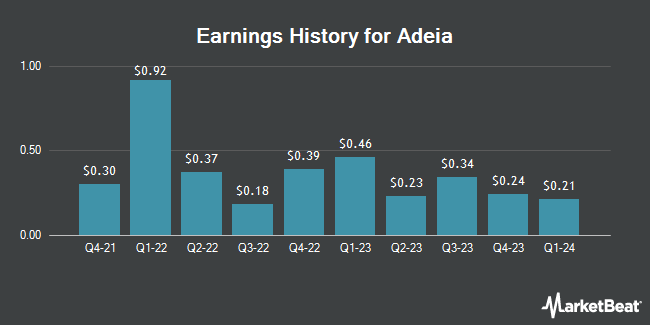

Adeia (NASDAQ:ADEA - Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The company reported $0.23 earnings per share for the quarter, beating analysts' consensus estimates of $0.20 by $0.03. Adeia had a return on equity of 33.28% and a net margin of 12.87%. The firm had revenue of $87.35 million for the quarter, compared to the consensus estimate of $83.74 million.

Adeia Price Performance

Shares of Adeia stock traded down $0.25 during trading on Thursday, reaching $12.43. The company's stock had a trading volume of 390,856 shares, compared to its average volume of 472,419. The business has a 50 day moving average price of $12.04 and a 200-day moving average price of $11.44. The company has a quick ratio of 3.00, a current ratio of 3.00 and a debt-to-equity ratio of 1.42. The company has a market capitalization of $1.35 billion, a P/E ratio of 31.70 and a beta of 1.45. Adeia has a 12-month low of $8.28 and a 12-month high of $13.39.

Analysts Set New Price Targets

A number of analysts have commented on ADEA shares. BWS Financial reiterated a "buy" rating and set a $16.00 target price on shares of Adeia in a research report on Thursday, September 26th. Rosenblatt Securities reiterated a "buy" rating and set a $15.00 target price on shares of Adeia in a research report on Thursday.

Check Out Our Latest Stock Report on ADEA

Adeia Company Profile

(

Get Free Report)

Adeia Inc, together with its subsidiaries, operates as a media and semiconductor intellectual property licensing company in the United States, Canada, Asia, Europe, the Middle East, and internationally. The company licenses its patent portfolios across various markets, including multichannel video programming distributors comprising cable, satellite, and telecommunications television providers that aggregate and distribute linear content over networks, as well as television providers that aggregate and stream linear content over broadband networks; over-the-top video service providers and social media companies, such as subscription video-on-demand and advertising-supported streaming service providers, as well as content providers, networks, and media companies.

Read More

Before you consider Adeia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adeia wasn't on the list.

While Adeia currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.